Printable New York Form it 256 Claim for Special Additional

What is the Printable New York Form IT 256 Claim For Special Additional

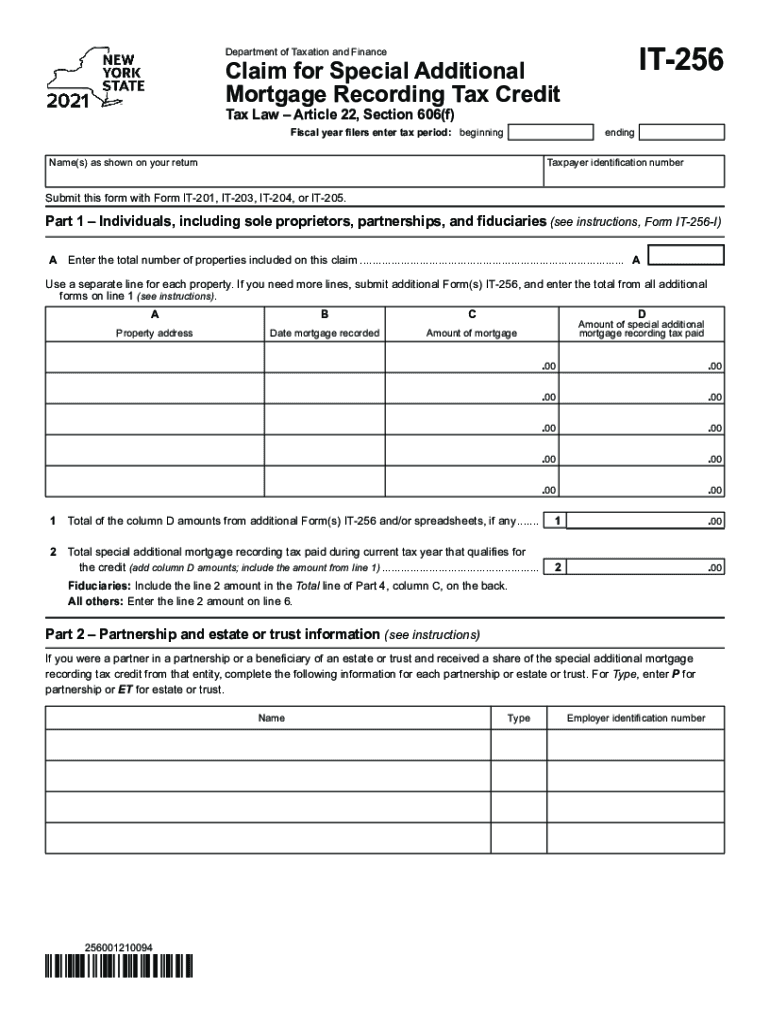

The Printable New York Form IT 256 is a tax form used by individuals and businesses to claim a special additional credit on their New York State tax returns. This form is specifically designed for taxpayers who meet certain eligibility criteria and wish to receive a tax benefit related to specific expenses or situations. Understanding the purpose of this form is crucial for ensuring that you maximize your tax benefits while remaining compliant with state regulations.

How to use the Printable New York Form IT 256 Claim For Special Additional

Using the Printable New York Form IT 256 involves several steps to ensure accurate completion. First, gather all necessary documentation that supports your claim, such as receipts or proof of eligibility. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once you have completed the form, review it for any errors before submission. This attention to detail will help avoid delays or issues with your claim.

Steps to complete the Printable New York Form IT 256 Claim For Special Additional

Completing the Printable New York Form IT 256 requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source, ensuring you have the most recent version.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the specific expenses or situations that qualify for the special additional credit.

- Calculate the amount of credit you are claiming based on the guidelines provided.

- Sign and date the form to certify its accuracy.

Legal use of the Printable New York Form IT 256 Claim For Special Additional

The legal use of the Printable New York Form IT 256 is governed by New York State tax laws. To ensure compliance, it is important to adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes using the form only for its intended purpose and ensuring that all claims are substantiated with appropriate documentation. Failure to comply with these regulations may result in penalties or denial of the claimed credit.

Eligibility Criteria

To qualify for the special additional credit claimed on the Printable New York Form IT 256, taxpayers must meet specific eligibility criteria. These criteria may include income limits, types of qualifying expenses, and residency requirements. It is essential to review the latest guidelines from the New York State Department of Taxation and Finance to confirm that you meet these requirements before submitting your claim.

Form Submission Methods (Online / Mail / In-Person)

The Printable New York Form IT 256 can be submitted through various methods, depending on your preference and the guidelines provided by the state. Options typically include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office address.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete printable new york form it 256 claim for special additional

Submit Printable New York Form IT 256 Claim For Special Additional seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-conscious substitute for conventional printed and signed forms, as you can access the appropriate template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents rapidly without interruptions. Handle Printable New York Form IT 256 Claim For Special Additional on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Printable New York Form IT 256 Claim For Special Additional effortlessly

- Obtain Printable New York Form IT 256 Claim For Special Additional and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and bears the same legal significance as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Printable New York Form IT 256 Claim For Special Additional and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable new york form it 256 claim for special additional

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 256?

airSlate SignNow is a user-friendly electronic signature solution that allows businesses to send and eSign documents efficiently. The term 'it 256' refers to the digital transformation tools that enhance business operations, and airSlate SignNow fits perfectly into this category by simplifying the document signing process.

-

How much does airSlate SignNow cost for users interested in it 256?

airSlate SignNow offers flexible pricing plans that cater to different business needs at competitive rates. For those looking into it 256, we provide cost-effective solutions that can scale with your organization, ensuring you get the best value for your investment.

-

What features does airSlate SignNow include for it 256 users?

airSlate SignNow comes with robust features such as customizable templates, easy document sharing, and secure electronic signatures. For businesses embracing it 256, these features streamline workflows, improve compliance, and enhance usability.

-

Can I integrate airSlate SignNow with other applications used in it 256?

Yes, airSlate SignNow offers seamless integrations with popular applications such as Google Workspace, Salesforce, and Microsoft Office. This interoperability is essential for businesses operating within the it 256 framework, allowing for more coherent workflows and data management.

-

What benefits does airSlate SignNow provide for companies focused on it 256?

By utilizing airSlate SignNow, companies can enjoy faster document turnaround times, reduced paper usage, and improved client satisfaction. These benefits align well with the goals of digital transformation initiatives encompassed by it 256.

-

How secure is airSlate SignNow for users concerned about it 256?

airSlate SignNow prioritizes security with advanced encryption, secure cloud storage, and compliance with industry standards such as GDPR and HIPAA. This is particularly comforting for businesses involved in it 256, as it ensures that sensitive documents are protected throughout the signing process.

-

Is airSlate SignNow suitable for small businesses looking into it 256?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses. Those exploring it 256 will find that the platform offers the necessary tools to enhance productivity without overwhelming complexity.

Get more for Printable New York Form IT 256 Claim For Special Additional

Find out other Printable New York Form IT 256 Claim For Special Additional

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease