Form it 613 Claim for Environmental Remediation Insurance Credit Tax Year

What is the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

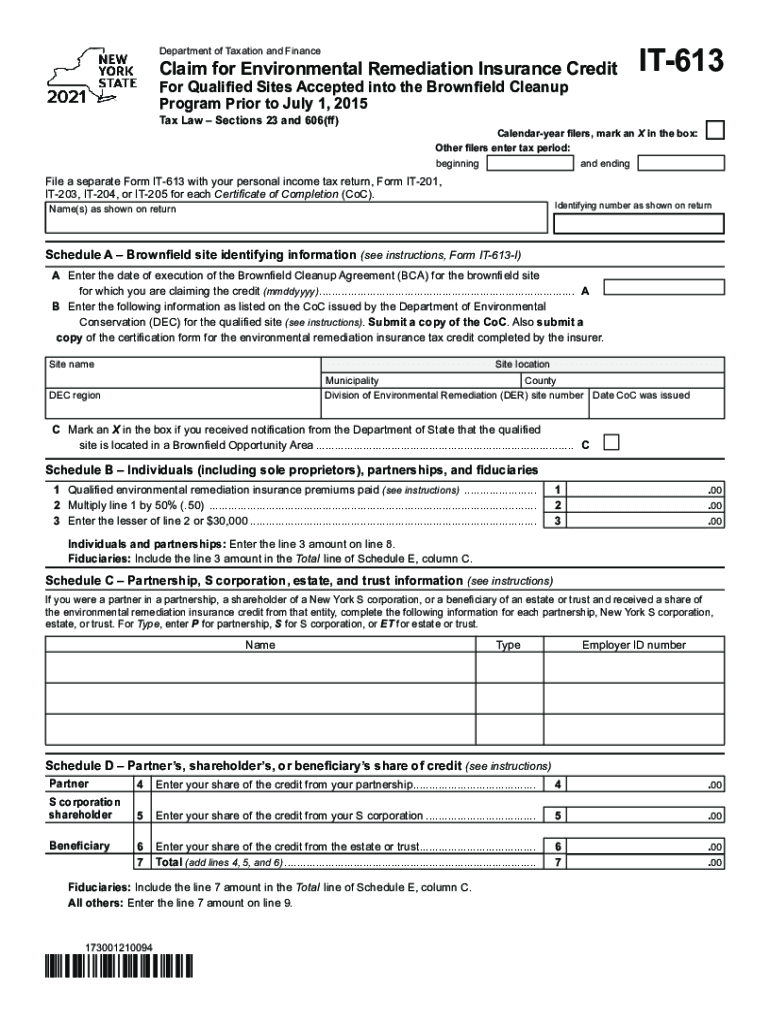

The Form IT 613 is a tax form used to claim an environmental remediation insurance credit for the tax year. This credit is available to businesses that incur costs related to environmental remediation efforts. It is designed to incentivize companies to engage in activities that improve environmental conditions. By filing this form, eligible taxpayers can reduce their tax liability based on the qualified expenses they have incurred in remediation efforts.

How to use the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Using the Form IT 613 involves several key steps. First, gather all necessary documentation that supports your claim, including receipts and records of expenses related to environmental remediation. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to provide detailed descriptions of the remediation activities and associated costs. After completing the form, submit it according to the instructions provided, either electronically or by mail, depending on your preference and the guidelines set forth by the IRS.

Steps to complete the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Completing the Form IT 613 involves a systematic approach:

- Gather all relevant documentation, including invoices and proof of payment.

- Fill out the identification section with your business details.

- Detail the environmental remediation activities undertaken, including dates and costs.

- Calculate the total credit being claimed based on your qualified expenses.

- Review the form for accuracy and completeness before submission.

Legal use of the Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

The legal use of the Form IT 613 requires adherence to specific guidelines established by the IRS. To ensure that the form is considered valid, it must be filled out correctly and submitted within the designated time frame. Additionally, all claims must be supported by adequate documentation that verifies the expenses incurred. Compliance with these legal requirements is essential to avoid penalties and ensure that the credit is honored by tax authorities.

Eligibility Criteria

To qualify for the environmental remediation insurance credit claimed through Form IT 613, businesses must meet specific eligibility criteria. These criteria typically include being a registered business entity in the United States and having incurred qualifying remediation expenses. The activities must align with federal and state environmental regulations, and the costs must be directly related to the remediation efforts undertaken. It is advisable to consult the IRS guidelines to confirm eligibility before filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 613 are crucial for ensuring that your claim is processed in a timely manner. Typically, the form must be submitted by the due date of your tax return for the year in which the remediation expenses were incurred. It is important to stay informed about any changes to deadlines, as these can vary from year to year. Marking your calendar with these important dates can help you avoid missing the opportunity to claim your credit.

Quick guide on how to complete form it 613 claim for environmental remediation insurance credit tax year 2021

Effortlessly Complete Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any holdups. Manage Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year effortlessly

- Locate Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to share your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 613 claim for environmental remediation insurance credit tax year 2021

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 613?

airSlate SignNow is a cost-effective eSignature solution that simplifies the process of sending and signing documents. With its features designed to streamline document workflows, it 613 users can enhance their efficiency and save time in their business operations.

-

How much does airSlate SignNow cost for users interested in it 613?

airSlate SignNow offers various pricing plans to cater to different business needs. For those exploring it 613, there are affordable options that ensure flexibility without compromising on essential features, making it a great choice for businesses of all sizes.

-

What key features does airSlate SignNow provide to users of it 613?

airSlate SignNow boasts a range of features, including customizable templates, real-time tracking, and advanced security measures. These capabilities empower it 613 users to effectively manage their document workflows while maintaining compliance and security.

-

What are the benefits of using airSlate SignNow for it 613 users?

Utilizing airSlate SignNow offers signNow benefits, including increased productivity, reduced turnaround times, and improved collaboration among team members. For it 613 users, this means more efficient document handling and enhanced customer satisfaction.

-

Can airSlate SignNow integrate with other applications relevant to it 613?

Yes, airSlate SignNow provides seamless integrations with a variety of applications including CRM systems and cloud storage services. This makes it easy for it 613 users to incorporate eSigning into their existing workflows and enhance overall efficiency.

-

Is airSlate SignNow suitable for small businesses interested in it 613?

Absolutely! airSlate SignNow is specifically designed to cater to businesses of all sizes, including small enterprises. For those exploring it 613, this platform offers scalable solutions that grow with your business needs, ensuring long-term value.

-

How secure is airSlate SignNow for handling documents related to it 613?

Security is a top priority for airSlate SignNow, which includes advanced encryption, secure storage, and compliance with privacy regulations. For it 613 users, this ensures that all document transactions are protected and confidential throughout the signing process.

Get more for Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

Find out other Form IT 613 Claim For Environmental Remediation Insurance Credit Tax Year

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template