Form it 112 C "New York State Resident Credit for Taxes

What is the Form IT 112 C?

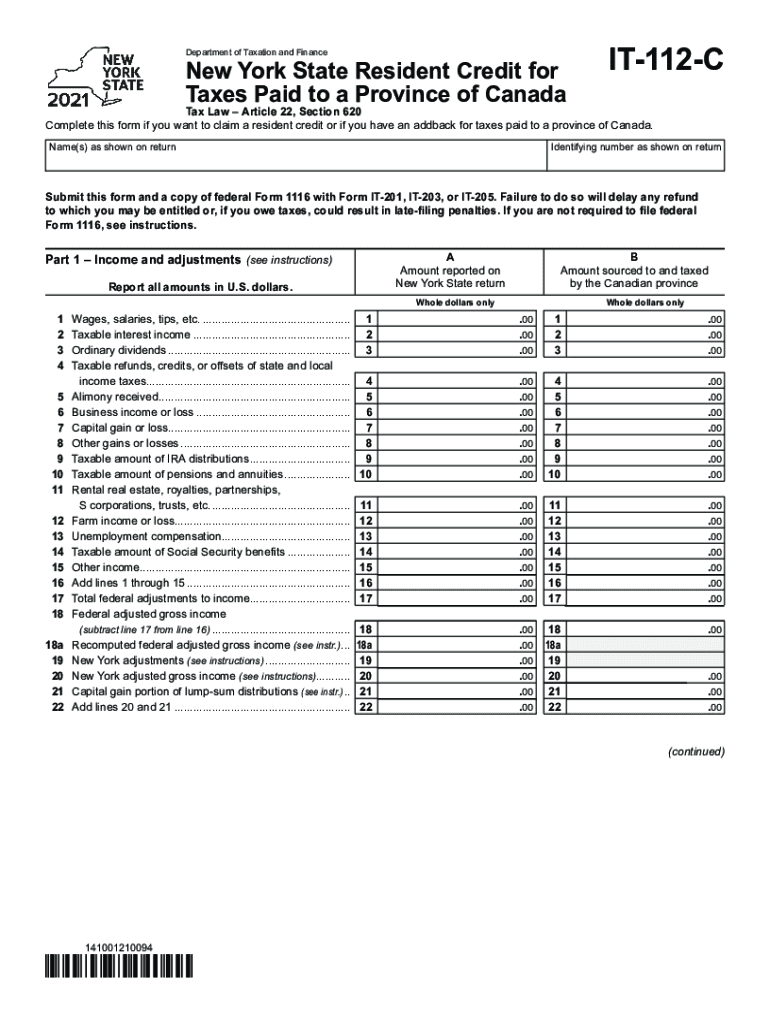

The Form IT 112 C, officially known as the New York State Resident Credit for Taxes, is a tax form used by residents of New York to claim a credit for taxes paid to other jurisdictions. This form allows taxpayers to reduce their New York State tax liability based on the taxes they have already paid to other states or localities. It is particularly beneficial for individuals who earn income in multiple states, ensuring that they are not taxed twice on the same income.

How to Use the Form IT 112 C

Using the Form IT 112 C involves several steps to ensure accurate completion. Taxpayers must first gather necessary documentation, including proof of taxes paid to other jurisdictions. Once the required information is collected, the form can be filled out, detailing the income earned and taxes paid in those jurisdictions. After completing the form, it should be submitted along with the New York State tax return to claim the credit effectively.

Steps to Complete the Form IT 112 C

Completing the Form IT 112 C requires careful attention to detail. Here are the key steps:

- Gather all relevant documents, including W-2s and 1099s, that show income and taxes paid to other states.

- Fill in personal information, including name, address, and Social Security number.

- Report income earned in other jurisdictions and the corresponding taxes paid.

- Calculate the credit amount based on the instructions provided with the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form IT 112 C

To be eligible to file the Form IT 112 C, taxpayers must meet specific criteria. They must be residents of New York State and have paid income taxes to another state or local jurisdiction. Additionally, the income for which the credit is claimed must be taxable in both New York and the other jurisdiction. It is essential for taxpayers to ensure they meet these criteria to avoid complications during the filing process.

Required Documents for the Form IT 112 C

When preparing to file the Form IT 112 C, certain documents are necessary to support the claim. These include:

- W-2 forms from employers that indicate income earned and taxes withheld.

- 1099 forms for any additional income sources.

- Documentation of taxes paid to other states, such as tax returns or payment receipts.

- Any additional forms that provide evidence of residency and income.

Filing Deadlines for the Form IT 112 C

Taxpayers must adhere to specific filing deadlines for the Form IT 112 C to ensure timely processing of their tax returns. Typically, the form must be submitted by the same deadline as the New York State income tax return, which is usually April fifteenth. However, it is advisable to verify the exact dates each year, as they may vary due to weekends or holidays.

Quick guide on how to complete form it 112 c ampquotnew york state resident credit for taxes

Facilitate Form IT 112 C "New York State Resident Credit For Taxes effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and safely archive it online. airSlate SignNow equips you with all the features you require to create, modify, and eSign your documents swiftly without complications. Manage Form IT 112 C "New York State Resident Credit For Taxes on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form IT 112 C "New York State Resident Credit For Taxes with ease

- Obtain Form IT 112 C "New York State Resident Credit For Taxes and click Get Form to commence.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically available through airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and eSign Form IT 112 C "New York State Resident Credit For Taxes and ensure effective communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 112 c ampquotnew york state resident credit for taxes

How to generate an e-signature for your PDF document in the online mode

How to generate an e-signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to it 112 c?

airSlate SignNow is an eSignature solution that enables businesses to easily send, sign, and manage documents online. With features that streamline document workflows, it supports compliance with forms like it 112 c, making it an ideal tool for businesses processing various tax forms.

-

How much does airSlate SignNow cost for managing it 112 c forms?

airSlate SignNow offers flexible pricing plans designed to accommodate different business needs. Depending on the features you select for managing your it 112 c documents, you can choose from several tiers that ensure you only pay for what you require.

-

What features does airSlate SignNow provide for it 112 c documentation?

The platform offers powerful features such as customizable templates, automated workflows, and real-time tracking, all of which simplify the process of managing it 112 c forms. Users can also utilize advanced security measures to protect sensitive information associated with these documents.

-

Can airSlate SignNow help with audit compliance for it 112 c?

Yes, airSlate SignNow is designed to provide secure and compliant document handling, ensuring that your it 112 c forms are audit-ready. The solution maintains a complete audit trail that tracks every action taken on documents, enhancing validity and reliability.

-

Is it easy to integrate airSlate SignNow with existing software for it 112 c processing?

Absolutely! airSlate SignNow features seamless integrations with various software solutions commonly used in document management. Whether you're using accounting software or CRMs, integrating to streamline your it 112 c workflows is simple and efficient.

-

What are the benefits of using airSlate SignNow for it 112 c submissions?

Using airSlate SignNow for your it 112 c submissions can signNowly increase efficiency and reduce turnaround times. Its user-friendly interface ensures that both senders and signers can navigate the submission process effortlessly, allowing for faster approvals.

-

How does airSlate SignNow ensure the security of it 112 c documents?

airSlate SignNow prioritizes security by implementing advanced encryption and secure storage protocols. For sensitive it 112 c documents, the platform ensures that all data is protected, allowing users to submit their forms confidently without fear of bsignNowes.

Get more for Form IT 112 C "New York State Resident Credit For Taxes

Find out other Form IT 112 C "New York State Resident Credit For Taxes

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement