Claim of Exemption California Form

What is the Claim Of Exemption California

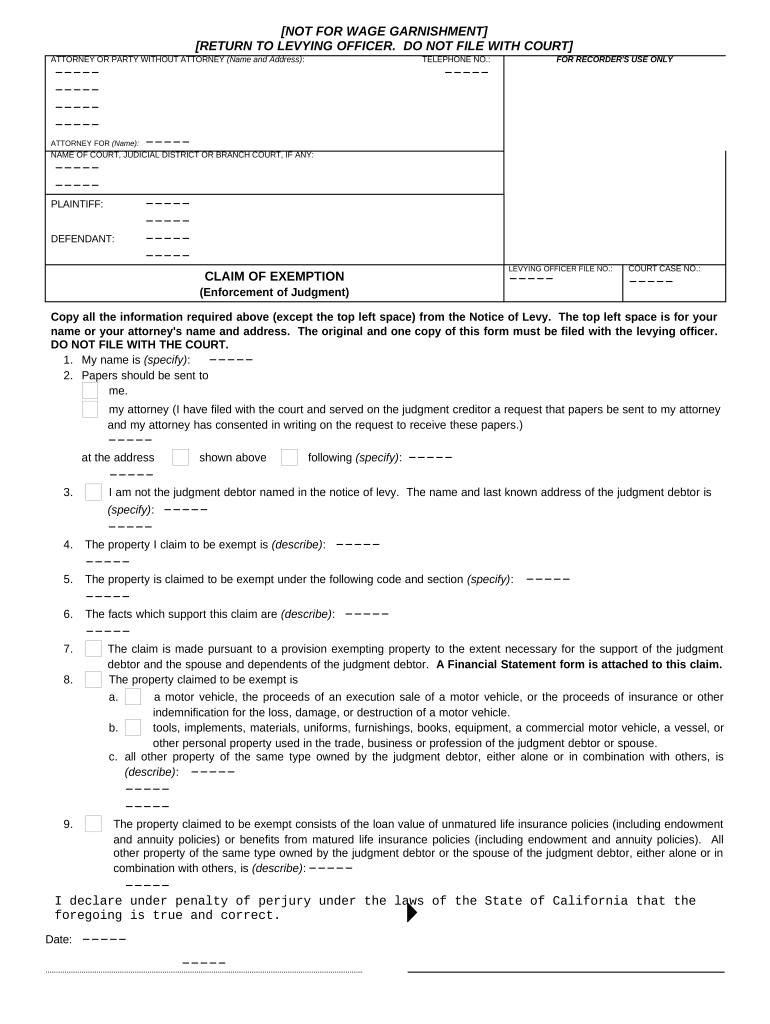

The Claim of Exemption California form is a legal document that allows individuals or businesses to assert their right to exemption from certain taxes or fees. This form is particularly relevant for those who qualify under specific criteria set by California tax laws. By filing this form, taxpayers can avoid unnecessary tax liabilities, ensuring compliance with state regulations while taking advantage of applicable exemptions.

Steps to Complete the Claim Of Exemption California

Completing the Claim of Exemption California form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including personal identification and financial details.

- Review the eligibility criteria to confirm that you qualify for the exemption.

- Fill out the form completely, providing all requested information accurately.

- Sign and date the form, ensuring that all signatures are valid and in accordance with legal requirements.

- Submit the completed form through the appropriate channels, such as online, by mail, or in person.

Legal Use of the Claim Of Exemption California

The Claim of Exemption California form is legally binding when completed correctly and submitted in accordance with state laws. It is crucial to understand the legal implications of the form, as improper use can lead to penalties or denial of the exemption. The form must be used only for its intended purpose and in compliance with California tax regulations to maintain its validity.

Eligibility Criteria

To qualify for the Claim of Exemption California, applicants must meet specific eligibility criteria. These criteria may include income thresholds, types of income, and residency status. It is essential to review the guidelines provided by the California tax authority to determine if you meet the requirements before filing the form.

Form Submission Methods

The Claim of Exemption California form can be submitted through various methods, including:

- Online: Many taxpayers prefer to submit their forms electronically for convenience and faster processing.

- By Mail: Physical copies of the form can be mailed to the appropriate tax authority address.

- In Person: Some individuals may choose to deliver the form directly to their local tax office.

Examples of Using the Claim Of Exemption California

There are several scenarios where the Claim of Exemption California may be applicable. For instance, a self-employed individual may use the form to claim exemptions related to business expenses. Similarly, retirees may qualify for exemptions based on their income levels. Understanding these examples can help taxpayers identify their eligibility and utilize the form effectively.

Quick guide on how to complete claim of exemption california

Complete Claim Of Exemption California effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Handle Claim Of Exemption California on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest method to modify and eSign Claim Of Exemption California without hassle

- Obtain Claim Of Exemption California and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Claim Of Exemption California and ensure excellent communication throughout any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Claim Of Exemption California?

A Claim Of Exemption California is a legal document that a debtor may file to protect certain assets from being seized by creditors. In California, specific exemptions apply to various types of property, and understanding these can help individuals retain essential assets during financial hardship.

-

How can airSlate SignNow assist with a Claim Of Exemption California?

airSlate SignNow provides an easy-to-use platform for creating and signing your Claim Of Exemption California documents electronically. With our solution, you can efficiently prepare your claim, share it securely, and ensure it is signed and filed on time.

-

Are there any costs associated with filing a Claim Of Exemption California using airSlate SignNow?

While filing a Claim Of Exemption California may incur court fees, using airSlate SignNow offers a cost-effective way to prepare and send your documents. Our subscription plans are designed to fit various budgets, providing you with a robust eSigning tool without breaking the bank.

-

What features does airSlate SignNow offer for Claim Of Exemption California?

airSlate SignNow offers features such as templates, customizable workflows, and secure cloud storage to streamline the process of creating your Claim Of Exemption California. Our platform also ensures compliance with legal standards, making document management hassle-free.

-

How secure is my information when filing a Claim Of Exemption California with airSlate SignNow?

Security is a top priority for airSlate SignNow. When you file your Claim Of Exemption California, your data is safeguarded with bank-level encryption, ensuring that sensitive information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other tools while preparing my Claim Of Exemption California?

Yes, airSlate SignNow easily integrates with various productivity and CRM tools to enhance your workflow when preparing a Claim Of Exemption California. This ensures you can manage your documents alongside your existing systems, improving efficiency and organization.

-

What benefits do I gain by using airSlate SignNow for my Claim Of Exemption California?

By using airSlate SignNow for your Claim Of Exemption California, you benefit from streamlined processes, enhanced collaboration, and faster turnaround times. Our user-friendly interface helps reduce the complexity of document management while ensuring compliance and accuracy.

Get more for Claim Of Exemption California

- Warning of default on commercial lease vermont form

- Warning of default on residential lease vermont form

- Landlord tenant closing statement to reconcile security deposit vermont form

- Vermont name change form

- Name change notification form vermont

- Commercial building or space lease vermont form

- Vermont relative caretaker legal documents package vermont form

- Vt legal form

Find out other Claim Of Exemption California

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free