Tax Wv GovPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department 2021-2026

Understanding the wv wvnrer Withholding Form

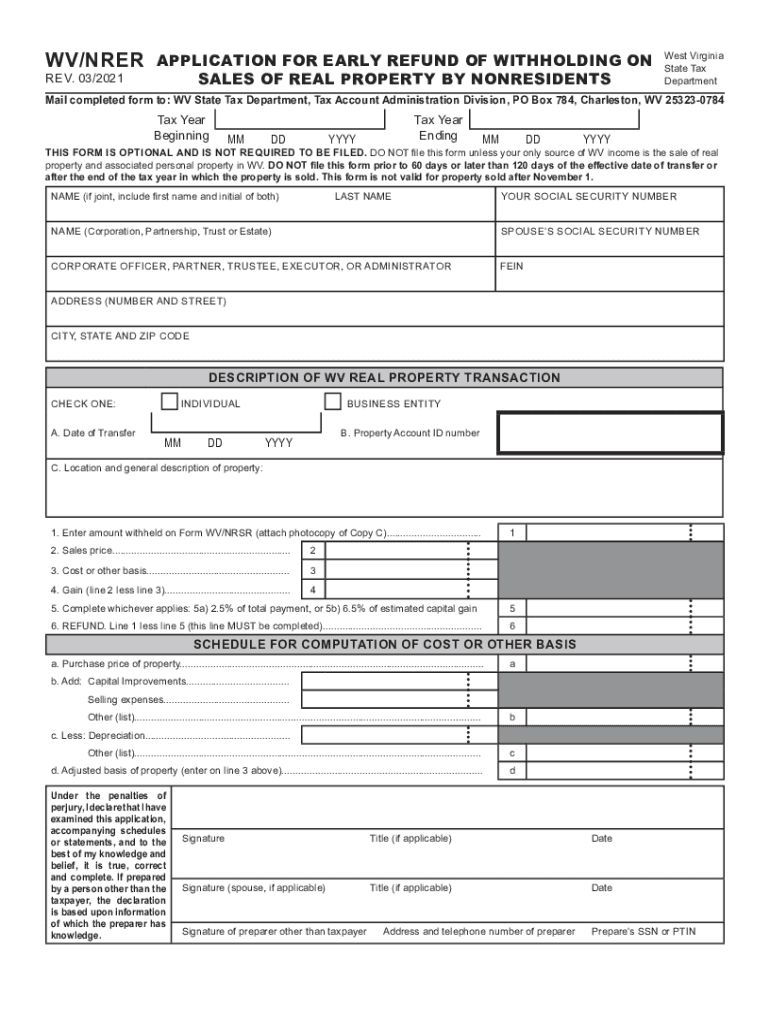

The wv wvnrer withholding form is a crucial document for taxpayers in West Virginia. This form is used to report and manage state income tax withholding for employees and certain payments. It is essential for ensuring that the correct amount of state tax is withheld from wages, which helps taxpayers avoid underpayment penalties when filing their annual tax returns. Understanding the purpose and requirements of this form is vital for both employers and employees.

Steps to Complete the wv wvnrer Withholding Form

Completing the wv wvnrer withholding form involves several key steps:

- Gather Necessary Information: Collect personal details such as your name, address, and Social Security number. You will also need information about your employer and your filing status.

- Determine Withholding Amount: Use the provided tax tables or calculators to determine the appropriate withholding amount based on your income and exemptions.

- Fill Out the Form: Accurately complete each section of the form, ensuring all information is correct and legible.

- Review and Sign: Double-check the form for accuracy before signing it. Your signature certifies that the information provided is true and complete.

- Submit the Form: Deliver the completed form to your employer or the relevant tax authority as instructed.

Legal Use of the wv wvnrer Withholding Form

The wv wvnrer withholding form is legally binding when filled out correctly and submitted according to state regulations. It is important to ensure compliance with all applicable laws to avoid potential penalties. The form must be completed with accurate information, as any discrepancies could lead to issues with tax withholding and filing. Understanding the legal implications of this form helps ensure that both employers and employees fulfill their tax obligations responsibly.

Filing Deadlines and Important Dates

Timely submission of the wv wvnrer withholding form is essential to avoid penalties. Generally, the form should be submitted at the beginning of employment or whenever there are changes in withholding status. Additionally, it is important to be aware of annual tax filing deadlines to ensure that all withholding amounts are accurately reported on your tax return. Staying informed about these dates can help you manage your tax responsibilities effectively.

Eligibility Criteria for the wv wvnrer Withholding Form

Eligibility to use the wv wvnrer withholding form typically includes individuals who are employed in West Virginia or receive certain types of income subject to state withholding. This may include full-time and part-time employees, as well as independent contractors in some cases. Understanding the eligibility criteria ensures that you complete the form correctly and comply with state tax laws.

Form Submission Methods

The wv wvnrer withholding form can be submitted through various methods. Common submission options include:

- Online Submission: Many employers offer electronic submission options for convenience.

- Mail: You can send the completed form via postal mail to your employer or the tax authority.

- In-Person: Some individuals may choose to submit the form in person at their employer's office or a local tax office.

Common Mistakes to Avoid

When completing the wv wvnrer withholding form, it is important to avoid common mistakes that could lead to issues. These include:

- Providing incorrect personal information, such as name or Social Security number.

- Failing to update the form when there are changes in your employment status or personal circumstances.

- Not signing the form, which is necessary for validation.

- Overlooking submission deadlines, which can result in penalties.

Quick guide on how to complete taxwvgovpageswithholdingtaxformswithholding tax forms west virginia state tax department

Complete Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, enabling you to obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents promptly without any holdups. Manage Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department with ease

- Locate Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department to ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxwvgovpageswithholdingtaxformswithholding tax forms west virginia state tax department

Create this form in 5 minutes!

How to create an eSignature for the taxwvgovpageswithholdingtaxformswithholding tax forms west virginia state tax department

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

The best way to create an e-signature for a PDF document on Android devices

People also ask

-

What is the form wv nrer and how does it work?

The form wv nrer is a document specifically designed for non-resident real estate transactions in West Virginia. It allows users to collect necessary information and signatures digitally, streamlining the entire process. With airSlate SignNow, you can easily fill out, send, and eSign the form wv nrer in just a few clicks.

-

How much does it cost to use airSlate SignNow for form wv nrer?

airSlate SignNow offers various pricing plans to fit your business needs, starting from a free trial to paid plans tailored for higher usage. Each plan includes the capability to manage the form wv nrer efficiently. To find the best fit, you can compare the features included in each pricing tier on our website.

-

What features does airSlate SignNow offer for the form wv nrer?

airSlate SignNow provides features such as template creation, automated workflows, and secure eSigning for the form wv nrer. These features enhance productivity by allowing users to send and track documents in real-time. Additionally, the platform ensures compliance with legal standards for eSignatures.

-

Can I integrate airSlate SignNow with other applications for use with form wv nrer?

Yes, airSlate SignNow seamlessly integrates with a variety of applications to enhance the functionality of the form wv nrer. You can connect it with CRM systems, cloud storage services, and other productivity tools. This integration streamlines data management and improves overall efficiency.

-

What are the advantages of using airSlate SignNow for my form wv nrer needs?

Using airSlate SignNow for your form wv nrer needs means you benefit from a user-friendly interface and automated signing processes that save time and reduce errors. The platform ensures document security and is compliant with industry regulations, making it a reliable choice for businesses. Plus, the ability to access documents from anywhere enhances flexibility.

-

Is airSlate SignNow suitable for small businesses needing to manage form wv nrer?

Absolutely! airSlate SignNow is particularly beneficial for small businesses that need an affordable yet effective solution for managing form wv nrer. Our platform provides all the necessary tools to create, send, and sign documents without the complexities of traditional methods. The scalability of our plans makes it a great fit as your business grows.

-

How do I get started with the form wv nrer on airSlate SignNow?

Getting started with the form wv nrer on airSlate SignNow is simple. Sign up for an account, choose the appropriate plan, and access our templates to create your document. Our step-by-step guides will help you navigate through filling and sending the form wv nrer quickly and efficiently.

Get more for Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department

- California identity 497299438 form

- California identity theft form

- Identity theft by known imposter package california form

- Your personal assets form

- Essential documents for the organized traveler package california form

- Essential documents for the organized traveler package with personal organizer california form

- Postnuptial agreements package california form

- Letters of recommendation package california form

Find out other Tax wv govPagesWithholdingTaxFormsWithholding Tax Forms West Virginia State Tax Department

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form