RPD 414 State of New Mexico Taxation and Revenue Form

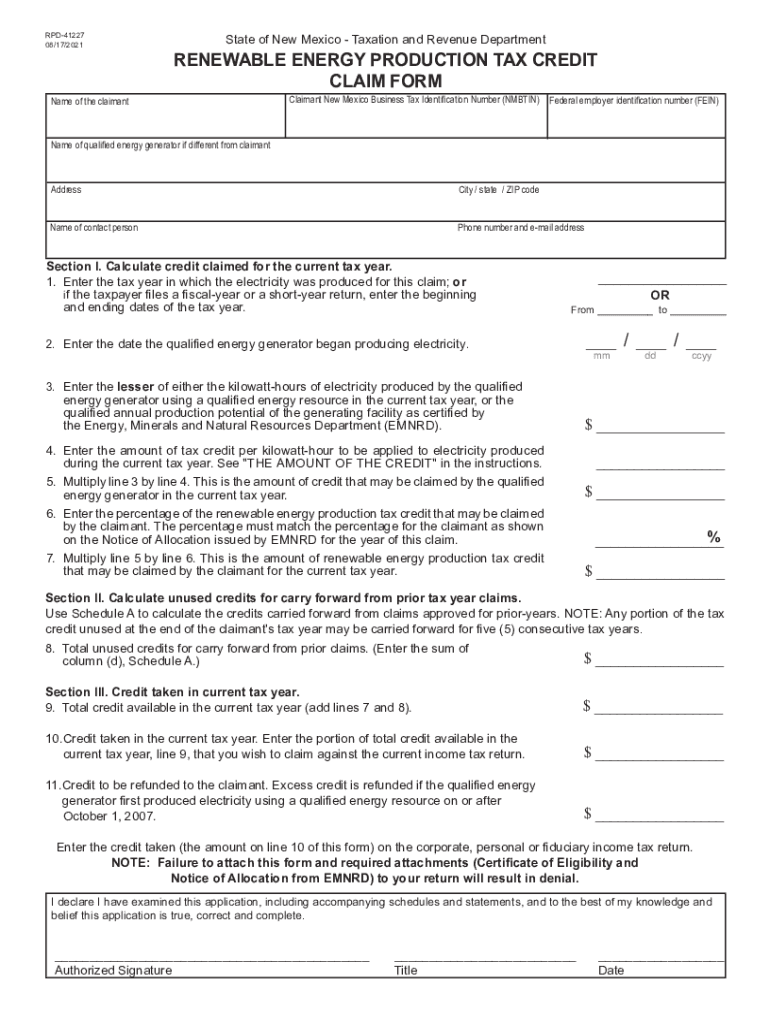

What is the RPD 41227 Form?

The RPD 41227 form is a document used by the State of New Mexico for tax purposes. It is specifically designed for reporting certain tax information to the New Mexico Taxation and Revenue Department. This form is essential for individuals and businesses to ensure compliance with state tax regulations. Understanding the purpose of the RPD 41227 is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the RPD 41227 Form

Completing the RPD 41227 form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather necessary information, including your personal details, tax identification number, and any relevant financial records.

- Download the RPD 41227 form from the New Mexico Taxation and Revenue Department website or access a fillable version online.

- Carefully fill out each section of the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions before submission.

- Submit the form according to the specified methods, such as online, by mail, or in person.

Legal Use of the RPD 41227 Form

The RPD 41227 form is legally binding when filled out correctly and submitted in accordance with state regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal consequences. The form must be signed and dated by the individual or authorized representative to validate its contents. Compliance with the legal requirements surrounding this form helps protect taxpayers from penalties and audits.

Filing Deadlines / Important Dates

Timely submission of the RPD 41227 form is critical for compliance. The filing deadlines may vary based on the specific tax year and the taxpayer's situation. Generally, it is advisable to submit the form by the end of the tax year to avoid late fees. Keeping track of important dates can help ensure that all tax obligations are met on time.

Required Documents for the RPD 41227 Form

To complete the RPD 41227 form, certain documents may be required. These typically include:

- Personal identification, such as a driver's license or social security number.

- Financial records, including income statements and expense receipts.

- Any prior tax returns that may be relevant to the current filing.

Having these documents ready can streamline the completion process and ensure that all necessary information is included.

Form Submission Methods

The RPD 41227 form can be submitted through various methods, providing flexibility for taxpayers. Common submission methods include:

- Online submission through the New Mexico Taxation and Revenue Department's website.

- Mailing a printed copy of the form to the appropriate tax office.

- In-person submission at designated tax offices.

Each method has its own guidelines, so it is important to follow the instructions provided for the chosen submission method.

Quick guide on how to complete rpd 414 state of new mexico taxation and revenue

Complete RPD 414 State Of New Mexico Taxation And Revenue with ease on any device

Web-based document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents quickly and efficiently. Manage RPD 414 State Of New Mexico Taxation And Revenue on any device through airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The easiest way to edit and electronically sign RPD 414 State Of New Mexico Taxation And Revenue effortlessly

- Obtain RPD 414 State Of New Mexico Taxation And Revenue and click Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced papers, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign RPD 414 State Of New Mexico Taxation And Revenue and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rpd 414 state of new mexico taxation and revenue

How to make an e-signature for your PDF in the online mode

How to make an e-signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

The best way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is the nm renewable energy tax credit?

The nm renewable energy tax credit is a financial incentive provided by the state of New Mexico for individuals and businesses that invest in renewable energy systems. This credit allows eligible taxpayers to reduce their tax liability by a percentage of the costs associated with the installation of solar, wind, or other renewable energy projects.

-

How do I qualify for the nm renewable energy tax credit?

To qualify for the nm renewable energy tax credit, you must install an eligible renewable energy system in your primary residence or business in New Mexico. Additionally, you must meet specific criteria related to system efficiency and documentation, ensuring that your installation complies with state regulations.

-

What types of renewable energy systems are eligible for the nm renewable energy tax credit?

Eligible renewable energy systems for the nm renewable energy tax credit include solar photovoltaic systems, solar water heating systems, and small wind systems. It’s important to ensure that your installation meets the required specifications set by the state for complete eligibility.

-

How much can I save with the nm renewable energy tax credit?

The nm renewable energy tax credit can provide signNow savings depending on the size and type of your renewable energy installation. Typically, the credit amounts to 10% of the installation costs, but this can vary based on specific conditions and eligibility criteria.

-

How do I claim the nm renewable energy tax credit?

To claim the nm renewable energy tax credit, you need to complete a tax form provided by the state of New Mexico and include necessary documentation showing the costs related to your renewable energy system installation. Be sure to consult a tax professional to ensure you accurately file and maximize your benefits.

-

Can businesses benefit from the nm renewable energy tax credit?

Yes, businesses in New Mexico can take full advantage of the nm renewable energy tax credit. This incentive encourages commercial entities to invest in renewable energy, thus reducing operational costs and promoting sustainability.

-

Are there any limitations to the nm renewable energy tax credit?

While the nm renewable energy tax credit offers signNow benefits, there are limitations to consider, such as the maximum credit amount that can be claimed and specific conditions that must be met during installation. Understanding these limitations will help you effectively navigate the credit process.

Get more for RPD 414 State Of New Mexico Taxation And Revenue

Find out other RPD 414 State Of New Mexico Taxation And Revenue

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free