Tax Shelter Reporting and Disclosure Requirements Form

Understanding Tax Shelter Reporting and Disclosure Requirements

The Tax Shelter Reporting and Disclosure Requirements are essential for individuals and businesses involved in tax shelters. These requirements ensure that taxpayers disclose certain information about tax shelters to the IRS, which helps maintain transparency and compliance with tax laws. The primary goal is to prevent tax avoidance schemes that can undermine the tax system.

Tax shelters can include a variety of financial arrangements that aim to reduce taxable income. Understanding these requirements is crucial for anyone participating in such arrangements, as failure to comply can result in significant penalties.

Steps to Complete the Tax Shelter Reporting and Disclosure Requirements

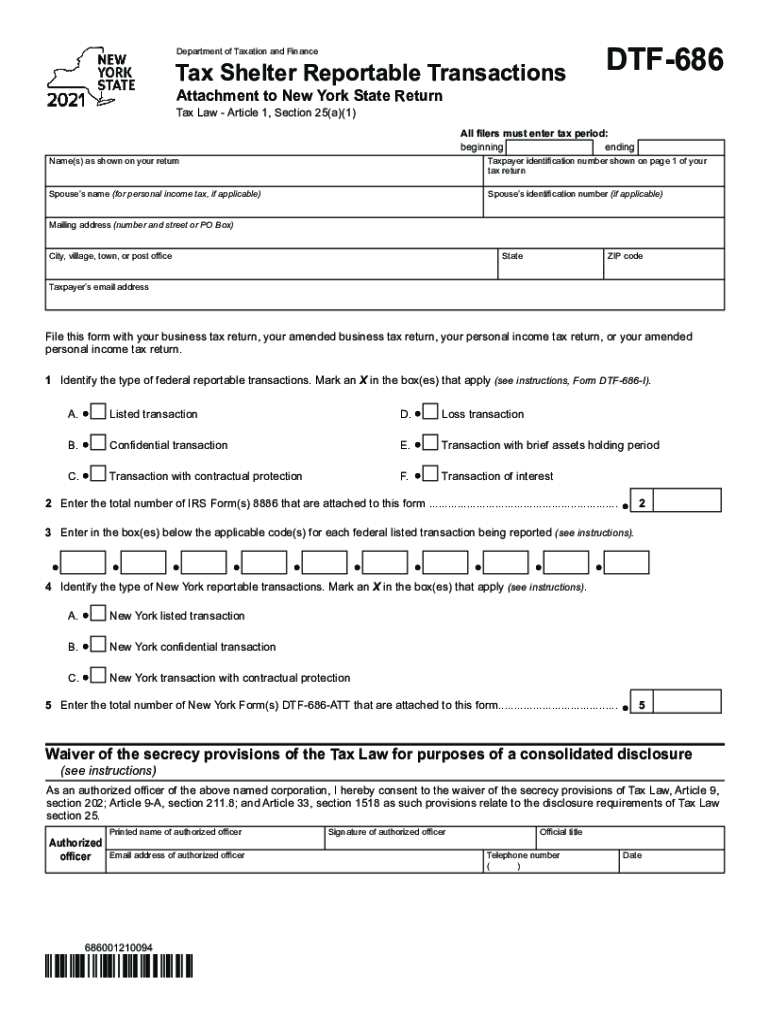

Completing the Tax Shelter Reporting and Disclosure Requirements involves several key steps:

- Identify the tax shelter: Determine if the financial arrangement qualifies as a tax shelter under IRS guidelines.

- Gather necessary information: Collect all relevant documents and details about the tax shelter, including its structure, participants, and expected tax benefits.

- Fill out the required forms: Complete the appropriate forms, such as Form 8886, which is specifically designed for reporting tax shelters.

- Submit the forms: File the completed forms with the IRS by the specified deadline, ensuring that all information is accurate and complete.

Legal Use of Tax Shelter Reporting and Disclosure Requirements

Utilizing the Tax Shelter Reporting and Disclosure Requirements legally involves adhering to IRS regulations and guidelines. Taxpayers must accurately report their participation in tax shelters to avoid penalties. Legal use also means ensuring that the tax shelter complies with all applicable laws and regulations, which can vary by state.

Engaging with a tax professional can provide additional guidance on the legal implications of tax shelters and the necessary reporting requirements.

Filing Deadlines and Important Dates

Filing deadlines for the Tax Shelter Reporting and Disclosure Requirements are critical for compliance. Typically, Form 8886 must be filed with the IRS by the due date of the tax return for the year in which the tax shelter was used. This ensures that the IRS receives timely information about the tax shelter.

It is important to keep track of any changes in deadlines or additional requirements that may arise, especially as tax laws evolve.

Required Documents for Tax Shelter Reporting

When preparing to report a tax shelter, specific documents are required to ensure compliance with the Tax Shelter Reporting and Disclosure Requirements. These documents may include:

- Form 8886: The primary form used to disclose tax shelters.

- Supporting documentation: Any agreements, contracts, or financial statements related to the tax shelter.

- Previous tax returns: Past returns may be needed to demonstrate the tax implications of the shelter.

Having these documents ready can streamline the reporting process and help mitigate any potential issues with the IRS.

Penalties for Non-Compliance with Tax Shelter Reporting

Failure to comply with the Tax Shelter Reporting and Disclosure Requirements can lead to severe penalties. The IRS may impose fines for not filing Form 8886 or for providing inaccurate information. Additionally, taxpayers may face increased scrutiny in future audits, which can result in further penalties or adjustments to their tax returns.

Understanding the importance of compliance can help individuals and businesses avoid these consequences and ensure that they meet their tax obligations.

Quick guide on how to complete tax shelter reporting and disclosure requirements

Complete Tax Shelter Reporting And Disclosure Requirements effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage Tax Shelter Reporting And Disclosure Requirements on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Tax Shelter Reporting And Disclosure Requirements with ease

- Obtain Tax Shelter Reporting And Disclosure Requirements and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and eSign Tax Shelter Reporting And Disclosure Requirements and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax shelter reporting and disclosure requirements

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

The best way to generate an e-signature for a PDF file on Android

People also ask

-

What are NY tax transactions and how can airSlate SignNow help?

NY tax transactions refer to the electronic filing and management of tax-related documents required by New York state. airSlate SignNow simplifies this process by providing an intuitive platform for businesses to send, sign, and manage these essential documents electronically, ensuring a smooth and efficient workflow.

-

What features does airSlate SignNow offer for managing NY tax transactions?

airSlate SignNow offers a variety of features tailored for NY tax transactions, including customizable templates, eSignature capabilities, and automated workflows. These features help ensure that all tax documents are completed accurately and submitted on time, reducing the risk of delays or errors.

-

Is airSlate SignNow affordable for small businesses dealing with NY tax transactions?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing NY tax transactions. With competitive pricing plans, companies can find an option that fits their budget while still accessing powerful tools for document management.

-

How does airSlate SignNow ensure the security of my NY tax transactions?

The security of your NY tax transactions is a top priority for airSlate SignNow. The platform employs industry-standard encryption and compliance measures to protect your sensitive tax documents, ensuring that your information remains confidential and secure throughout the signing process.

-

Can airSlate SignNow integrate with other systems for NY tax transactions?

Absolutely! airSlate SignNow can seamlessly integrate with various business systems and software used for managing NY tax transactions. This integration capability helps streamline workflows, enabling users to import and export documents easily while maintaining an organized approach to tax management.

-

How can I track the status of my NY tax transactions in airSlate SignNow?

Tracking the status of your NY tax transactions is simple with airSlate SignNow. The platform offers real-time updates and notifications, allowing you to see when documents are sent, viewed, and signed, ensuring you never miss a crucial deadline in your tax workflow.

-

What benefits can I expect from using airSlate SignNow for NY tax transactions?

Using airSlate SignNow for your NY tax transactions can lead to signNow benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. The electronic signing solution streamlines the tax process, ultimately saving you time and minimizing the risk of costly mistakes.

Get more for Tax Shelter Reporting And Disclosure Requirements

Find out other Tax Shelter Reporting And Disclosure Requirements

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free