Form it 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year 2021

What is the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

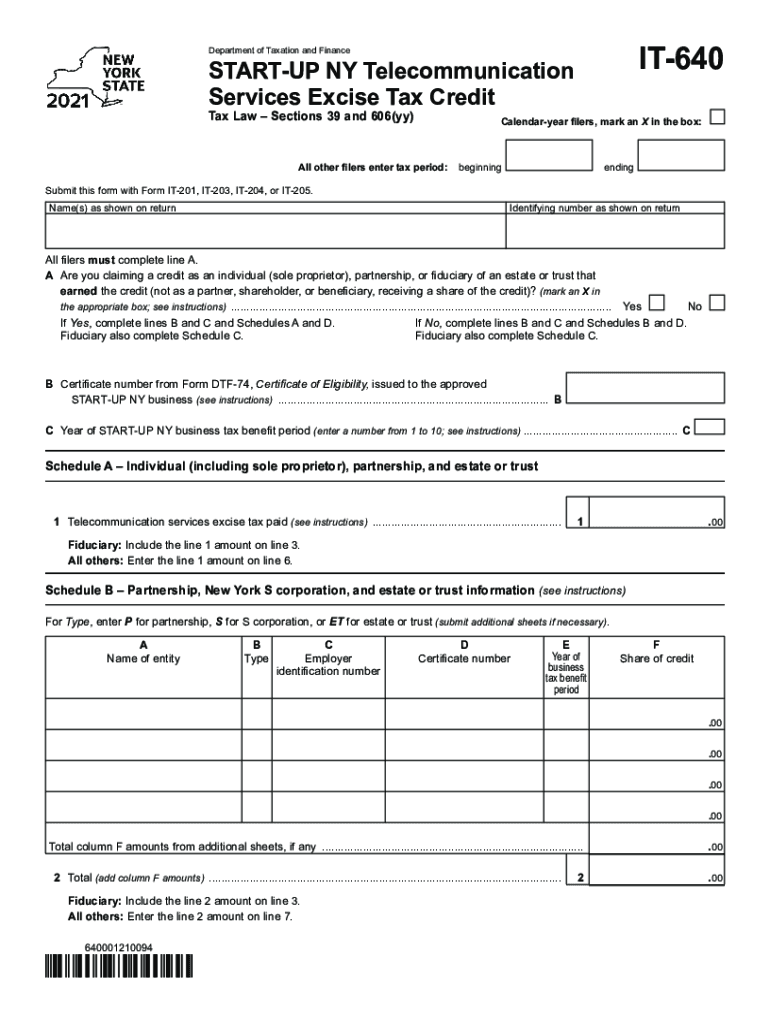

The Form IT 640 is designed for businesses in New York that wish to claim the START-UP NY Telecommunication Services Excise Tax Credit. This credit is available to eligible telecommunication service providers that operate within designated START-UP NY zones. The purpose of the form is to facilitate the reporting of eligible expenses and calculate the amount of credit that can be claimed against the excise tax imposed on telecommunication services. Understanding this form is essential for businesses looking to maximize their tax benefits while complying with state regulations.

Steps to complete the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Completing the Form IT 640 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including financial records that detail eligible telecommunication expenses. Next, fill out the form by providing your business information, including your Employer Identification Number (EIN) and the specific START-UP NY zone where your business operates. Carefully calculate the credit based on your eligible expenses and enter the amount on the designated line. Finally, review the form for any errors before submitting it to the appropriate tax authority.

Eligibility Criteria

To qualify for the START-UP NY Telecommunication Services Excise Tax Credit, businesses must meet specific eligibility criteria. Primarily, the business must be a telecommunication service provider operating within a START-UP NY zone. Additionally, the business must have incurred eligible expenses related to the provision of telecommunication services. These expenses may include costs associated with infrastructure, equipment, and operational expenditures. It is crucial for businesses to review the eligibility requirements thoroughly to ensure compliance and maximize their potential tax credits.

Required Documents

When filing the Form IT 640, certain documents are necessary to support your claim for the tax credit. These documents typically include detailed financial statements that outline eligible expenses, invoices for telecommunication services, and any other relevant records that demonstrate compliance with the eligibility criteria. Maintaining organized records will facilitate the completion of the form and ensure that all claims are substantiated, reducing the risk of audits or penalties.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial for businesses seeking to claim the START-UP NY Telecommunication Services Excise Tax Credit. Typically, the form must be submitted by a specific date following the end of the tax year in which the eligible expenses were incurred. It is advisable to check the New York State Department of Taxation and Finance website for the most current deadlines and any changes to filing requirements. Missing the deadline may result in the inability to claim the credit, impacting the overall financial health of the business.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Form IT 640. The form can be filed online through the New York State Department of Taxation and Finance's secure portal, which offers a streamlined process for electronic submissions. Alternatively, businesses may choose to mail the completed form to the appropriate tax office. In-person submissions are also possible at designated tax offices. Each method has its advantages, and businesses should select the one that best fits their operational needs and preferences.

Quick guide on how to complete form it 640 start up ny telecommunication services excise tax credit tax year 2021

Complete Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to adjust and eSign Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year effortlessly

- Obtain Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year and then click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specializes in for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your updates.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document versions. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 640 start up ny telecommunication services excise tax credit tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 640 start up ny telecommunication services excise tax credit tax year 2021

The best way to create an e-signature for a PDF file online

The best way to create an e-signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

The way to generate an e-signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is form 318925 and how can it be used?

Form 318925 is a specific document used for various business processes, allowing for efficient data collection and signature management. With airSlate SignNow, you can easily create, send, and eSign form 318925, streamlining your workflow and ensuring compliance.

-

How can I integrate form 318925 with other software?

airSlate SignNow offers seamless integrations with various applications that can enhance the functionality of form 318925. By utilizing our integrations, you can automate data transfers between systems, ensuring a cohesive experience while handling input from form 318925.

-

What are the pricing options for using form 318925 with airSlate SignNow?

Our pricing plans for using airSlate SignNow with form 318925 are designed to fit various business needs. We offer flexible options, including monthly and annual subscriptions, which provide access to all features associated with form 318925, ensuring you find a plan that suits your budget.

-

What features does airSlate SignNow provide for form 318925?

airSlate SignNow provides an array of features specifically tailored for managing form 318925, including customizable templates, automated workflows, and real-time tracking of document status. These features make it easier for businesses to manage their documents effectively.

-

What are the benefits of using form 318925 with airSlate SignNow?

Using form 318925 with airSlate SignNow offers signNow benefits, such as improved efficiency, reduced paperwork, and faster turnaround times for document approvals. This solution not only enhances productivity but also cuts costs by minimizing the resources needed for document management.

-

Can I track the status of form 318925 after sending it?

Yes, airSlate SignNow allows you to track the status of form 318925 in real-time. You will receive notifications and updates whenever the document is viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is it easy to customize form 318925 in airSlate SignNow?

Absolutely! airSlate SignNow provides user-friendly tools for customizing form 318925 to suit your specific business needs. You can easily add fields, change layouts, and incorporate branding elements, ensuring that the form reflects your business identity.

Get more for Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

- California claim exemption form

- Legal last will and testament form for single person with no children california

- Legal last will and testament form for a single person with minor children california

- Legal last will and testament form for single person with adult and minor children california

- Legal last will and testament form for single person with adult children california

- Legal last will and testament for married person with minor children from prior marriage california form

- Ca last will testament form

- Legal last will and testament form for married person with adult children from prior marriage california

Find out other Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later