Printable New York Form it 640 START UP NY Telecommunication Services Excise Tax Credit 2020

What is the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

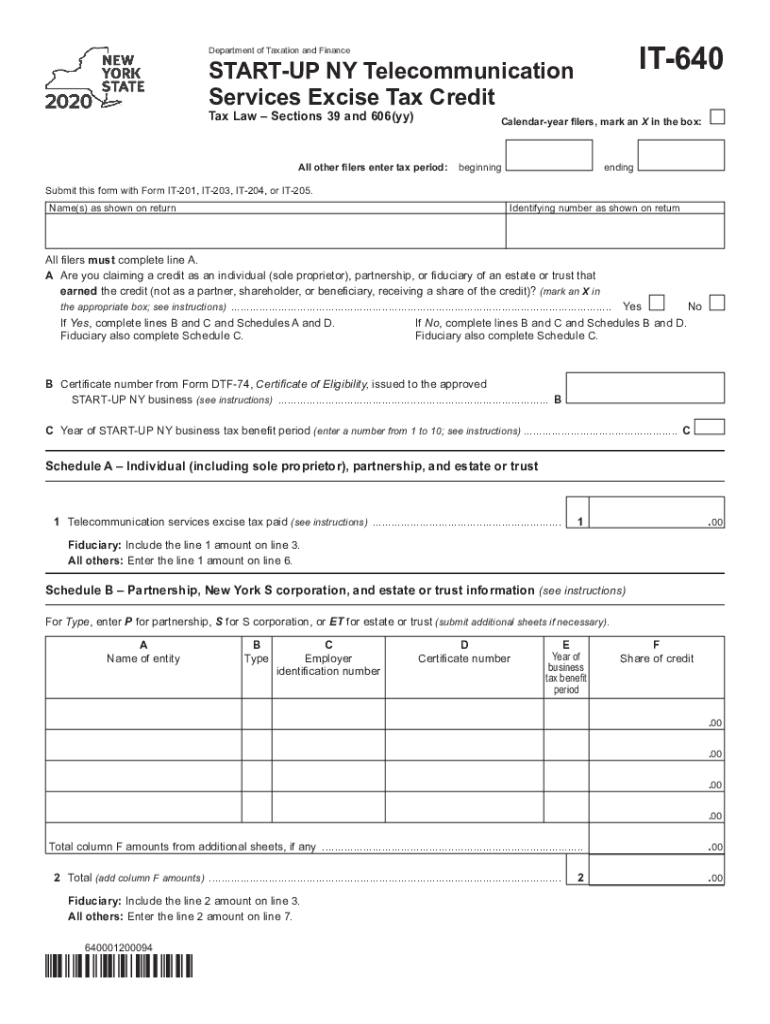

The Printable New York Form IT 640 is designed for businesses that qualify for the START-UP NY Telecommunication Services Excise Tax Credit. This tax credit aims to encourage telecommunication companies to establish operations in New York, thereby stimulating economic growth. The form allows eligible businesses to claim a credit against their excise tax liability, effectively reducing their overall tax burden. Understanding this form is essential for businesses seeking to benefit from the incentives provided under the START-UP NY program.

How to use the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

Using the Printable New York Form IT 640 involves several steps. First, ensure that your business meets the eligibility criteria set forth by the New York State Department of Taxation and Finance. Once eligibility is confirmed, download the form from an official source. Fill out the required information accurately, including details about your business operations and the specific excise tax credit being claimed. Finally, submit the completed form according to the guidelines provided by the state, either electronically or by mail.

Steps to complete the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

Completing the Printable New York Form IT 640 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including your business's tax identification number and financial records.

- Download the form from a reliable source.

- Complete the form by entering your business information, the amount of credit you are claiming, and any other required details.

- Review the form for accuracy to avoid delays in processing.

- Submit the form according to the specified submission methods, ensuring you meet any deadlines.

Eligibility Criteria

To qualify for the Printable New York Form IT 640, businesses must meet specific eligibility criteria. Generally, this includes being a telecommunication service provider that has established operations within New York State. Additionally, businesses must demonstrate that they meet the investment and job creation requirements outlined by the START-UP NY program. It is crucial to review these criteria thoroughly to ensure compliance and maximize the potential benefits of the tax credit.

Legal use of the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

The legal use of the Printable New York Form IT 640 hinges on compliance with state tax regulations. Businesses must ensure that they are accurately reporting their excise tax liabilities and claiming credits only for eligible expenses. It is advisable to maintain thorough records of all transactions and communications related to the form. By adhering to legal guidelines, businesses can safeguard against potential audits and penalties.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Printable New York Form IT 640 can be done through various methods. Businesses may choose to file the form online via the New York State Department of Taxation and Finance website, which often provides a faster processing time. Alternatively, the form can be mailed to the designated address provided in the instructions. In-person submissions may also be possible at certain state offices, depending on local regulations and availability. It is important to follow the specific submission guidelines to ensure proper processing.

Quick guide on how to complete printable 2020 new york form it 640 start up ny telecommunication services excise tax credit

Prepare Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit with ease

- Locate Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information using the tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to confirm your changes.

- Select your preferred method to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your preferred device. Modify and eSign Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 new york form it 640 start up ny telecommunication services excise tax credit

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 new york form it 640 start up ny telecommunication services excise tax credit

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

The Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit is a tax form that offers businesses in New York a means to claim credits for telecommunication services expenses. This form is designed to help eligible companies reduce their tax liabilities while promoting economic growth in specific sectors. Understanding how to use this form effectively can benefit your business financially.

-

How can I obtain the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

You can easily obtain the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit through our platform, airSlate SignNow. Our solution provides a straightforward way to download and print the form directly from your device. By using our service, you ensure that you have the most up-to-date version of the form.

-

What features does airSlate SignNow offer for completing the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

airSlate SignNow provides an array of features that simplify the completion of the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit. Users can easily fill out the form electronically, add signatures, and securely store completed documents. Additionally, our tool enhances productivity by allowing multiple users to collaborate on the form simultaneously.

-

Is there a cost associated with using airSlate SignNow for the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

While accessing the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit is free, airSlate SignNow operates on a subscription model for premium features. This cost-effective solution enhances document management and eSignature capabilities. We offer a variety of plans to meet different business needs, ensuring you get the best value for your investment.

-

What are the benefits of using airSlate SignNow for tax credits?

Using airSlate SignNow to handle the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit streamlines the tax filing process. It reduces the likelihood of errors through automated checks and allows for efficient tracking of your submitted forms. With our platform, you can save time, reduce stress, and focus on growing your business.

-

How does airSlate SignNow ensure the security of my Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

At airSlate SignNow, we prioritize the security of your documents, including the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit. Our platform employs industry-standard encryption practices to safeguard your information. Additionally, users can control access permissions, ensuring that sensitive data remains confidential.

-

Can I integrate airSlate SignNow with other software for managing the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit?

Yes, airSlate SignNow offers various integrations with popular business software that can enhance the management of the Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit. By connecting with tools like CRM systems and project management software, you can ensure seamless workflow and documentation processes. This integration helps centralize your operations and improve efficiency.

Get more for Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

- Defendants request for postponement of traffic court trial formid ri tr01 riverside courts ca

- Marin county superior court telephonic appearance form

- Hc 001 form

- Civil form ch 100 form harassment pdf online

- Tr 25 form

- Harbor newport beach faclility 4601 jamboree rd form

- Ct 9 complaint to the california attorney general regarding a form

- Care options for children of incarcerated parents la court form

Find out other Printable New York Form IT 640 START UP NY Telecommunication Services Excise Tax Credit

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity

- Can I Electronic signature Florida Affidavit of Title

- How Can I Electronic signature Ohio Affidavit of Service

- Can I Electronic signature New Jersey Affidavit of Identity

- How Can I Electronic signature Rhode Island Affidavit of Service

- Electronic signature Tennessee Affidavit of Service Myself

- Electronic signature Indiana Cease and Desist Letter Free

- Electronic signature Arkansas Hold Harmless (Indemnity) Agreement Fast

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed