Form it 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year 2024-2026

Understanding the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

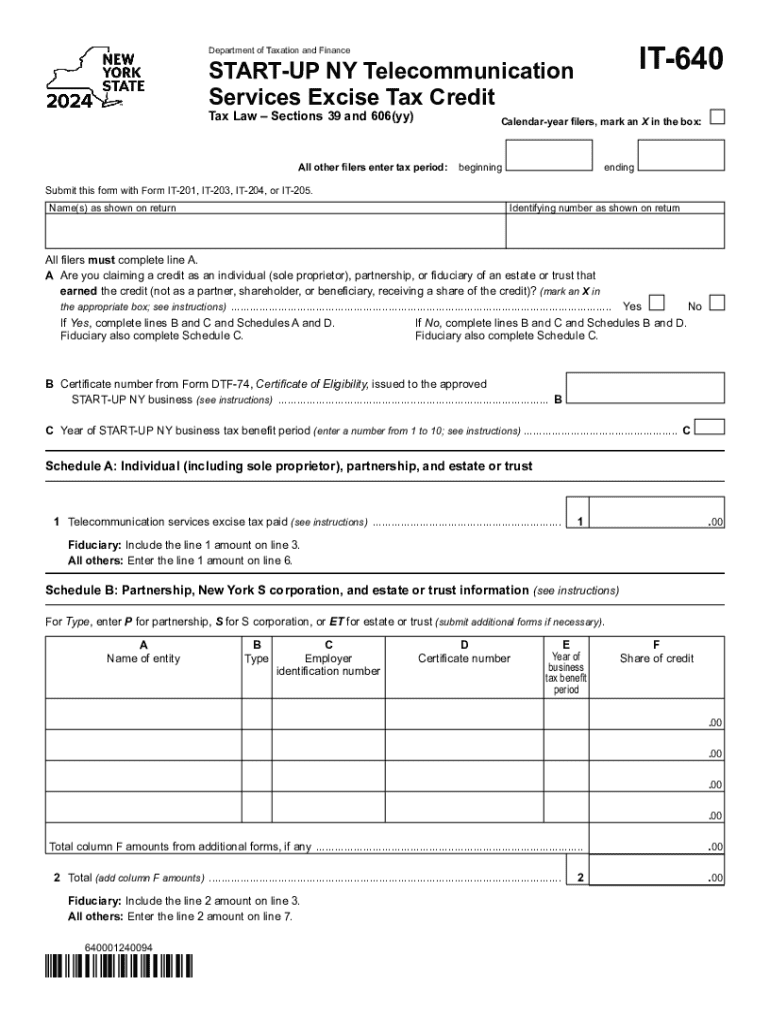

The Form IT 640 is a specific tax form used in New York State for claiming the Telecommunication Services Excise Tax Credit. This credit is designed for eligible businesses that provide telecommunication services and are participating in the START-UP NY program. The purpose of this form is to facilitate the claiming of tax credits that can significantly reduce the overall tax liability for qualifying entities. Understanding the details of this form is essential for businesses seeking to maximize their tax benefits under the START-UP NY initiative.

Steps to Complete the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Completing the Form IT 640 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your telecommunication services and any previous tax filings. Next, fill out the form with precise information regarding your business, including your tax identification number and the specific tax year for which you are claiming the credit. It is crucial to provide accurate figures for the excise tax paid, as this will directly influence the amount of credit you can claim. After completing the form, review it thoroughly for any errors before submission.

Eligibility Criteria for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

To qualify for the Telecommunication Services Excise Tax Credit using Form IT 640, businesses must meet specific eligibility criteria. Primarily, the business must be registered in New York State and provide telecommunication services. Additionally, the business must be participating in the START-UP NY program, which is aimed at fostering economic growth by offering tax incentives to new businesses. It is also important that the business has paid the excise tax during the tax year for which the credit is being claimed.

Required Documents for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

When preparing to submit Form IT 640, several documents are required to support your claim. These typically include proof of the excise tax paid, such as tax payment receipts or statements from the New York State Department of Taxation and Finance. Additionally, businesses should have documentation verifying their participation in the START-UP NY program. This may include application forms, approval letters, or any other relevant correspondence that confirms eligibility for the tax credit.

Filing Deadlines for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Timely filing of Form IT 640 is crucial for businesses seeking to claim the Telecommunication Services Excise Tax Credit. The filing deadline generally aligns with the due date for the business's tax return. It is essential to check the specific deadlines for the tax year in question, as these can vary. Failure to file by the deadline may result in the forfeiture of the tax credit, so businesses should ensure that all forms and supporting documents are submitted promptly.

Form Submission Methods for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Businesses can submit Form IT 640 through various methods, depending on their preference and the requirements set by the New York State Department of Taxation and Finance. The form can typically be filed electronically through the department's online portal, which may offer a more streamlined process. Alternatively, businesses may choose to submit the form via mail, ensuring that it is sent to the correct address for processing. In-person submissions may also be available, although this option can vary based on location and current regulations.

Create this form in 5 minutes or less

Find and fill out the correct form it 640 start up ny telecommunication services excise tax credit tax year 772088892

Create this form in 5 minutes!

How to create an eSignature for the form it 640 start up ny telecommunication services excise tax credit tax year 772088892

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year is a tax form used by businesses in New York to claim credits for telecommunication services. This form helps eligible companies reduce their tax liability while promoting growth in the telecommunication sector. Understanding this form is crucial for maximizing your tax benefits.

-

How can airSlate SignNow help with Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

airSlate SignNow simplifies the process of preparing and submitting Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year. With our eSignature capabilities, you can easily sign and send documents securely, ensuring compliance and efficiency. This streamlines your tax credit application process.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage for managing tax documents like Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year. These tools enhance productivity and ensure that your documents are organized and easily accessible. You can also track document status in real-time.

-

Is airSlate SignNow cost-effective for small businesses filing Form IT 640?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses needing to file Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year. Our pricing plans are flexible and cater to various business sizes, ensuring that you get the best value for your investment. This affordability allows small businesses to manage their tax documentation efficiently.

-

Can I integrate airSlate SignNow with my existing accounting software for tax filing?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easier to manage your tax filings, including Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year. This integration allows for a smooth workflow, reducing the chances of errors and saving you time during tax season.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents like Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year provides numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform ensures that your documents are signed and sent securely, minimizing the risk of fraud. Additionally, the user-friendly interface makes it accessible for everyone.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents, including Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year, by employing advanced encryption and secure cloud storage. We comply with industry standards to protect your sensitive information, ensuring that your documents are safe from unauthorized access. You can trust us to keep your data secure.

Get more for Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

- Bethpage federal credit union dispute charge form

- Complete the table with the correct form of be

- Dcarng 1315 form

- Custody child form

- Molina california service request form fill on pc

- Usac medical examination form for usac and fia drivers license v2018 1 for pwc

- Scottish private residential tenancy agreement template form

- Scottish secure tenancy agreement template form

Find out other Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast