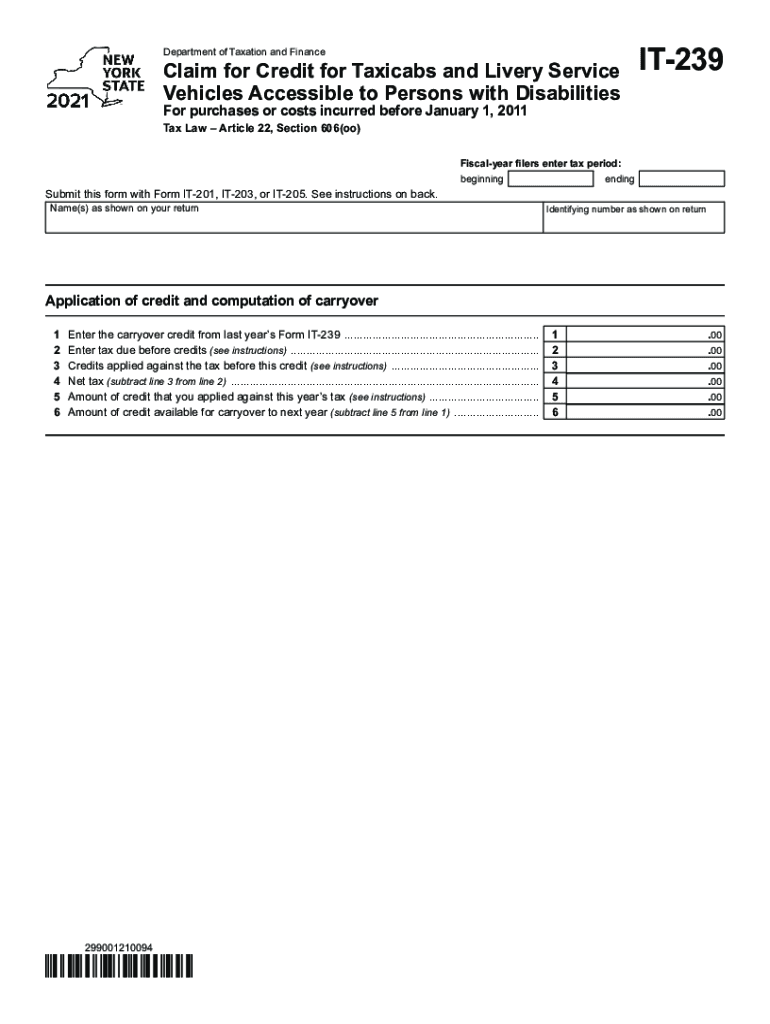

Form it 239 Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities Tax Year 2021

What is the Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

The Form IT 239 is a tax document designed for individuals and businesses operating taxicabs and livery service vehicles that are accessible to persons with disabilities. This form allows eligible taxpayers to claim a credit against their tax liability for expenses incurred in providing accessible transportation services. The credit aims to support the provision of accessible transportation options, ensuring that individuals with disabilities have equal access to transportation services. Understanding the purpose of this form is crucial for those looking to benefit from the tax credits available in the tax year.

How to use the Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

Using the Form IT 239 involves several steps to ensure accurate completion and submission. First, gather all necessary documentation that supports your claim, including proof of expenses related to maintaining and operating accessible vehicles. Next, fill out the form with precise details, including your business information and the specific expenses you are claiming. Finally, submit the completed form to the appropriate tax authority by the designated deadline. It is essential to keep copies of all submitted documents for your records and potential future audits.

Steps to complete the Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

Completing the Form IT 239 requires careful attention to detail. Follow these steps:

- Gather necessary documentation, including receipts and records of expenses related to accessible vehicles.

- Obtain the latest version of the Form IT 239 from the relevant tax authority.

- Fill in your business information accurately, including your tax identification number.

- List the expenses you are claiming, ensuring they meet the eligibility criteria for the credit.

- Review the completed form for accuracy before submission.

- Submit the form by mail or electronically, depending on the options available.

Eligibility Criteria

To qualify for the credit claimed on the Form IT 239, certain eligibility criteria must be met. The vehicles must be used primarily for providing transportation services to individuals with disabilities. Additionally, the expenses claimed must be directly related to the operation and maintenance of these accessible vehicles. It is important to ensure that all documentation reflects compliance with the requirements set forth by the tax authority to avoid delays or denials in processing your claim.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 239 are critical to ensure that claims are processed in a timely manner. Typically, the form must be submitted by the tax filing deadline for the corresponding tax year. It is advisable to check the specific deadlines announced by the tax authority each year, as they may vary. Staying informed about these dates helps prevent missed opportunities for claiming the credit.

Required Documents

When preparing to file the Form IT 239, certain documents are required to substantiate your claim. These may include:

- Receipts for expenses related to the purchase or modification of accessible vehicles.

- Documentation proving the use of vehicles for transporting individuals with disabilities.

- Any additional records that demonstrate compliance with eligibility criteria.

Having these documents organized and readily available will facilitate a smoother filing process.

Quick guide on how to complete form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 2021

Complete Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year seamlessly

- Find Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to confirm your changes.

- Select your preferred method of sharing your form, whether it be via email, SMS, an invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 2021

Create this form in 5 minutes!

How to create an eSignature for the form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 2021

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to make an e-signature straight from your mobile device

The way to make an e-signature for a PDF file on iOS

The best way to make an e-signature for a PDF document on Android devices

People also ask

-

What is it239 in the context of airSlate SignNow?

The term it239 refers to a specific feature set within airSlate SignNow that streamlines the document signing process. It enables users to quickly eSign documents, enhancing workflow efficiency. By leveraging it239, businesses can signNowly reduce turnaround time for contract approvals.

-

How much does airSlate SignNow cost for users interested in it239?

Pricing for airSlate SignNow, including the it239 features, varies based on the plan you choose. Typically, the costs are competitive and reflect the robust functionality offered by it239. We recommend checking the pricing page for the latest information and special offers.

-

What are the key features of it239 in airSlate SignNow?

Key features of it239 include document templates, multi-party signing, and customizable workflows. These features make it239 a powerful tool for managing electronic signatures efficiently. Users benefit from a simplified and organized approach to document handling.

-

How does it239 enhance the benefits of using airSlate SignNow?

it239 enhances airSlate SignNow by providing additional functionalities that streamline business operations. With it239, users gain access to automated reminders and audit trails, which improve compliance and accountability. This results in a more reliable and faster document signing process.

-

Can I integrate it239 with other applications?

Yes, it239 in airSlate SignNow allows for seamless integration with various third-party applications. This includes CRMs, project management tools, and cloud storage solutions. Thanks to these integrations, businesses can enhance their workflows and increase productivity.

-

Is it239 suitable for businesses of all sizes?

Absolutely, it239 is designed to cater to the needs of businesses of all sizes, from startups to large enterprises. The scalability of it239 means that it can grow alongside your business, providing the necessary tools for effective document management. This adaptability makes it239 a popular choice for diverse industries.

-

What benefits do I gain from using it239 in my business?

Using it239 provides multiple benefits including reduced paperwork, improved turnaround times, and enhanced security. These advantages not only streamline your document signing process but also help in cutting down operational costs signNowly. It239 makes your business more agile and responsive to client needs.

Get more for Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- Revocation of premarital or prenuptial agreement colorado form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children colorado form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497299728 form

- Colorado pre incorporation agreement shareholders agreement and confidentiality agreement colorado form

- Colorado bylaws for corporation colorado form

- Corporate records maintenance package for existing corporations colorado form

- Colorado llc form

- Co company form

Find out other Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure