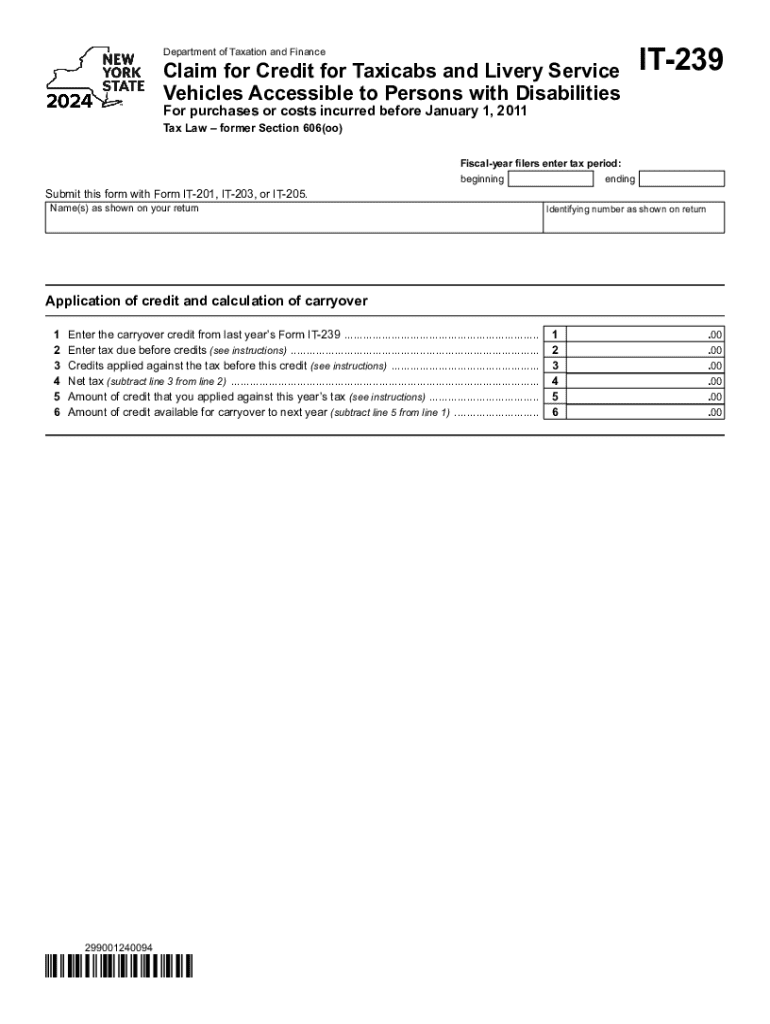

Form it 239 Claim for Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities Tax Year 2024-2026

Understanding the Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

The Form IT 239 is a tax document used to claim credits for the purchase or lease of taxicabs and livery service vehicles that are accessible to persons with disabilities. This form is essential for businesses and individuals who provide transportation services and want to ensure they are compliant with tax regulations while also supporting accessibility initiatives. The credit aims to encourage the use of accessible vehicles in the transportation industry, thereby enhancing mobility for individuals with disabilities.

Steps to Complete the Form IT 239

Completing the Form IT 239 involves several key steps:

- Gather necessary information, including details about the vehicle, its accessibility features, and proof of purchase or lease.

- Fill out the identification section with your name, business name, and contact information.

- Provide specific details about the vehicle, including make, model, and year, along with the vehicle identification number (VIN).

- Document the accessibility features of the vehicle, ensuring that all criteria for the tax credit are met.

- Calculate the credit amount based on the cost of the vehicle and any applicable limits.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Using the Form IT 239

To qualify for the credit claimed through Form IT 239, certain eligibility criteria must be met:

- The vehicle must be used primarily for transporting passengers.

- The vehicle must be accessible to individuals with disabilities, meeting specific design and equipment standards.

- The claimant must be a registered business or individual who pays taxes in the United States.

- Documentation proving the purchase or lease of the vehicle must be provided.

Required Documents for Form IT 239

When filing Form IT 239, it is crucial to include the following documents:

- A copy of the purchase or lease agreement for the vehicle.

- Proof of payment, such as receipts or invoices.

- Documentation demonstrating the vehicle's accessibility features.

- Any previous tax filings that may support the claim.

Form Submission Methods

Form IT 239 can be submitted through various methods, ensuring flexibility for taxpayers:

- Online submission through the appropriate tax authority's electronic filing system.

- Mailing the completed form to the designated tax office, ensuring it is postmarked by the filing deadline.

- In-person submission at local tax offices, where assistance may be available.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential for successful submission of Form IT 239. Generally, the form must be filed by the tax return deadline for the year in which the vehicle was purchased or leased. Extensions may be available, but it is crucial to check specific dates each tax year to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 772082768

Create this form in 5 minutes!

How to create an eSignature for the form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 772082768

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year?

Form IT 239 is a tax form that allows eligible businesses to claim a credit for the purchase or lease of taxicabs and livery service vehicles that are accessible to persons with disabilities. This form is essential for businesses looking to support accessibility while also benefiting from tax credits.

-

How can airSlate SignNow help with Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year?

airSlate SignNow streamlines the process of completing and submitting Form IT 239 by providing an easy-to-use platform for eSigning and managing documents. Our solution ensures that all necessary forms are filled out accurately and submitted on time, helping you maximize your tax credits.

-

What features does airSlate SignNow offer for managing Form IT 239?

With airSlate SignNow, you can easily create, edit, and eSign Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year. Our platform also includes templates, document tracking, and secure storage to ensure your forms are always accessible and compliant.

-

Is there a cost associated with using airSlate SignNow for Form IT 239?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions provide access to all features necessary for managing Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year, ensuring you get the best value for your investment.

-

Can I integrate airSlate SignNow with other software for Form IT 239?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when managing Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year. This integration helps you maintain efficiency and accuracy across your business processes.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including Form IT 239, offers numerous benefits such as enhanced security, ease of use, and time savings. Our platform ensures that your documents are securely stored and easily accessible, allowing you to focus on your business while we handle the paperwork.

-

How does airSlate SignNow ensure the security of Form IT 239?

airSlate SignNow prioritizes the security of your documents, including Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year. We utilize advanced encryption and secure cloud storage to protect your sensitive information from unauthorized access.

Get more for Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- Edinburgh postpartum depression scale form

- Staar science tutorial 30 answer key form

- Emudhra form download

- Maybank account opening form pdf

- Form no fa 02

- Bakery confectionery pension direct deposit form

- Use of form use of this form is mandatory for family child care centers to comply with dcf 250

- Hospice intake form 422241911

Find out other Form IT 239 Claim For Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities Tax Year

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast