K 40PT Property Tax Relief Claim for Low Income Seniors Rev 7 21 the Property Tax Relief Claim K 40PT Allows a Refund of Propert 2021

Understanding the K-40PT Property Tax Relief Claim for Low-Income Seniors

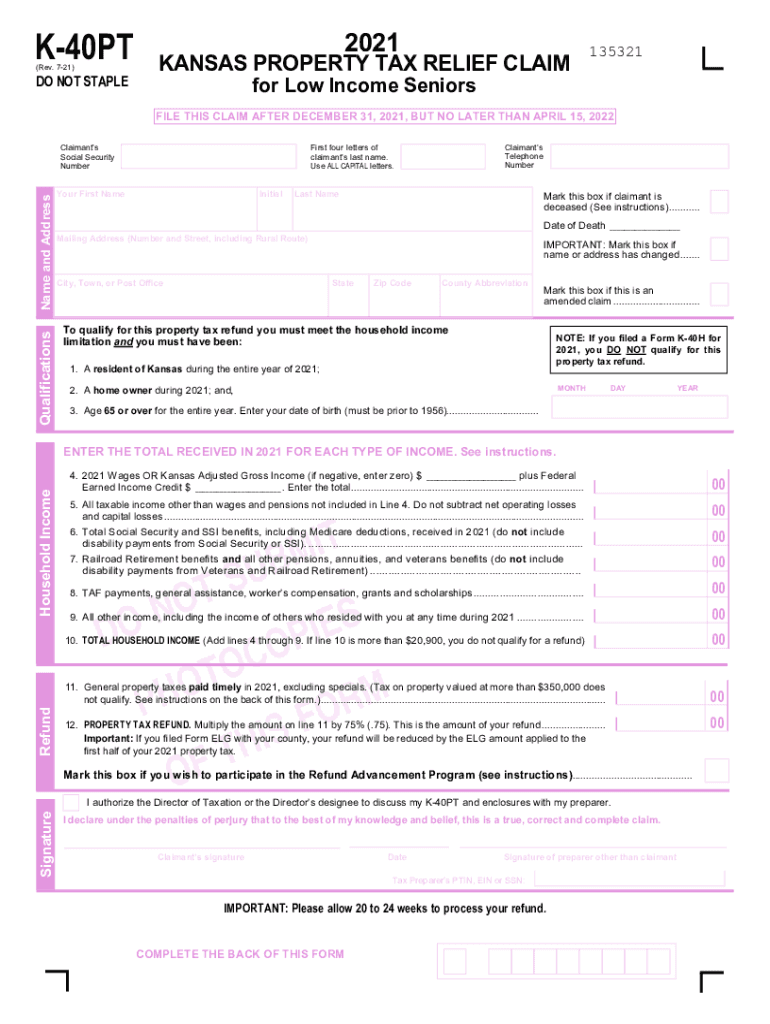

The K-40PT form is designed to provide property tax relief for low-income senior citizens who own their homes in Kansas. This program allows eligible individuals to receive a refund of up to seventy-five percent of the property taxes they have paid, provided that these taxes were paid in a timely manner. The aim is to ease the financial burden on seniors, ensuring they can maintain their homes without excessive tax pressure.

Eligibility Criteria for the K-40PT Property Tax Relief Claim

To qualify for the K-40PT tax relief, applicants must meet specific criteria. Primarily, the individual must be a senior citizen, typically defined as being sixty-five years of age or older. Additionally, the applicant must own and occupy the property for which they are claiming relief. Income limits are also imposed, ensuring that only low-income seniors benefit from this program. It is essential to review these criteria carefully to confirm eligibility before proceeding with the application.

Steps to Complete the K-40PT Property Tax Relief Claim

Filling out the K-40PT form involves several straightforward steps:

- Gather necessary documentation, including proof of age, income statements, and property tax receipts.

- Obtain the K-40PT form from the appropriate state department or download it from a reliable source.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Submit the completed form along with any required documentation by the specified deadline.

Following these steps can help ensure a smooth application process and increase the likelihood of receiving the tax relief refund.

Form Submission Methods for the K-40PT

The K-40PT form can be submitted through various methods, making it accessible for all applicants. Options typically include:

- Online submission through the state’s official tax website, where applicable.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, providing an opportunity for immediate assistance if needed.

Choosing the most convenient submission method can help facilitate a timely review of the claim.

Required Documents for the K-40PT Claim

When applying for the K-40PT property tax relief, certain documents are essential to support the claim. These typically include:

- Proof of age, such as a birth certificate or driver's license.

- Income verification, which may consist of tax returns or Social Security statements.

- Property tax receipts to demonstrate timely payment of taxes.

Having these documents ready can expedite the application process and ensure compliance with all requirements.

Important Filing Deadlines for the K-40PT

It is crucial to be aware of the filing deadlines associated with the K-40PT form. Typically, applications must be submitted by a specific date each year to qualify for the tax relief for that tax year. Missing the deadline may result in the loss of the opportunity for relief. Applicants should check the current year's deadline and plan accordingly to ensure timely submission.

Quick guide on how to complete k 40pt property tax relief claim for low income seniors rev 7 21 the property tax relief claim k 40pt allows a refund of

Complete K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert easily on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without interruptions. Manage K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and electronically sign K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert stress-free

- Locate K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes requiring you to print new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert to ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct k 40pt property tax relief claim for low income seniors rev 7 21 the property tax relief claim k 40pt allows a refund of

Create this form in 5 minutes!

How to create an eSignature for the k 40pt property tax relief claim for low income seniors rev 7 21 the property tax relief claim k 40pt allows a refund of

The best way to make an electronic signature for your PDF file in the online mode

The best way to make an electronic signature for your PDF file in Chrome

The best way to make an e-signature for putting it on PDFs in Gmail

The way to generate an e-signature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

The way to generate an e-signature for a PDF file on Android

People also ask

-

What is k 40pt in the context of airSlate SignNow?

K 40pt refers to a specific pricing tier within the airSlate SignNow platform. This tier offers advanced features specifically designed to enhance the document signing experience for businesses. With k 40pt, users gain access to seamless integration and powerful tools for their eSignature needs.

-

How does the k 40pt pricing plan compare to other plans?

The k 40pt pricing plan is a cost-effective solution that balances functionality and affordability. Compared to other plans, k 40pt includes exclusive features that cater to growing businesses, ensuring they have all necessary tools to streamline document management without excessive costs.

-

What features are included in the k 40pt plan?

The k 40pt plan includes features such as document templates, team management, and advanced reporting. These features enable businesses to customize their workflow and enhance collaboration. Additionally, users benefit from unlimited eSignatures, making the k 40pt plan a comprehensive solution.

-

Are there any benefits to choosing the k 40pt plan?

Choosing the k 40pt plan means gaining access to exclusive functionality designed to optimize document signing processes. Users can improve efficiency, save time, and reduce costs associated with traditional document handling. The k 40pt plan is perfect for businesses looking to modernize their operations.

-

Can the k 40pt plan integrate with other software?

Yes, the k 40pt plan offers seamless integrations with various software applications, including CRMs and project management tools. This ability to connect with other platforms ensures that businesses can maintain a smooth workflow and enhance their productivity. Integrating with the k 40pt plan can signNowly benefit business operations.

-

Is customer support available for k 40pt subscribers?

Absolutely! K 40pt subscribers receive dedicated customer support to assist with any inquiries or technical difficulties. Our support team is trained to address all aspects of the airSlate SignNow platform, ensuring that users can maximize their experience with the k 40pt plan.

-

How secure is the k 40pt eSigning process?

The k 40pt plan employs state-of-the-art security measures to protect users' documents and personal information. With encryption and compliance with various security regulations, airSlate SignNow ensures that your eSigning experience is both safe and reliable. Security is a top priority in the k 40pt offering.

Get more for K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert

- Landlord tenant lease co signer agreement colorado form

- Application for sublease colorado form

- Inventory and condition of leased premises for pre lease and post lease colorado form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out colorado form

- Property manager agreement colorado form

- Agreement for delayed or partial rent payments colorado form

- Tenants maintenance repair request form colorado

- Guaranty attachment to lease for guarantor or cosigner colorado form

Find out other K 40PT Property Tax Relief Claim For Low Income Seniors Rev 7 21 The Property Tax Relief Claim K 40PT Allows A Refund Of Propert

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT