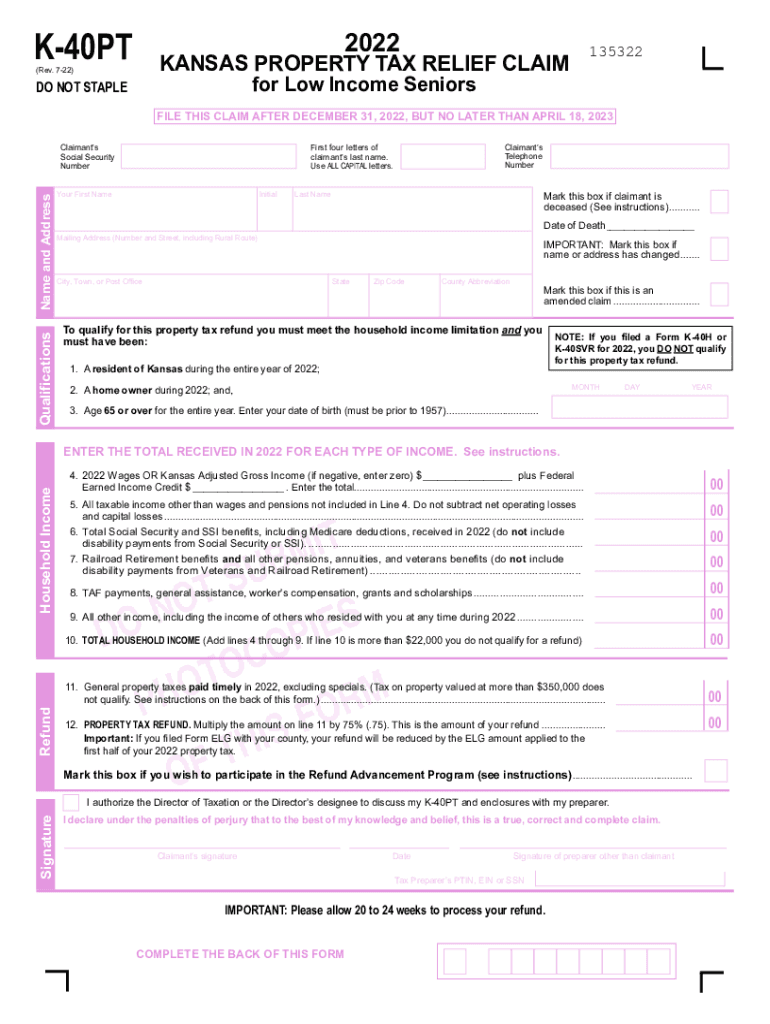

Form K 40PT "Kansas Property Tax Relief Claim for Low Income Seniors 2022

What is the K 40PT Form?

The K 40PT form, officially known as the Kansas Property Tax Relief Claim for Low Income Seniors, is designed to provide financial assistance to eligible low-income seniors in Kansas. This form allows qualifying individuals to claim property tax relief, helping to alleviate the financial burden associated with property taxes. The relief is aimed at seniors who meet specific income criteria and own their homes, ensuring that they can maintain their housing without undue financial strain.

Eligibility Criteria for the K 40PT Form

To qualify for the K 40PT form, applicants must meet certain eligibility requirements. These include:

- Being a resident of Kansas.

- Being at least sixty-five years old on or before December 31 of the tax year.

- Having a total household income below the specified threshold set by the state.

- Owning and occupying the property for which the tax relief is being claimed.

It is essential for applicants to review the current income limits and other criteria to ensure they qualify before submitting the form.

Steps to Complete the K 40PT Form

Completing the K 40PT form requires careful attention to detail. Follow these steps to ensure accurate submission:

- Obtain the K 40PT form from an authorized source, such as the Kansas Department of Revenue website.

- Fill out personal information, including your name, address, and Social Security number.

- Provide details about your property, including the address and property tax information.

- Report your total household income, ensuring you include all sources of income.

- Sign and date the form to certify the information provided is accurate.

After completing the form, review it for accuracy before submission to avoid delays in processing.

How to Submit the K 40PT Form

The K 40PT form can be submitted through various methods. Applicants may choose to:

- Submit the form online through the Kansas Department of Revenue portal.

- Mail the completed form to the appropriate county appraiser's office.

- Deliver the form in person to the local county appraiser's office.

Each submission method has its own processing timelines, so it is advisable to choose the method that best suits your needs.

Legal Use of the K 40PT Form

The K 40PT form is legally recognized as a valid claim for property tax relief in Kansas, provided all requirements are met. To ensure the legal standing of your claim, it is crucial to:

- Submit the form within the designated filing deadlines.

- Provide accurate and truthful information on the form.

- Retain copies of all submitted documents for your records.

Failure to comply with these legal requirements may result in denial of the claim or potential penalties.

Required Documents for the K 40PT Form

When filing the K 40PT form, certain documents may be required to support your claim. Commonly needed items include:

- Proof of age, such as a birth certificate or driver's license.

- Documentation of total household income, including tax returns and pay stubs.

- Property tax statements for the property for which relief is being claimed.

Gathering these documents in advance can streamline the application process and ensure that your claim is processed without unnecessary delays.

Quick guide on how to complete form k 40pt ampquotkansas property tax relief claim for low income seniors

Complete Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal sustainable substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly and without delays. Handle Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors effortlessly

- Locate Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form k 40pt ampquotkansas property tax relief claim for low income seniors

Create this form in 5 minutes!

How to create an eSignature for the form k 40pt ampquotkansas property tax relief claim for low income seniors

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is k 40pt in the context of airSlate SignNow?

The term 'k 40pt' refers to a specific pricing tier available in the airSlate SignNow platform. This tier offers robust features at a competitive price, making it an attractive option for businesses looking to streamline their document signing processes.

-

How much does the k 40pt plan cost?

The k 40pt plan is designed to provide businesses with affordable options for document eSigning. Our pricing includes various features tailored to meet business needs, ensuring that you get the best value for your investment.

-

What features are included in the k 40pt plan?

The k 40pt plan includes essential features such as unlimited eSignatures, customizable templates, and secure cloud storage. These features empower businesses to manage their document workflows efficiently and effectively.

-

Can k 40pt integrate with other software applications?

Yes, the k 40pt plan seamlessly integrates with a variety of other software applications, including CRM and project management tools. This integration enhances productivity by allowing users to manage documents and signatures within their existing workflows.

-

What are the benefits of choosing the k 40pt plan?

Choosing the k 40pt plan provides businesses with a cost-effective solution for eSigning documents. It also improves operational efficiency, reduces turnaround time, and ensures compliance with legal requirements in the digital signing process.

-

Is customer support included in the k 40pt plan?

Absolutely! The k 40pt plan includes dedicated customer support, ensuring that users have access to assistance whenever they need it. Our support team is knowledgeable and ready to help with any questions or issues that may arise.

-

Can I try the k 40pt plan before committing?

Yes, airSlate SignNow offers a free trial for the k 40pt plan, allowing users to experience the full benefits of the platform. This trial is a great way to see how our eSigning solution can enhance your business operations.

Get more for Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors

- General warranty deed five individual grantors to four individual grantees subject to life estate texas form

- Texas conservator form

- Tx managing conservator form

- General warranty deed individual to limited liability company texas form

- Certificate of service tx rappproc 63 texas form

- Bill sale golf form

- Terms of sale golf cart and waiver and release of liability for purchase texas form

- Indemnification pdf form

Find out other Form K 40PT "Kansas Property Tax Relief Claim For Low Income Seniors

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy