Dor Georgia Gov500 Individual Income Tax Return500 Individual Income Tax ReturnGeorgia Department of Revenue Form

Understanding the 500 Individual Income Tax Return

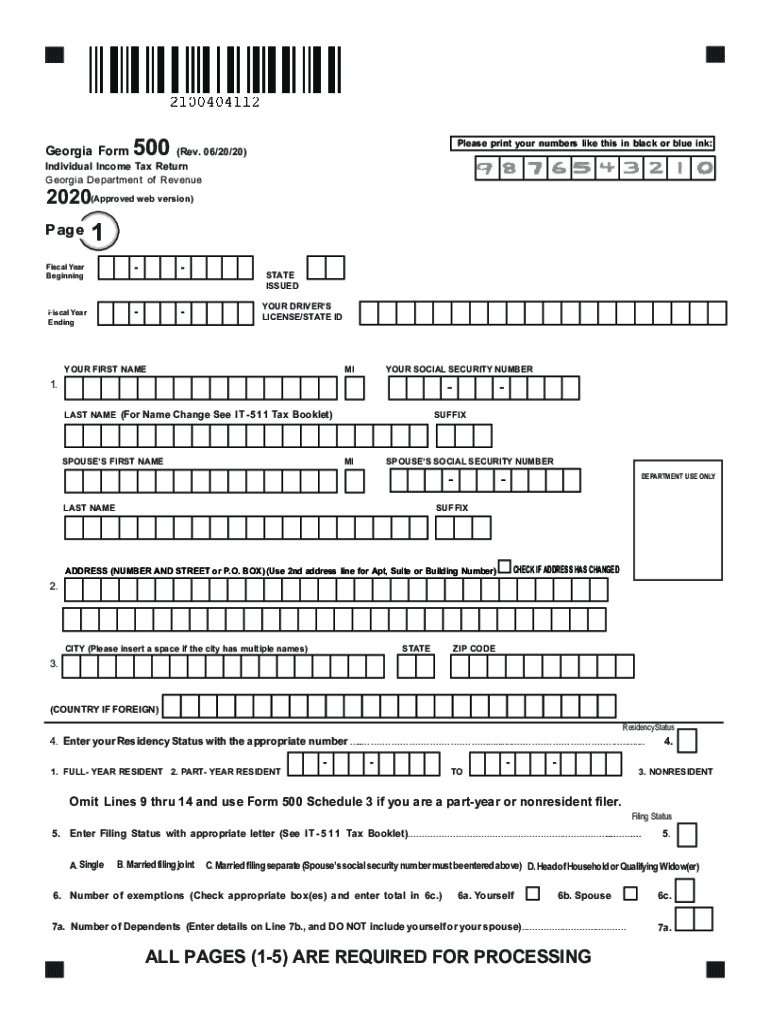

The 500 income tax return form is a crucial document for individuals filing their state taxes in Georgia. This form is specifically designed for residents who need to report their income and calculate their tax liability. It is essential for ensuring compliance with state tax laws and for determining eligibility for various tax credits and deductions. The Georgia Department of Revenue oversees the distribution and processing of this form, making it a vital part of the state's tax system.

Steps to Complete the 500 Individual Income Tax Return

Completing the 500 individual income tax return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is important to double-check all entries for accuracy. After completing the form, review it for any errors before submitting it to the Georgia Department of Revenue.

Filing Deadlines and Important Dates

Awareness of filing deadlines is essential when submitting the 500 income tax return. Typically, the deadline for filing is April 15th of each year, aligning with federal tax deadlines. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Georgia Department of Revenue’s official website for any updates or changes to deadlines, especially for extensions or specific situations that may apply to your filing.

Required Documents for Filing

To successfully file the 500 individual income tax return, certain documents are required. These typically include:

- W-2 forms from all employers

- 1099 forms for any additional income

- Records of any deductions or credits you plan to claim

- Proof of residency if applicable

Having these documents ready will streamline the filing process and help avoid delays in processing your return.

Legal Use of the 500 Individual Income Tax Return

The 500 individual income tax return is legally binding once submitted to the Georgia Department of Revenue. It is crucial to provide accurate information, as any discrepancies can lead to penalties or audits. The form must be signed, either electronically or physically, to validate its authenticity. Compliance with state regulations ensures that your tax return is processed correctly and that you avoid potential legal issues.

Form Submission Methods

There are multiple methods to submit the 500 income tax return form. Taxpayers can choose to file online through the Georgia Department of Revenue's e-filing system, which is often the fastest method. Alternatively, individuals may opt to mail a printed version of the form or submit it in person at designated tax offices. Each method has its own processing times and requirements, so it is beneficial to choose the one that best suits your needs.

Quick guide on how to complete dorgeorgiagov500 individual income tax return500 individual income tax returngeorgia department of revenue

Effortlessly prepare Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Handle Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue with ease

- Locate Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools available from airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form—through email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dorgeorgiagov500 individual income tax return500 individual income tax returngeorgia department of revenue

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

Does Georgia have a state income tax for residents?

Yes, Georgia has a state income tax that applies to residents earning income within the state. The tax is progressive, meaning rates increase with higher income levels. Understanding your tax obligations is essential for managing your finances.

-

What are the current tax rates in Georgia?

Georgia's state income tax rates range from 1% to 5.75%, depending on your income bracket. It’s important to check the latest tax brackets to ensure compliance when filing. This is vital information for anyone concerned about 'does Georgia have a state income tax'.

-

How does airSlate SignNow help with tax-related documentation?

airSlate SignNow simplifies the process of sending and eSigning tax-related documents, ensuring you stay organized and efficient. By utilizing our platform, you can securely handle important files, reducing the stress associated with tax season. This is especially helpful for individuals needing clarity about 'does Georgia have a state income tax'.

-

Does eSigning documents on airSlate SignNow hold legal standing in Georgia?

Yes, eSigning documents using airSlate SignNow holds legal standing in Georgia, in accordance with the Electronic Signature in Global and National Commerce (ESIGN) Act. This means you can confidently sign documents related to state income tax or any other legal matters online. This is crucial for those asking 'does Georgia have a state income tax'.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow provides competitive pricing plans that cater to various business needs. This cost-effective solution empowers users to manage their documents and workflows efficiently. Understanding such details can benefit those who may be concerned about tax costs, including 'does Georgia have a state income tax'.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow offers seamless integration with numerous accounting and financial software platforms. This capability helps streamline your workflow, especially when managing tax documentation. For those inquiring about 'does Georgia have a state income tax', this feature can enhance financial management.

-

What features make airSlate SignNow a great choice for businesses?

AirSlate SignNow offers a wide range of features, including customizable templates, bulk sending, and real-time tracking of document status. These functionalities make it easier for businesses to stay compliant and efficient when managing important documents, including tax-related ones. Thus, understanding if 'does Georgia have a state income tax' becomes smoother.

Get more for Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue

Find out other Dor georgia gov500 individual income tax return500 Individual Income Tax ReturnGeorgia Department Of Revenue

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF