Fillable Online Marsh McLennan 800 Deductible Plan Fax 2021

IRS Guidelines for the 8992 Form

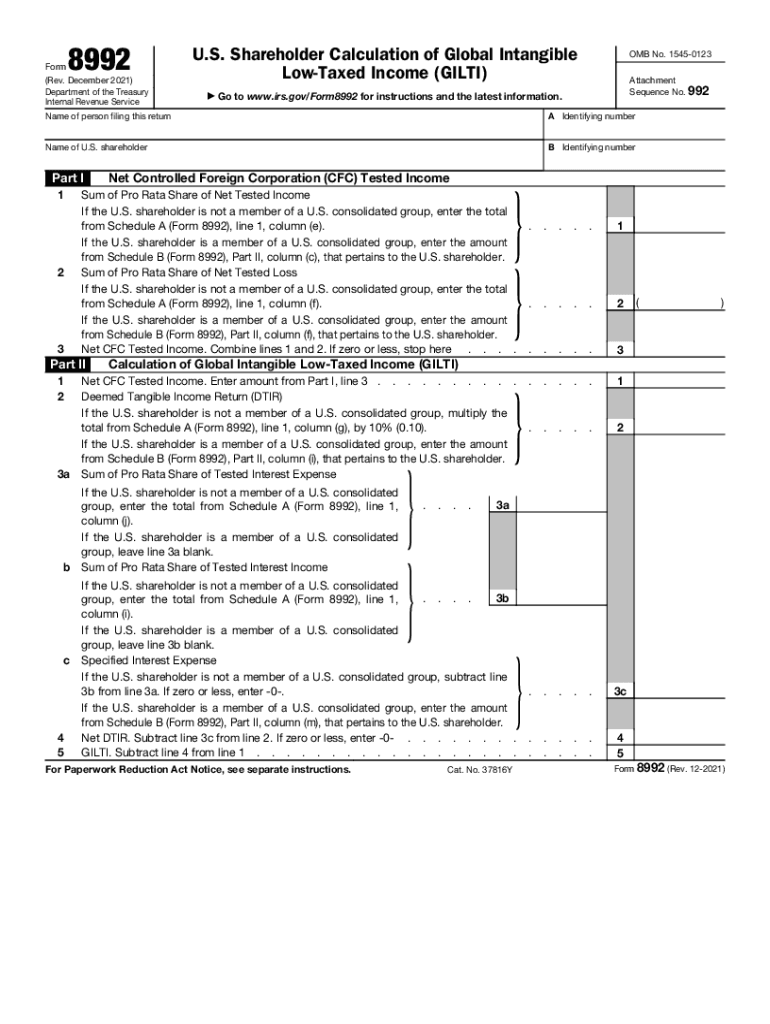

The IRS 8992 form, also known as the IRS 8992 GILTI form, is essential for U.S. taxpayers with controlled foreign corporations (CFCs). This form is used to calculate the Global Intangible Low-Taxed Income (GILTI) and ensure compliance with U.S. tax regulations. Taxpayers must accurately report their GILTI to avoid potential penalties. The IRS provides detailed instructions for completing the 8992 form, including definitions of key terms and the necessary calculations to determine the GILTI amount.

Filing Deadlines and Important Dates

Timely filing of the IRS 8992 form is crucial for compliance. The form is typically due on the same date as your income tax return. For most taxpayers, this means April 15 of the following year. If you file for an extension, the deadline can be extended to October 15. However, it is important to note that an extension to file does not extend the time to pay any taxes owed. Taxpayers should mark their calendars to ensure they meet these critical deadlines.

Required Documents for the 8992 Form

To complete the IRS 8992 form accurately, you will need several documents. These include:

- Financial statements of your controlled foreign corporations.

- Details of foreign taxes paid or accrued.

- Information regarding your ownership percentage in the CFCs.

- Any prior year tax returns that may impact your GILTI calculation.

Having these documents ready will streamline the process and ensure that your form is completed correctly.

Form Submission Methods

The IRS 8992 form can be submitted in several ways. Taxpayers have the option to file electronically or submit a paper version by mail. Electronic filing is often preferred as it allows for quicker processing and confirmation of receipt. If you choose to file by mail, ensure that you send your form to the correct address specified by the IRS to avoid delays in processing.

Penalties for Non-Compliance

Failure to file the IRS 8992 form or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filings, which can accumulate over time. Additionally, inaccuracies can result in further audits or investigations. It is essential to ensure that the form is completed accurately and submitted on time to avoid these potential issues.

Eligibility Criteria for Filing the 8992 Form

Not all taxpayers are required to file the IRS 8992 form. Generally, it applies to U.S. shareholders of controlled foreign corporations. To determine eligibility, you must assess your ownership stake in foreign entities and whether those entities qualify as CFCs under IRS regulations. Understanding these criteria is vital for compliance and accurate reporting.

Quick guide on how to complete fillable online marsh mclennan 800 deductible plan fax

Complete Fillable Online Marsh McLennan 800 Deductible Plan Fax effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Fillable Online Marsh McLennan 800 Deductible Plan Fax on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented operation today.

The easiest method to edit and electronically sign Fillable Online Marsh McLennan 800 Deductible Plan Fax without effort

- Obtain Fillable Online Marsh McLennan 800 Deductible Plan Fax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Fillable Online Marsh McLennan 800 Deductible Plan Fax to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online marsh mclennan 800 deductible plan fax

Create this form in 5 minutes!

How to create an eSignature for the fillable online marsh mclennan 800 deductible plan fax

The way to create an e-signature for your PDF document in the online mode

The way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an e-signature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an e-signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow 8992?

airSlate SignNow 8992 is an easy-to-use electronic signature solution that empowers businesses to send and eSign documents efficiently. With streamlined workflows, it ensures that you can manage your documents seamlessly from anywhere. The platform is designed to increase productivity while providing a secure way to handle important paperwork.

-

How much does airSlate SignNow 8992 cost?

The pricing for airSlate SignNow 8992 is competitive and offers various plans tailored to fit the needs of different businesses. You can choose from monthly or annual subscriptions, ensuring flexibility regardless of your company size. It's beneficial to evaluate the features included at each pricing tier to find the best value for your requirements.

-

What features are available with airSlate SignNow 8992?

airSlate SignNow 8992 includes a variety of features such as customizable templates, real-time status tracking, and robust integration options. These features help streamline your document workflows and enhance collaboration within teams. Additionally, the platform supports mobile access, allowing users to sign documents on the go.

-

Can I integrate airSlate SignNow 8992 with other applications?

Yes, airSlate SignNow 8992 offers seamless integrations with popular applications like Google Drive, Salesforce, and Dropbox. This capability allows for a smoother workflow by connecting your existing tools with our electronic signature platform. It ensures all your business processes are cohesive and efficient.

-

What are the benefits of using airSlate SignNow 8992?

Using airSlate SignNow 8992 offers numerous benefits, including quicker document turnaround times and improved compliance with regulations. Its user-friendly interface allows employees to adopt the platform easily, resulting in higher productivity. Furthermore, it enhances the customer experience by facilitating faster transactions and secure document handling.

-

Is airSlate SignNow 8992 secure for sensitive documents?

Absolutely, airSlate SignNow 8992 prioritizes security and utilizes advanced encryption methods to protect your sensitive documents. The platform complies with various regulations, ensuring that your data remains safe throughout the signing process. Our focus on security provides peace of mind for users handling confidential information.

-

How can I get support for airSlate SignNow 8992?

airSlate SignNow 8992 offers comprehensive customer support through various channels, including live chat, email, and a dedicated knowledge base. You can access tutorials and support documentation to help you navigate the platform effectively. Our team is always ready to assist with any questions or issues that may arise.

Get more for Fillable Online Marsh McLennan 800 Deductible Plan Fax

- Motion parenting time form

- Instructions for motion to modify restrict parenting time colorado form

- Motion jdf 497300281 form

- Colorado child support form

- Terminate support order form

- Instructions to file a motion or stipulation to modify custody or decision making responsibility colorado form

- Petition underage form

- Parental responsibilities form

Find out other Fillable Online Marsh McLennan 800 Deductible Plan Fax

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now