Form 8992 Rev December U S Shareholder Calculation of Global Intangible Low Taxed Income GILTI 2022-2026

What is the Form 8992?

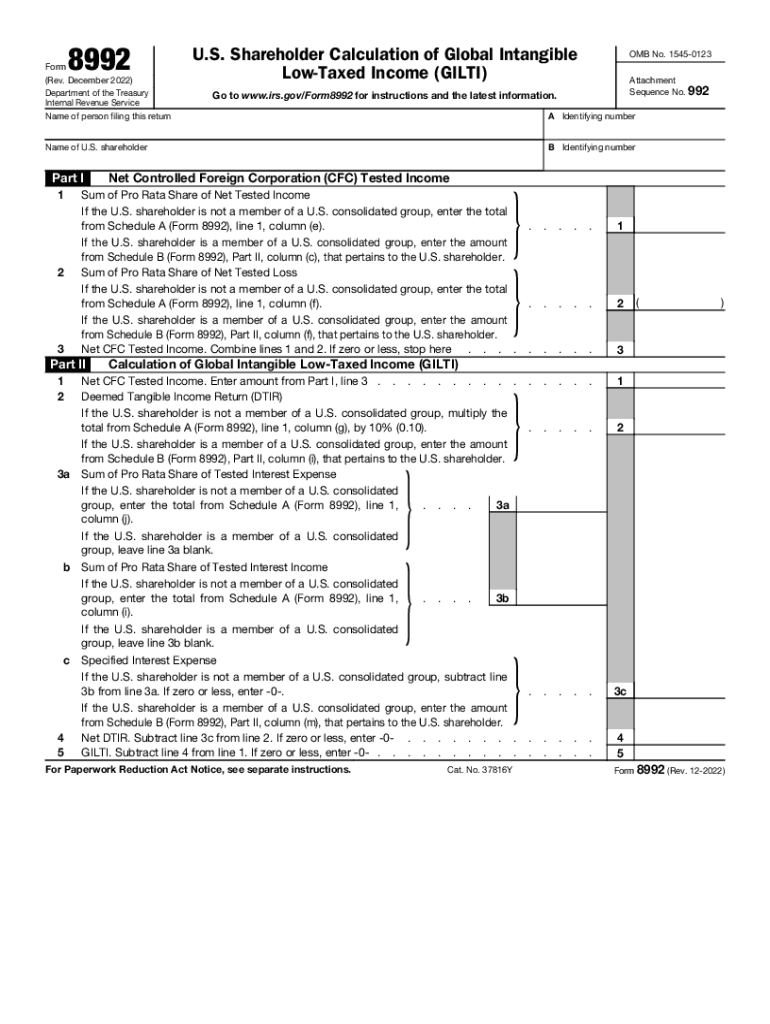

The Form 8992, officially titled the U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI), is a tax form used by U.S. shareholders of controlled foreign corporations (CFCs). This form is essential for calculating the GILTI inclusion amount, which is part of the U.S. tax system aimed at addressing the taxation of foreign income. It allows U.S. taxpayers to report their share of GILTI, ensuring compliance with tax regulations and contributing to the overall tax liability of the shareholder.

Steps to Complete the Form 8992

Completing the Form 8992 involves several key steps:

- Gather necessary financial information from the controlled foreign corporation, including income statements and balance sheets.

- Determine the GILTI inclusion amount based on the CFC’s income and the shareholder's ownership percentage.

- Fill out the form accurately, ensuring all calculations align with IRS guidelines.

- Review the form for completeness and accuracy before submission.

Key Elements of the Form 8992

The Form 8992 includes several critical components:

- Shareholder Information: Identifying details of the U.S. shareholder.

- Controlled Foreign Corporation Details: Information about the CFC, including its name and Employer Identification Number (EIN).

- GILTI Calculation: Detailed calculations that determine the GILTI amount, including tested income and qualified business asset investment.

- Signature: The form must be signed by the shareholder or an authorized representative.

IRS Guidelines for Form 8992

The IRS provides specific guidelines for completing and filing the Form 8992. These guidelines include instructions on eligibility, required documentation, and deadlines for submission. It is crucial to refer to the latest IRS publications to ensure compliance with any updates or changes in tax law that may affect the filing process.

Filing Deadlines for Form 8992

Understanding the filing deadlines for the Form 8992 is essential for compliance. Generally, the form must be filed with the U.S. tax return by the due date of that return, including extensions. Taxpayers should stay informed about any changes to deadlines that may arise due to legislative updates or IRS announcements.

Penalties for Non-Compliance with Form 8992

Failure to file the Form 8992 or inaccuracies in the information reported can result in significant penalties. The IRS may impose fines for late submissions or incorrect calculations, which can add to the overall tax liability. It is vital for taxpayers to ensure that the form is completed accurately and submitted on time to avoid these penalties.

Quick guide on how to complete form 8992 rev december 2022 us shareholder calculation of global intangible low taxed income gilti

Effortlessly complete Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI on any gadget

Managing documents online has become increasingly favored by businesses and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely keep it online. airSlate SignNow provides all the resources necessary to create, adjust, and electronically sign your documents swiftly without any holdups. Handle Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to adjust and electronically sign Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI with ease

- Obtain Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management requirements with just a few clicks from any preferred device. Modify and electronically sign Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI to ensure outstanding communication throughout any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8992 rev december 2022 us shareholder calculation of global intangible low taxed income gilti

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 8992?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents efficiently. The reference to '8992' highlights a specific feature or campaign that may enhance your understanding and use of our platform, showcasing its powerful functionalities.

-

What are the pricing options for airSlate SignNow under the 8992 plan?

The pricing for airSlate SignNow, including our '8992' plan, is designed to be cost-effective. You can choose from various subscription tiers tailored to your business needs, ensuring that you receive maximum value for document signing and management.

-

What features does the 8992 plan offer?

The 8992 plan includes a suite of essential features such as unlimited document signing, templates, and advanced security options. These features empower users to streamline their workflows and improve efficiency in document management.

-

How can airSlate SignNow benefit my business with the 8992 plan?

Utilizing the 8992 plan with airSlate SignNow brings signNow benefits to your business, including faster turnaround times for document processing and enhanced team collaboration. It simplifies the signing process, allowing you to focus on critical tasks and boost productivity.

-

Is it easy to integrate airSlate SignNow with existing tools in the 8992 plan?

Yes, airSlate SignNow is designed to seamlessly integrate with a variety of platforms such as CRM systems and cloud storage solutions under the 8992 plan. This flexibility ensures you can incorporate our eSigning capabilities into your current workflows without hassle.

-

What types of documents can I send and eSign using the 8992 plan?

With the 8992 plan, you can send a wide range of documents for eSigning, such as contracts, agreements, and forms. The versatility of airSlate SignNow allows you to manage and execute any document that requires a signature efficiently.

-

Are there any compliance guarantees with airSlate SignNow's 8992 plan?

Absolutely! airSlate SignNow adheres to industry standards and regulations, ensuring compliance with eSignature laws under the 8992 plan. This gives you peace of mind that your documents are legally binding and secure.

Get more for Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI

- Nevada change name 497320889 form

- Nv name new form

- Nv request pdf form

- Nevada name change 497320892 form

- Nevada unsecured installment payment promissory note for fixed rate nevada form

- Nv note form

- Nevada installments fixed rate promissory note secured by personal property nevada form

- Nevada note form

Find out other Form 8992 Rev December U S Shareholder Calculation Of Global Intangible Low Taxed Income GILTI

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free