8992 2020

What is the 8992?

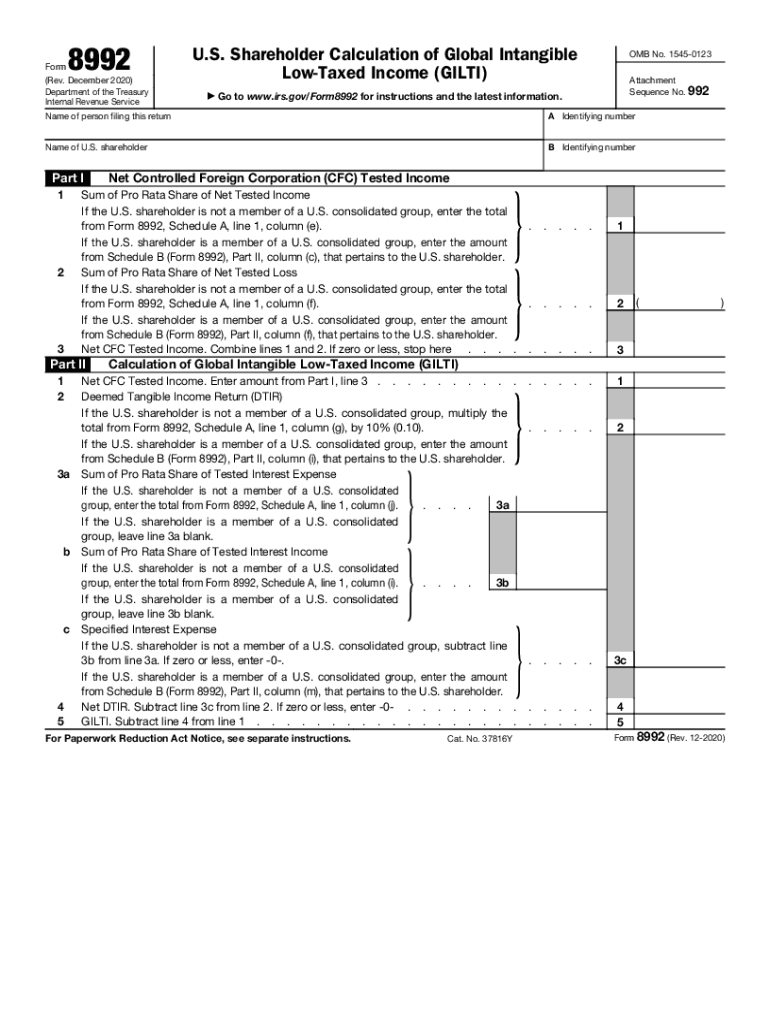

The 2 form, also known as the IRS 8992, is a tax document used by U.S. taxpayers to calculate the Global Intangible Low-Taxed Income (GILTI) for foreign corporations. This form is essential for U.S. shareholders of controlled foreign corporations (CFCs) to report their share of GILTI, which is part of the Tax Cuts and Jobs Act. The GILTI provision aims to tax U.S. companies on their foreign income, ensuring that profits earned abroad are subject to U.S. tax rates.

Steps to complete the 8992

Completing the 2 form requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect data on foreign corporations, including income, taxes paid, and ownership percentages.

- Calculate GILTI: Use the provided formulas to determine the GILTI amount based on your share of foreign income and taxes.

- Fill out the form: Input the calculated GILTI and other required information into the appropriate sections of the form.

- Review for accuracy: Double-check all entries to ensure that the information is correct and complete.

- Submit the form: File the completed 8992 form with your annual tax return.

How to obtain the 8992

The 2 form can be easily obtained from the IRS website. It is available as a downloadable PDF, allowing taxpayers to print, fill out, and submit it. Additionally, tax software programs often include this form, making it accessible for those who prefer digital completion. Ensure you are using the correct version for the tax year you are filing.

IRS Guidelines

The IRS provides specific guidelines for completing the 2 form. These guidelines include detailed instructions on how to calculate GILTI, what information is required, and how to report it accurately. It is crucial to follow these instructions closely to avoid errors that could lead to penalties or delays in processing your tax return.

Legal use of the 8992

The 2 form is legally binding when completed accurately and submitted on time. Compliance with IRS regulations is essential to ensure that the calculated GILTI is reported correctly. Failure to file the form or inaccuracies in the reported information can result in penalties, interest, and potential audits. Therefore, understanding the legal implications of this form is vital for U.S. shareholders of foreign corporations.

Filing Deadlines / Important Dates

Timely filing of the 2 form is essential to avoid penalties. The form must be submitted along with your annual tax return, typically due on April 15 for most taxpayers. If you file for an extension, ensure that the 8992 is included in your extended return. Keeping track of these important dates helps maintain compliance with IRS requirements.

Quick guide on how to complete 8992

Complete 8992 effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without any holdups. Manage 8992 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

The easiest method to modify and eSign 8992 with ease

- Find 8992 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tiring document searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign 8992 and guarantee excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8992

Create this form in 5 minutes!

How to create an eSignature for the 8992

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 2020 8992 form and why is it important?

The 2020 8992 form is used by businesses to calculate the foreign-derived intangible income (FDII) deduction. This form is essential for optimizing tax benefits under the Tax Cuts and Jobs Act, and it can signNowly affect your tax liability, making it vital for companies involved in international business.

-

How can airSlate SignNow help in filling out the 2020 8992 form?

airSlate SignNow provides a user-friendly platform that allows businesses to easily prepare, sign, and send the 2020 8992 form electronically. The solution streamlines the document management process, ensuring that all necessary signatures and approvals are obtained efficiently and securely.

-

Is airSlate SignNow affordable for small businesses needing to file the 2020 8992 form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to small businesses. Our pricing structure is designed to provide you with comprehensive eSignature and document management capabilities at a price point that won't break the bank, especially essential when managing forms like the 2020 8992.

-

What features does airSlate SignNow offer for the 2020 8992 form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and automated workflows that make completing the 2020 8992 form straightforward. These features help reduce errors and streamline the submission process, making it easier for businesses to handle their tax obligations.

-

Can airSlate SignNow integrate with other software for managing the 2020 8992 form?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax preparation software, making it easier to manage your 2020 8992 form alongside your existing business tools. This interoperability facilitates a smoother workflow and enhances efficiency in handling tax documents.

-

What are the benefits of using airSlate SignNow for tax-related documents like the 2020 8992 form?

Using airSlate SignNow for tax documents like the 2020 8992 form provides numerous benefits, including enhanced security, reduced turnaround time, and improved compliance. Our platform ensures that your documents are signed securely and stored safely, which is critical in maintaining tax records.

-

How does airSlate SignNow ensure the security of the 2020 8992 form?

airSlate SignNow prioritizes the security of all documents, including the 2020 8992 form, by using encryption technology and secure access controls. This ensures that sensitive tax information remains confidential and protected against unauthorized access, giving businesses peace of mind.

Get more for 8992

Find out other 8992

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile