Your Pathway to Becoming an Enrolled Agent IRS Tax Forms 2021

What is the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms

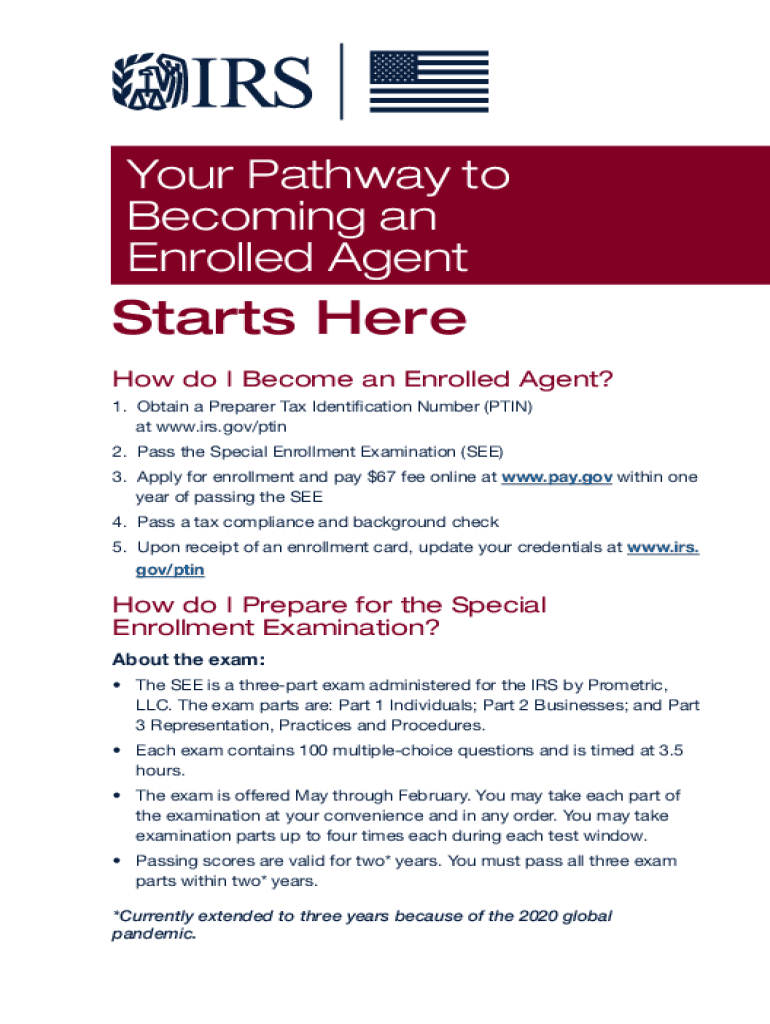

The Your Pathway To Becoming An Enrolled Agent IRS Tax Forms is a crucial document for individuals aspiring to become enrolled agents. This form outlines the necessary steps and requirements mandated by the IRS for certification. It serves as a roadmap, guiding candidates through the process of becoming authorized to represent taxpayers before the IRS. Understanding this form is essential for those looking to navigate the complexities of tax representation and compliance effectively.

Steps to complete the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms

Completing the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms involves several key steps:

- Review the eligibility criteria to ensure you meet the requirements.

- Gather all necessary documentation, including proof of tax compliance and any relevant educational credentials.

- Fill out the form accurately, ensuring all information is complete and correct.

- Submit the form along with any required fees to the appropriate IRS office.

- Prepare for the enrolled agent exam, utilizing study materials and guides to enhance your knowledge.

- Schedule and take the exam, ensuring you adhere to all guidelines provided by the IRS.

Legal use of the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms

The legal use of the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms is governed by IRS regulations. This form must be completed and submitted in accordance with established guidelines to ensure its validity. It is essential for candidates to understand that any inaccuracies or omissions may lead to delays or rejections. Compliance with all legal requirements not only facilitates the application process but also reinforces the candidate's commitment to ethical practices in tax representation.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms. These guidelines include:

- Detailed instructions on filling out the form.

- Information on acceptable forms of payment for any associated fees.

- Timelines for processing applications and issuing credentials.

- Resources for exam preparation and study materials.

Eligibility Criteria

To qualify for the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms, candidates must meet certain eligibility criteria. These typically include:

- Demonstrating tax compliance for the previous five years.

- Possessing a valid Social Security number.

- Meeting educational requirements, if applicable.

Application Process & Approval Time

The application process for the Your Pathway To Becoming An Enrolled Agent IRS Tax Forms involves submitting the completed form to the IRS along with any required documentation. The approval time can vary, but candidates should anticipate a processing period of several weeks. It is advisable to monitor the status of the application and be prepared to provide additional information if requested by the IRS.

Quick guide on how to complete your pathway to becoming an enrolled agent irs tax forms

Effortlessly Prepare Your Pathway To Becoming An Enrolled Agent IRS Tax Forms on Any Device

Managing documents online has become increasingly popular among both companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Your Pathway To Becoming An Enrolled Agent IRS Tax Forms on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented process today.

The Easiest Way to Alter and eSign Your Pathway To Becoming An Enrolled Agent IRS Tax Forms with Ease

- Find Your Pathway To Becoming An Enrolled Agent IRS Tax Forms and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Your Pathway To Becoming An Enrolled Agent IRS Tax Forms to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct your pathway to becoming an enrolled agent irs tax forms

Create this form in 5 minutes!

How to create an eSignature for the your pathway to becoming an enrolled agent irs tax forms

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is included in the IRS enrolled agent exam study guide PDF 2022?

The IRS enrolled agent exam study guide PDF 2022 includes comprehensive coverage of all exam topics, practice questions, and detailed explanations. Additionally, it features tips for effective exam preparation and strategies to maximize your study time.

-

How much does the IRS enrolled agent exam study guide PDF 2022 cost?

The pricing for the IRS enrolled agent exam study guide PDF 2022 is competitively set to ensure affordability. You can purchase it for a one-time fee, which grants you lifetime access and updates whenever necessary, ensuring you're always prepared.

-

Is the IRS enrolled agent exam study guide PDF 2022 regularly updated?

Yes, the IRS enrolled agent exam study guide PDF 2022 is regularly updated to reflect the latest changes in tax laws and exam formats. Subscribers receive free updates, ensuring that your study materials remain relevant and effective.

-

Can I access the IRS enrolled agent exam study guide PDF 2022 on my mobile device?

Absolutely! The IRS enrolled agent exam study guide PDF 2022 is optimized for viewing on various devices, including smartphones and tablets. This allows you the flexibility to study wherever and whenever it’s convenient for you.

-

What are the benefits of using the IRS enrolled agent exam study guide PDF 2022?

Using the IRS enrolled agent exam study guide PDF 2022 can greatly enhance your study efficiency by providing targeted materials and practice questions. The guide is designed to help you understand key concepts and increase your chances of passing the exam on your first try.

-

Are there any money-back guarantees for the IRS enrolled agent exam study guide PDF 2022?

Yes, we offer a satisfaction guarantee on the IRS enrolled agent exam study guide PDF 2022. If you are not satisfied within a specified period, you can request a full refund, giving you peace of mind as you invest in your education.

-

How does the IRS enrolled agent exam study guide PDF 2022 compare to in-person classes?

The IRS enrolled agent exam study guide PDF 2022 offers a more flexible and cost-effective alternative to in-person classes. You'll have the ability to study at your own pace, accessing all materials online without the commuting hassles or high tuition fees associated with traditional classes.

Get more for Your Pathway To Becoming An Enrolled Agent IRS Tax Forms

- Petition paternity file form

- Summons in paternity colorado form

- Admission paternity form

- Motion for genetic testing colorado form

- Agreement for genetic testing colorado form

- Order for genetic testing by agreement colorado form

- Order for genetic testing colorado form

- Instructions to disclaim paternity colorado form

Find out other Your Pathway To Becoming An Enrolled Agent IRS Tax Forms

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document