Publication 5279 5 Your Pathway to Becoming an Enrolled Agent Starts Here 2020

What is the Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here

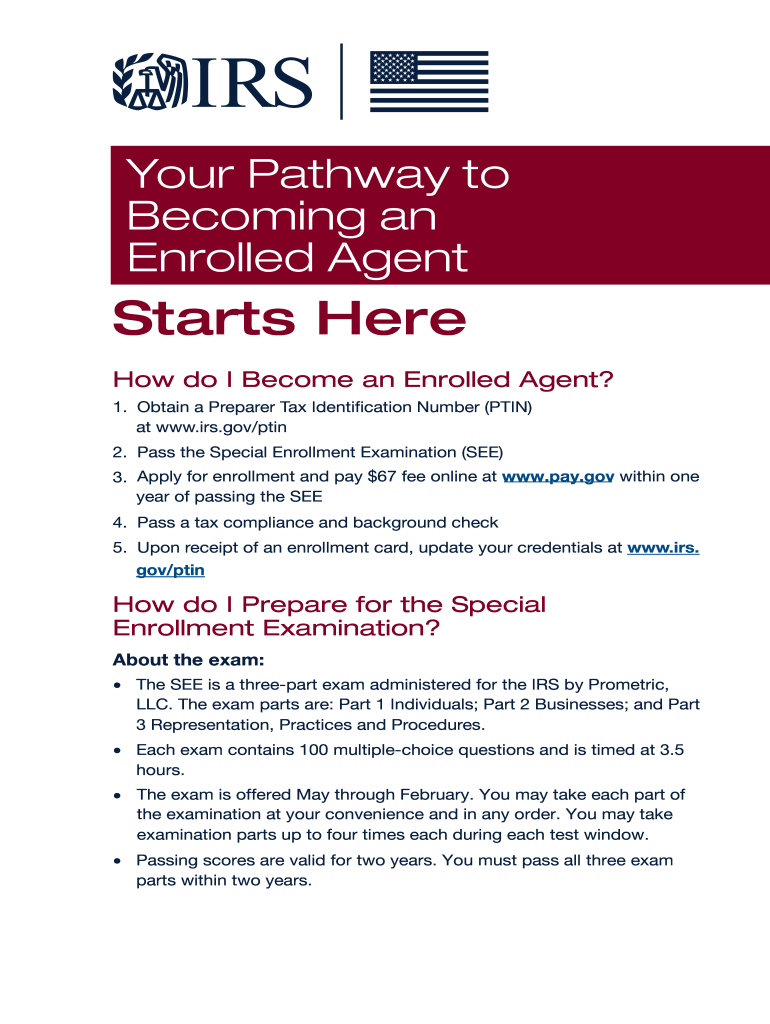

The Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here is an essential IRS document designed for individuals seeking to become enrolled agents. This publication outlines the requirements, responsibilities, and benefits associated with this professional designation. Enrolled agents are authorized to represent taxpayers before the IRS, making this publication a crucial resource for those pursuing a career in tax representation. It provides detailed information on the examination process, ethical standards, and continuing education requirements necessary for maintaining the enrolled agent status.

How to use the Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here

Using the Publication 5279 5 effectively involves understanding its structure and applying the information to your situation. Start by reviewing the eligibility criteria outlined in the publication to ensure you meet the necessary qualifications. Next, familiarize yourself with the examination process detailed within the document. This includes understanding the topics covered in the exam and the format of the questions. Additionally, the publication offers guidance on preparing for the exam, including recommended study materials and resources. By following these steps, you can effectively navigate your path to becoming an enrolled agent.

Steps to complete the Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here

Completing the steps outlined in the Publication 5279 5 is vital for aspiring enrolled agents. First, ensure you meet the eligibility requirements, which typically include having a valid Social Security number and passing a background check. Next, register for the enrolled agent examination through the IRS website. Once registered, develop a study plan based on the topics covered in the publication. After thorough preparation, schedule your examination date. Upon passing the exam, you will need to apply for your enrolled agent status, which includes submitting the necessary forms and fees as outlined in the publication.

Eligibility Criteria

The eligibility criteria for becoming an enrolled agent are clearly defined in the Publication 5279 5. To qualify, individuals must possess a valid Social Security number and have not been disqualified from practice before the IRS. Additionally, candidates must pass the Special Enrollment Examination, which tests knowledge of federal tax laws and regulations. The publication also emphasizes the importance of ethical conduct and adherence to IRS guidelines throughout the application process. Understanding these criteria is crucial for anyone considering this professional path.

IRS Guidelines

The IRS guidelines provided in the Publication 5279 5 are essential for ensuring compliance and understanding the responsibilities of an enrolled agent. These guidelines cover various aspects of tax representation, including the rights of taxpayers, ethical considerations, and the scope of practice for enrolled agents. Familiarizing yourself with these guidelines not only prepares you for the examination but also equips you with the necessary knowledge to effectively represent clients in tax matters. Adhering to these guidelines is vital for maintaining your enrolled agent status and ensuring professional integrity.

Application Process & Approval Time

The application process for becoming an enrolled agent, as detailed in the Publication 5279 5, involves several key steps. After passing the Special Enrollment Examination, candidates must complete Form 23, Application for Enrollment to Practice Before the IRS. Along with this form, applicants are required to submit a fee and provide proof of passing the examination. The IRS typically processes applications within a few weeks, but this can vary based on the volume of applications received. Understanding the timeline and requirements for the application process is crucial for prospective enrolled agents.

Quick guide on how to complete publication 5279 5 2017your pathway to becoming an enrolled agent starts here

Complete Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here with ease

- Locate Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here and then click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 5279 5 2017your pathway to becoming an enrolled agent starts here

Create this form in 5 minutes!

How to create an eSignature for the publication 5279 5 2017your pathway to becoming an enrolled agent starts here

The best way to create an eSignature for your PDF document online

The best way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

The best way to make an eSignature for a PDF file on Android OS

People also ask

-

What is 'Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here'?

Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here is a resource designed to guide individuals through the process of becoming an enrolled agent. It provides insights into the requirements, benefits, and steps necessary to complete your journey to achieving this IRS designation. By following this pathway, you can streamline your preparation and enhance your understanding of the enrolled agent role.

-

How does airSlate SignNow integrate with Publication 5279 5?

airSlate SignNow facilitates the signing and management of documents essential for completing Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here. With our user-friendly interface, you can easily eSign and send essential documents securely. This integration saves time and enhances productivity for individuals pursuing their enrolled agent certification.

-

What are the pricing options for access to resources linked to Publication 5279 5?

Pricing for resources related to Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here can vary based on the selected features and subscription plans. airSlate SignNow offers cost-effective and flexible pricing to meet your needs as you pursue becoming an enrolled agent. To understand the best plan for you, visit our pricing page or contact our sales team for personalized assistance.

-

What features does airSlate SignNow offer that support Publication 5279 5's objectives?

airSlate SignNow offers various features that align with the goals of Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here, including document templates, eSignature capabilities, and automated workflows. These features ensure a seamless experience in handling the paperwork involved in becoming an enrolled agent. Additionally, our platform enhances collaboration and document tracking for all users.

-

What are the benefits of becoming an enrolled agent through Publication 5279 5?

Becoming an enrolled agent as outlined in Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here confers several benefits. You will gain the ability to represent clients before the IRS, access to advanced tax knowledge, and heightened career opportunities in tax preparation and consulting. This designation also provides you credibility and recognition in the financial industry.

-

Can I use airSlate SignNow to manage client documents while following Publication 5279 5?

Absolutely! airSlate SignNow is specifically designed to help you manage client documents efficiently while you follow the guidelines in Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here. You can easily upload, eSign, and store documents in one secure platform, ensuring compliance and a professional workflow for your enrolled agent practice.

-

Is there customer support available for queries related to Publication 5279 5?

Yes, airSlate SignNow offers dedicated customer support for all users, including those navigating Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here. Our knowledgeable support team is available to answer your questions and provide assistance with the signNow platform. This support enhances your learning experience and ensures you can maximize your use of our services.

Get more for Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here

- Personal history form phf

- Schulnachweis lehrer vorlage form

- Eyeglasses receipt form

- Seller possession after closing agreement form

- Court probate forms supplememt to clear probate notes

- Umc letterhead form

- Form 15227 en sp rev 1 application for an identity protection personal identification number ip pin english spanish version

- Irs information and forms 2025 tax forms instructions

Find out other Publication 5279 5 Your Pathway To Becoming An Enrolled Agent Starts Here

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy