Form 2643a pdfFiller Com2019 Form MO 2643A Fill Online, Printable, Fillable 2019

Understanding the Missouri Sales Tax Registration Application

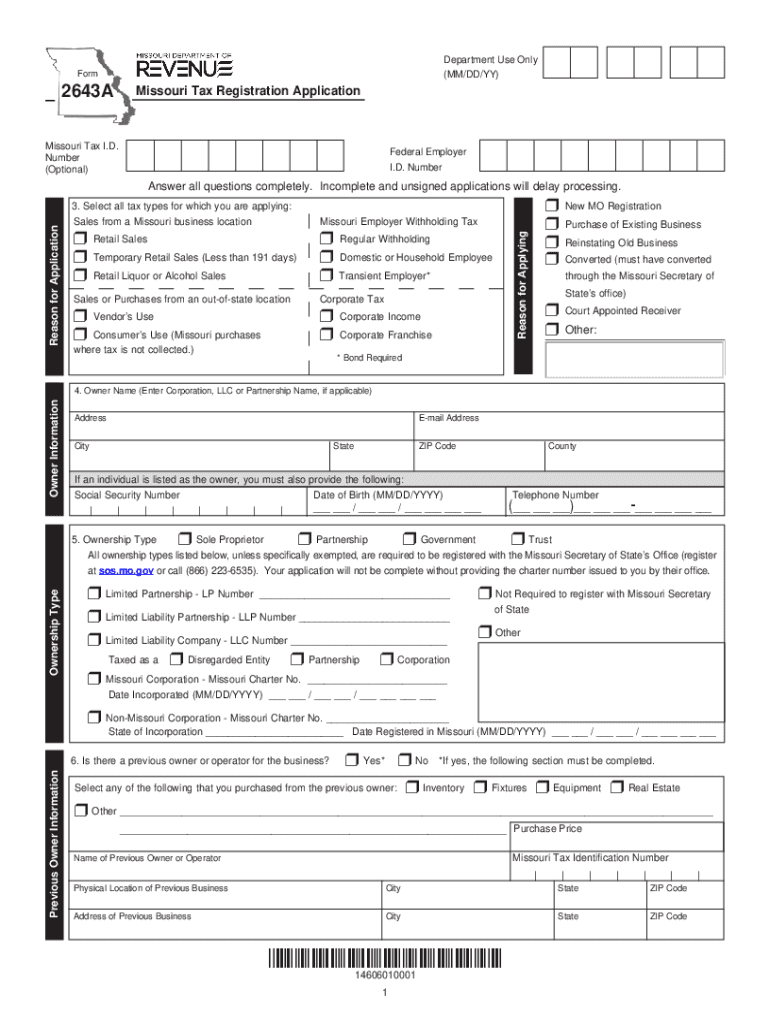

The Missouri sales tax registration application, known as Form 2643, is essential for businesses operating within the state. This form allows businesses to register for a Missouri sales tax ID, enabling them to collect and remit sales tax on taxable sales. Completing this form accurately is crucial for compliance with state tax regulations. The Missouri Department of Revenue oversees this process, ensuring that businesses adhere to the state's tax laws.

Steps to Complete the Missouri Sales Tax Application

Completing the Missouri sales tax application involves several key steps:

- Gather necessary information, such as your business name, address, and federal employer identification number (EIN).

- Access the Form 2643 from the Missouri Department of Revenue website or other reliable sources.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form online or by mail to the appropriate state department.

Required Documents for Application Submission

When applying for a Missouri sales tax ID using Form 2643, several documents may be required to support your application:

- Proof of business registration, such as articles of incorporation or a business license.

- Identification documents for business owners or partners.

- Federal EIN confirmation letter from the IRS.

Having these documents ready can streamline the application process and help avoid delays.

Legal Considerations for Missouri Sales Tax Compliance

Understanding the legal implications of the Missouri sales tax registration is essential for businesses. Once registered, businesses must collect sales tax on taxable sales and remit it to the state on a regular basis. Non-compliance can lead to penalties, including fines and interest on unpaid taxes. It is important to stay informed about changes in sales tax laws and regulations to maintain compliance.

Filing Deadlines for Sales Tax Registration

Timely submission of the Missouri sales tax application is crucial. Generally, businesses should register for a sales tax ID before they begin making taxable sales. The Missouri Department of Revenue recommends submitting the application at least 30 days prior to the anticipated start of sales. This allows sufficient time for processing and ensures compliance with state tax obligations.

Submission Methods for Form 2643

Businesses can submit the Missouri sales tax application through various methods:

- Online submission via the Missouri Department of Revenue's website.

- Mailing the completed form to the designated address provided on the form.

- In-person submission at local Department of Revenue offices.

Choosing the right submission method can help expedite the application process and ensure that your business is registered promptly.

Quick guide on how to complete form 2643apdffillercom2019 2021 form mo 2643a fill online printable fillable

Complete Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable effortlessly

- Locate Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2643apdffillercom2019 2021 form mo 2643a fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the form 2643apdffillercom2019 2021 form mo 2643a fill online printable fillable

The way to make an e-signature for a PDF online

The way to make an e-signature for a PDF in Google Chrome

The way to create an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The way to make an e-signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is Missouri sales tax?

Missouri sales tax is a tax imposed on sales of goods and services in the state of Missouri. The rate can vary by location due to additional local taxes. Understanding Missouri sales tax is essential for businesses to ensure compliance and accurate tax reporting.

-

How can airSlate SignNow help with Missouri sales tax documentation?

With airSlate SignNow, you can efficiently send and eSign documents such as sales tax reports and compliance forms. This digital solution minimizes the paperwork involved, allowing you to manage Missouri sales tax documents more effectively and securely.

-

Does airSlate SignNow offer features for tracking Missouri sales tax?

While airSlate SignNow does not track sales tax itself, it provides a platform to manage and sign essential documents related to Missouri sales tax compliance. You can utilize our templates to create and store relevant documents for ease of access and organization.

-

What is the pricing structure for using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to different business needs. Our flexible options ensure you can find a plan that suits your requirements for handling documents related to Missouri sales tax at a cost-effective rate.

-

Are there integrations available for managing Missouri sales tax?

Yes, airSlate SignNow integrates with various accounting and financial software that can help manage Missouri sales tax calculations and filings. These integrations streamline your workflow, allowing for a comprehensive approach to sales tax management.

-

How can airSlate SignNow benefit businesses needing to handle Missouri sales tax?

airSlate SignNow simplifies the eSigning process, enabling businesses to manage their Missouri sales tax documentation more efficiently. By reducing turnaround times and enhancing document security, our solution helps you stay compliant with Missouri sales tax regulations.

-

Is it easy to use airSlate SignNow for Missouri sales tax-related documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy to create, send, and eSign documents related to Missouri sales tax. Our intuitive interface allows anyone to navigate the platform and manage their documentation effortlessly.

Get more for Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable

- Intestacy form

- Colorado personal representative 497300577 form

- Application for informal appointment of special administrator pursuant to 15 12 614 crs colorado

- 15 12 crs form

- Colorado information appointment

- Estate inventory colorado form

- Summary of receipts and expenditures only colorado form

- Notice crs form

Find out other Form 2643a pdffiller com2019 Form MO 2643A Fill Online, Printable, Fillable

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online