Form 2643, Missouri Tax Registration Application Yumpu 2023-2026

What is the Form 2643, Missouri Tax Registration Application

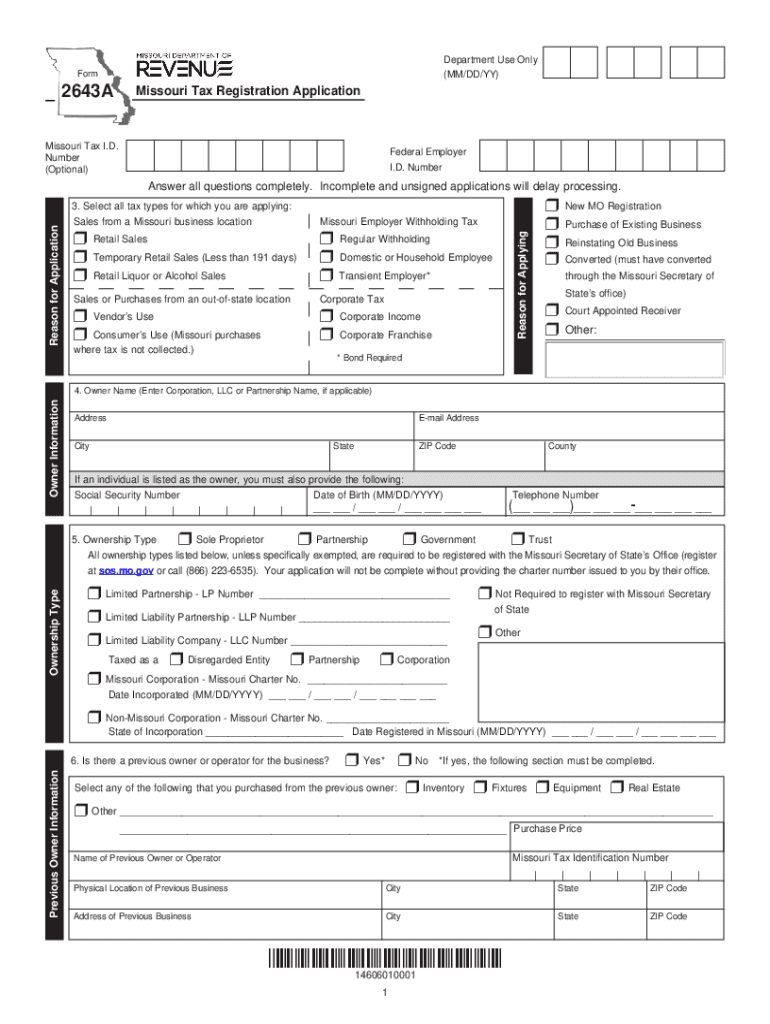

The Form 2643, also known as the Missouri Tax Registration Application, is a crucial document for businesses operating in Missouri. This form is used to register for various state taxes, including sales tax, withholding tax, and other applicable taxes. Completing this form accurately ensures compliance with Missouri tax laws and enables businesses to collect and remit taxes appropriately. The Missouri Department of Revenue requires this form to establish a tax identification number for new businesses or for existing businesses that need to update their tax information.

Steps to Complete the Form 2643, Missouri Tax Registration Application

Completing the Form 2643 involves several key steps to ensure that all necessary information is accurately provided. Here is a straightforward process to follow:

- Begin by gathering essential information about your business, including the legal name, address, and type of business entity.

- Provide details regarding the owners or responsible parties, including their names, Social Security numbers, and contact information.

- Indicate the specific types of taxes you will be collecting, such as sales tax or withholding tax.

- Review the form for accuracy and completeness before submission.

Completing these steps diligently will facilitate a smoother registration process with the Missouri Department of Revenue.

Legal Use of the Form 2643, Missouri Tax Registration Application

The legal use of Form 2643 is vital for businesses to operate within the law. By submitting this form, businesses are officially registering with the Missouri Department of Revenue, which is a requirement for tax compliance. The information provided on the form is used to establish a tax identification number, which is necessary for filing tax returns and making tax payments. Ensuring that the form is filled out correctly and submitted on time can help prevent legal issues and penalties associated with non-compliance.

Required Documents for Form 2643 Submission

When preparing to submit the Form 2643, certain documents must be gathered to support your application. These documents may include:

- Proof of business registration, such as articles of incorporation or a business license.

- Identification documents for the owners or responsible parties, including Social Security cards or driver’s licenses.

- Any additional documentation that may be required based on the type of business entity.

Having these documents ready will streamline the application process and help ensure that your registration is processed without delays.

Form Submission Methods for 2643

The Form 2643 can be submitted through various methods, providing flexibility for businesses. The available submission options include:

- Online: Businesses can complete and submit the form electronically through the Missouri Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via postal mail to the appropriate address designated by the Department of Revenue.

- In-Person: Businesses may also choose to submit the form in person at their local Department of Revenue office.

Choosing the most convenient submission method can help expedite the registration process.

Penalties for Non-Compliance with Form 2643

Failure to submit the Form 2643 or to comply with Missouri tax registration requirements can lead to significant penalties. These may include:

- Fines for late registration or failure to register.

- Interest on unpaid taxes that accrue from the date the taxes were due.

- Potential legal action from the Missouri Department of Revenue for continued non-compliance.

Understanding these penalties underscores the importance of timely and accurate submission of the Form 2643.

Quick guide on how to complete form 2643 missouri tax registration application yumpu

Prepare Form 2643, Missouri Tax Registration Application Yumpu effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 2643, Missouri Tax Registration Application Yumpu on any platform via airSlate SignNow Android or iOS applications and enhance any document-centered task today.

How to modify and eSign Form 2643, Missouri Tax Registration Application Yumpu with ease

- Find Form 2643, Missouri Tax Registration Application Yumpu and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that function.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 2643, Missouri Tax Registration Application Yumpu and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2643 missouri tax registration application yumpu

Create this form in 5 minutes!

How to create an eSignature for the form 2643 missouri tax registration application yumpu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is '2643a' and how does it relate to airSlate SignNow?

'2643a' refers to a specific feature set within airSlate SignNow that allows users to streamline their document signing process. This powerful tool helps businesses enhance productivity by simplifying the way they manage and execute eSignatures. By incorporating '2643a', users can experience a signNow improvement in their workflow.

-

How much does airSlate SignNow cost and what does '2643a' include in terms of features?

The pricing for airSlate SignNow varies based on the plan selected, but the '2643a' features typically fall under mid-tier to premium plans. These plans often include unlimited eSigning, document templates, and integration capabilities with other tools. This ensures that businesses can efficiently manage their signing processes without breaking the bank.

-

What are the benefits of using the '2643a' features in airSlate SignNow?

By utilizing '2643a', users can enjoy benefits such as increased efficiency in document handling, a secure signing environment, and customizable templates. These advantages lead to quicker turnaround times on essential agreements and save valuable time. Ultimately, '2643a' empowers users to focus more on their core business activities.

-

Can airSlate SignNow with '2643a' integrate with other software?

Yes, airSlate SignNow, including the '2643a' feature set, offers integration with various third-party software like CRMs, HR systems, and management tools. This allows businesses to create a seamless workflow across different platforms, enhancing productivity. Integrating '2643a' ensures that your document management is both efficient and streamlined.

-

Is '2643a' suitable for businesses of all sizes?

'2643a' in airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. The flexibility and scalability of the features ensure that every organization can benefit from efficient eSigning. No matter the scale, '2643a' can adapt to your specific business needs.

-

What security measures are in place when using '2643a'?

Security is a top priority for airSlate SignNow, and '2643a' includes several robust measures to protect your documents. It utilizes encryption, secure access, and audit trails to ensure that all eSignatures are legitimate and protected. Businesses can confidently use '2643a' knowing their sensitive information is secure.

-

How does '2643a' improve the document signing process?

'2643a' enhances the document signing process by allowing users to create templates, automate workflows, and manage signatures from one centralized platform. This not only saves time but also reduces the risk of errors during the signing process. Ultimately, '2643a' streamlines operations and boosts overall efficiency.

Get more for Form 2643, Missouri Tax Registration Application Yumpu

Find out other Form 2643, Missouri Tax Registration Application Yumpu

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors