Dor Mo Gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department of Revenue 2021

Understanding the Missouri Form 126

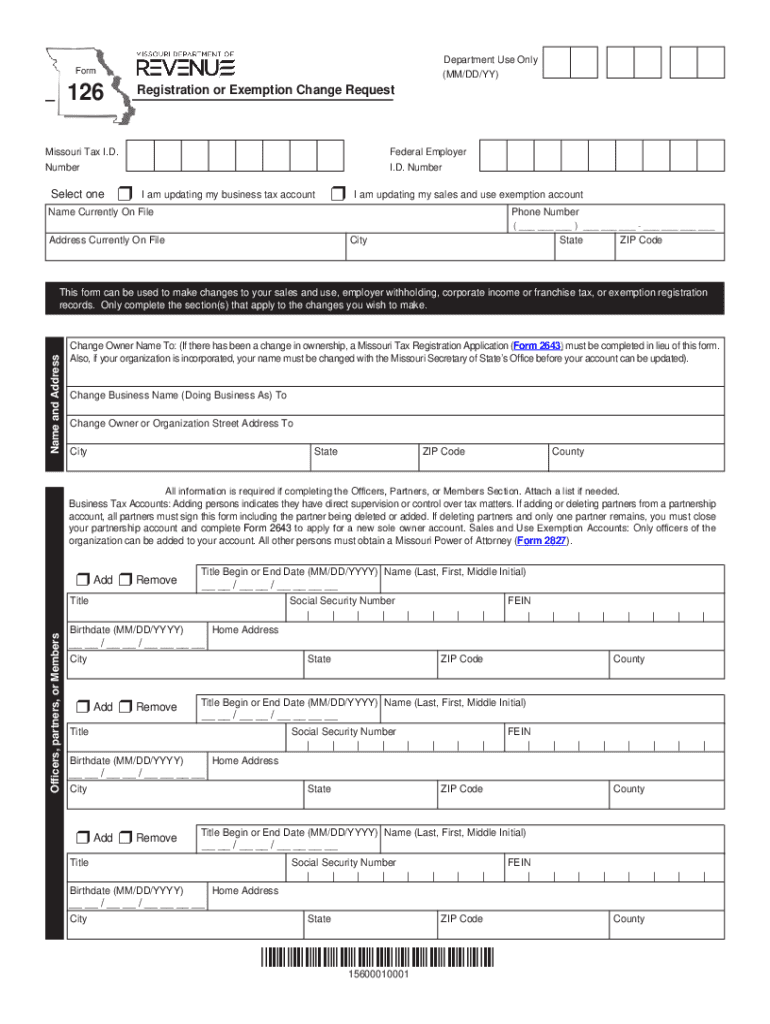

The Missouri Form 126, also known as the Missouri registration change, is a crucial document for individuals and businesses needing to update their registration details with the Missouri Department of Revenue (DOR). This form is essential for maintaining accurate records and ensuring compliance with state regulations. It is often used when there are changes in business ownership, address, or other significant details that require official notification to the state.

Steps to Complete the Missouri Form 126

Completing the Missouri Form 126 involves several clear steps to ensure accuracy and compliance. Begin by gathering all necessary information, including your current registration details and the specific changes you wish to make. Fill out the form carefully, ensuring that all fields are completed accurately. Double-check for any errors or omissions that could delay processing. Once completed, you can submit the form electronically or via mail, depending on your preference and the requirements set by the Missouri DOR.

Legal Use of the Missouri Form 126

The legal validity of the Missouri Form 126 is supported by compliance with state regulations. When filled out correctly, this form serves as an official record of your changes, which can be crucial for legal and business purposes. It is important to ensure that the signatures and any required documentation are included to avoid complications. Utilizing a reliable eSignature solution can enhance the legitimacy of your submission and ensure that it meets all legal standards.

Required Documents for Submission

When submitting the Missouri Form 126, certain documents may be required to support your changes. These may include proof of identity, such as a driver's license or state ID, and any relevant business documents that verify ownership or operational changes. Having these documents ready can streamline the submission process and help avoid delays in processing your form.

Form Submission Methods

The Missouri Form 126 can be submitted through various methods, including online, by mail, or in person at designated DOR offices. Online submission is often the quickest and most efficient method, allowing for immediate confirmation of receipt. If you choose to submit by mail, ensure that you send it to the correct address and consider using a trackable mailing option to confirm delivery.

Penalties for Non-Compliance

Failing to submit the Missouri Form 126 when required can lead to several penalties, including fines and potential legal repercussions. It is essential to stay informed about your obligations and ensure timely submission to avoid these issues. Regularly reviewing your registration status and making necessary updates can help maintain compliance and prevent complications with the Missouri DOR.

Quick guide on how to complete dormogov forms 53 1sales tax return form 53 1 missouri department of revenue

Easily manage Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue on any device

Digital document management has gained traction with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly and efficiently. Handle Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue on any device with the airSlate SignNow apps for Android or iOS and enhance your document-centric processes today.

The easiest way to modify and electronically sign Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue

- Obtain Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue and click on Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Select how you'd like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or corrections that require new printouts. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue while ensuring effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct dormogov forms 53 1sales tax return form 53 1 missouri department of revenue

Create this form in 5 minutes!

How to create an eSignature for the dormogov forms 53 1sales tax return form 53 1 missouri department of revenue

The way to make an e-signature for a PDF in the online mode

The way to make an e-signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

How to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

How to make an e-signature for a PDF document on Android OS

People also ask

-

What is the MO Form 126?

The MO Form 126 is a tax document used in Missouri that requires careful completion for accurate reporting. Using airSlate SignNow, you can easily fill out and eSign your MO Form 126, ensuring compliance and timely submissions. Our platform simplifies the process, making it efficient for both businesses and individuals.

-

How much does it cost to use airSlate SignNow for MO Form 126?

AirSlate SignNow offers flexible pricing plans that cater to various business needs, including the electronic signing of documents like the MO Form 126. Pricing varies based on the features and number of users, so you can choose a plan that fits your budget while still benefiting from the ease of eSigning your forms.

-

Can I integrate airSlate SignNow with other software for handling MO Form 126?

Yes, airSlate SignNow seamlessly integrates with a range of applications, enhancing your workflow when managing the MO Form 126. You can connect it with your CRM, document storage, or team collaboration tools, making it easier to access and sign your forms from multiple platforms.

-

What features does airSlate SignNow offer for MO Form 126 eSignatures?

AirSlate SignNow provides features like customizable templates, secure cloud storage, and real-time tracking for your signed MO Form 126 documents. These features ensure that you maintain control over your documents and can monitor their status efficiently, all in one user-friendly platform.

-

Is airSlate SignNow secure for signing MO Form 126?

Absolutely! AirSlate SignNow employs advanced encryption and security measures to protect your MO Form 126 and any other sensitive documents. Your data integrity and confidentiality are our top priorities, providing you peace of mind when eSigning important tax forms.

-

How quickly can I eSign my MO Form 126 using airSlate SignNow?

With airSlate SignNow, you can eSign your MO Form 126 almost instantly, thanks to our intuitive interface. Whether you're using a computer or mobile device, the signing process takes just a few minutes, allowing you to submit your forms promptly without unnecessary delays.

-

What benefits does airSlate SignNow offer when completing the MO Form 126?

Using airSlate SignNow for your MO Form 126 provides numerous benefits, including increased efficiency, reduced paper waste, and enhanced collaboration. You can effortlessly share your form with colleagues or clients for signatures, streamlining the process and saving valuable time.

Get more for Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue

- Determination heirs 497300584 form

- 12 1303 form

- Colorado notice hearing 497300586 form

- Application for informal appointment of successor personal representative colorado

- Successor personal representative form

- Colorado instructions closing form

- Instructions for closing a small estate informally colorado

- Colorado instructions closing 497300591 form

Find out other Dor mo gov Forms 53 1Sales Tax Return Form 53 1 Missouri Department Of Revenue

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy