Fillable Online Revenue Ky Form 720S Kentucky Department 2019-2026

Key elements of the Fillable Online Revenue Ky Form 720S

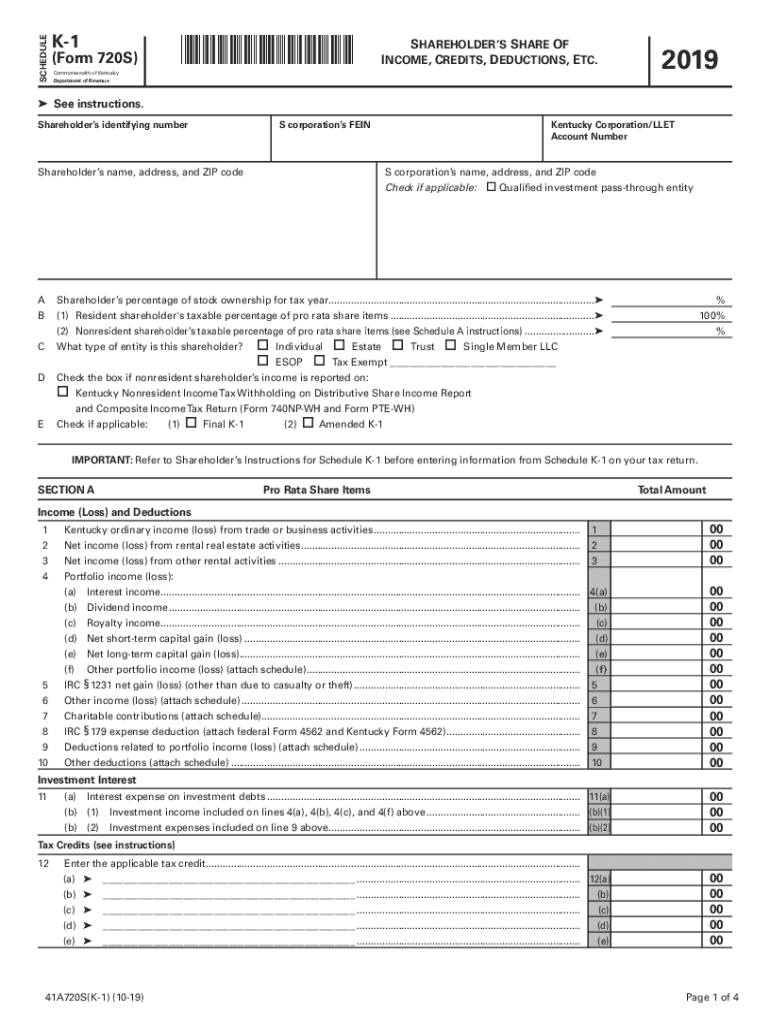

The Fillable Online Revenue Ky Form 720S is essential for Kentucky shareholders to report income, deductions, and credits. This form is specifically designed for S corporations and their shareholders. Key elements include:

- Shareholder Information: This section requires details about each shareholder, including their names, addresses, and ownership percentages.

- Income Reporting: Shareholders must report their share of the corporation's income, which is crucial for accurate tax calculations.

- Deductions and Credits: The form allows for the inclusion of various deductions and credits that can reduce taxable income.

- Signature Requirement: A valid signature is necessary to authenticate the form, ensuring compliance with legal standards.

Steps to complete the Fillable Online Revenue Ky Form 720S

Completing the Fillable Online Revenue Ky Form 720S involves several clear steps to ensure accuracy and compliance. Follow these steps:

- Gather Required Information: Collect all necessary documents, including prior year tax returns and financial statements.

- Access the Form: Navigate to the Kentucky Department of Revenue website to access the fillable form.

- Fill in Shareholder Details: Enter the required information for each shareholder, ensuring accuracy in names and addresses.

- Report Income: Input the income figures as reported by the corporation, including any adjustments.

- Include Deductions and Credits: Carefully list any applicable deductions and credits to optimize tax obligations.

- Review and Sign: Double-check all entries for accuracy before signing the form electronically.

- Submit the Form: Follow the submission guidelines to ensure the form is filed correctly, whether online or via mail.

Legal use of the Fillable Online Revenue Ky Form 720S

The Fillable Online Revenue Ky Form 720S is legally recognized for reporting income and tax obligations for S corporations in Kentucky. To ensure its legal validity:

- Compliance with Regulations: The form must be completed in accordance with Kentucky tax laws and regulations.

- Electronic Signatures: Utilizing a secure e-signature solution can enhance the legal standing of the submitted form.

- Retention of Records: It is advisable to keep copies of the completed form and any supporting documents for future reference.

Filing Deadlines / Important Dates

Timely submission of the Fillable Online Revenue Ky Form 720S is critical to avoid penalties. Important dates include:

- Filing Deadline: Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year.

- Extension Requests: If additional time is needed, a request for an extension can be filed, but it must be submitted by the original deadline.

Form Submission Methods

Submitting the Fillable Online Revenue Ky Form 720S can be done through various methods to accommodate different preferences:

- Online Submission: The form can be completed and submitted electronically via the Kentucky Department of Revenue website.

- Mail Submission: Alternatively, completed forms can be printed and mailed to the appropriate address provided on the form.

- In-Person Submission: Taxpayers may also opt to submit the form in person at designated Kentucky Department of Revenue offices.

Who Issues the Form

The Fillable Online Revenue Ky Form 720S is issued by the Kentucky Department of Revenue. This agency is responsible for overseeing tax compliance and ensuring that all forms meet state requirements. The department provides resources and guidance to assist taxpayers in completing and submitting the form accurately.

Quick guide on how to complete fillable online revenue ky form 720s kentucky department

Complete Fillable Online Revenue Ky Form 720S Kentucky Department effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Fillable Online Revenue Ky Form 720S Kentucky Department on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Fillable Online Revenue Ky Form 720S Kentucky Department without effort

- Obtain Fillable Online Revenue Ky Form 720S Kentucky Department and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choosing. Edit and eSign Fillable Online Revenue Ky Form 720S Kentucky Department and guarantee excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online revenue ky form 720s kentucky department

Create this form in 5 minutes!

How to create an eSignature for the fillable online revenue ky form 720s kentucky department

How to create an e-signature for a PDF file in the online mode

How to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your smartphone

How to generate an e-signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF document on Android

People also ask

-

What features does airSlate SignNow offer for managing a Kentucky schedule?

airSlate SignNow provides a variety of features that streamline your Kentucky schedule management. You can easily create, send, and eSign documents, allowing for efficient workflow and collaboration. The platform also offers templates specifically suited for businesses operating in Kentucky, enhancing your scheduling processes.

-

How does airSlate SignNow support the Kentucky schedule for document signing?

With airSlate SignNow, managing your Kentucky schedule for document signing is simple. You can set reminders, track the status of your documents, and ensure all signatories are notified promptly. This helps keep your scheduling organized and ensures timely completion of agreements.

-

Is there a cost associated with using airSlate SignNow for Kentucky schedule management?

Yes, airSlate SignNow offers competitively priced plans that cater to different needs. The pricing is designed to be cost-effective for businesses managing their Kentucky schedule, providing various tiers based on the number of users and features required. You can choose a plan that fits your budget while maximizing productivity.

-

Can airSlate SignNow integrate with other tools for a better Kentucky schedule experience?

Absolutely! airSlate SignNow offers seamless integrations with popular applications that enhance your Kentucky schedule management. Whether it's CRM systems or project management tools, these integrations help you centralize your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for my Kentucky schedule?

Using airSlate SignNow for your Kentucky schedule comes with numerous benefits. It saves time and reduces paperwork, allowing you to focus on your core business activities. Additionally, the ease of eSigning documents speeds up the process, leading to quicker decision-making.

-

Is airSlate SignNow easy to use for managing Kentucky schedules?

Yes, airSlate SignNow is known for its user-friendly interface that caters to businesses of all sizes in Kentucky. The platform is designed to be intuitive, allowing users to quickly learn how to create, send, and edit their schedules with minimal training. This ease of use enhances overall productivity.

-

How secure is my data when using airSlate SignNow for a Kentucky schedule?

Security is a top priority for airSlate SignNow, especially for users managing confidential Kentucky schedules. The platform utilizes advanced encryption protocols and complies with international security standards to protect your data. You can trust that your information remains safe and secure throughout the signing process.

Get more for Fillable Online Revenue Ky Form 720S Kentucky Department

- Supplemental report form

- Colorado workers compensation 497300792 form

- Election of remedies for workers compensation colorado form

- Colorado claim workers form

- Colorado final 497300795 form

- Request for voluntary mediation for workers compensation colorado form

- Petition to reopen for workers compensation colorado form

- Rejection compensation form

Find out other Fillable Online Revenue Ky Form 720S Kentucky Department

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document