Kentucky K1 Form 2016

What is the Kentucky K1 Form

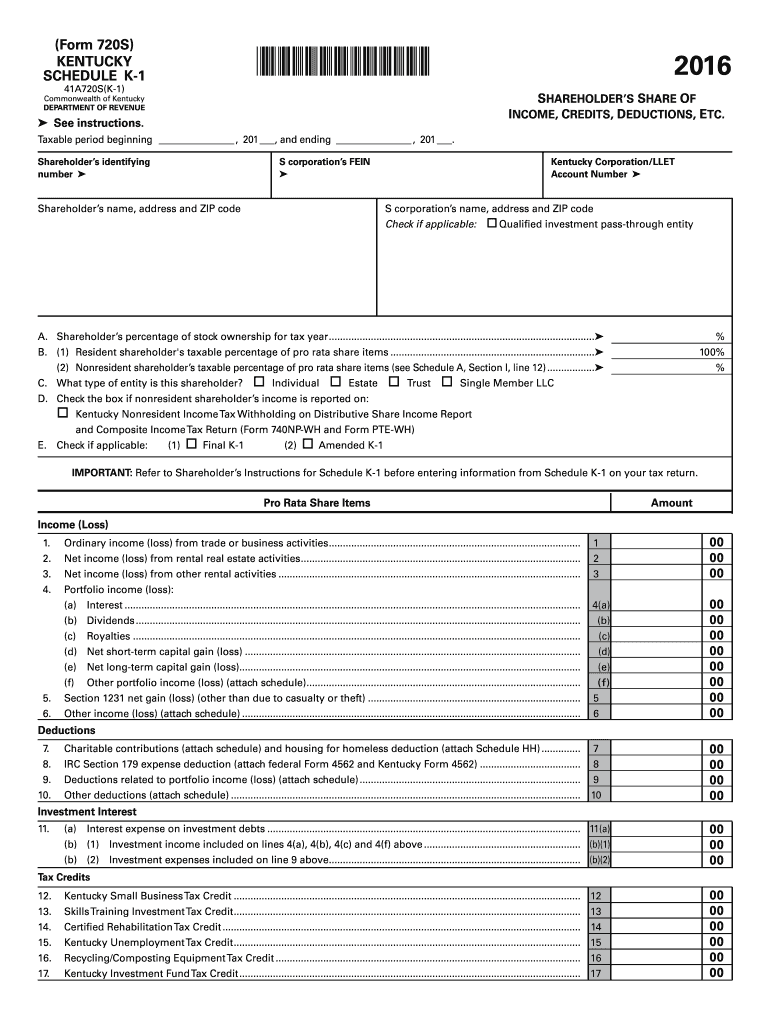

The Kentucky K1 form, officially known as the Kentucky withholding tax form K1, is a crucial document used for reporting income, deductions, and credits for individuals who receive income from partnerships, S corporations, estates, and trusts. This form is essential for ensuring that the correct amount of state tax is withheld from the income earned by these entities. It provides detailed information about the taxpayer's share of income, which is then used to calculate their overall tax liability in the state of Kentucky.

How to use the Kentucky K1 Form

To effectively use the Kentucky K1 form, individuals must first gather all relevant financial information related to their income from partnerships or S corporations. Once the form is obtained, it should be filled out with accurate details, including the taxpayer's name, Social Security number, and the income received. After completing the form, it must be submitted alongside the individual's Kentucky tax return to ensure proper tax reporting and compliance with state regulations.

Steps to complete the Kentucky K1 Form

Completing the Kentucky K1 form involves several key steps:

- Obtain the form from the Kentucky Department of Revenue or an authorized source.

- Fill in the taxpayer's personal information, including name and Social Security number.

- Report the income received from the partnership or S corporation, including any deductions or credits.

- Review the completed form for accuracy and completeness.

- Submit the form with the Kentucky tax return by the designated filing deadline.

Legal use of the Kentucky K1 Form

The legal use of the Kentucky K1 form is governed by state tax laws and regulations. This form must be filled out accurately to ensure compliance with Kentucky's tax requirements. An incorrect or incomplete form can lead to penalties or audits. It is important for taxpayers to understand their obligations regarding this form, as it serves as a legal document for reporting income and tax withholding.

Key elements of the Kentucky K1 Form

Key elements of the Kentucky K1 form include:

- Taxpayer Information: Name, address, and Social Security number.

- Income Reporting: Details of income received from partnerships or S corporations.

- Deductions and Credits: Any applicable deductions or credits that affect tax liability.

- Signature: Required signature of the taxpayer or authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky K1 form align with the general tax return deadlines in Kentucky. Typically, individual tax returns are due by April 15 of each year. It is important for taxpayers to be aware of these dates to avoid late filing penalties. Additionally, any extensions granted for filing the overall tax return may also apply to the submission of the K1 form.

Quick guide on how to complete kentucky k1 form

Complete Kentucky K1 Form effortlessly on any device

Managing documents online has gained popularity among enterprises and individuals alike. It offers an excellent eco-conscious alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, alter, and electronically sign your documents swiftly without delays. Handle Kentucky K1 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Kentucky K1 Form seamlessly

- Find Kentucky K1 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Kentucky K1 Form and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky k1 form

Create this form in 5 minutes!

How to create an eSignature for the kentucky k1 form

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the Kentucky K1 E form?

The Kentucky K1 E form is a vital document used for reporting income from partnerships and S corporations in Kentucky. This form helps ensure that all income is accurately reported to the state tax authorities, making tax filing simpler and more straightforward for individuals.

-

How can airSlate SignNow help with filling out the Kentucky K1 E form?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out the Kentucky K1 E form. With its intuitive interface and template options, users can quickly enter the required information, ensuring they don’t miss any critical tax details.

-

Is there a cost associated with using airSlate SignNow for the Kentucky K1 E form?

airSlate SignNow provides various pricing plans to accommodate different needs, including plans suitable for users preparing the Kentucky K1 E form. You can choose from monthly or annual subscriptions, and all plans offer an extensive range of features at competitive prices.

-

What features does airSlate SignNow offer for completing the Kentucky K1 E form?

airSlate SignNow includes several features designed to facilitate the completion of the Kentucky K1 E form. Users can benefit from eSigning capabilities, document templates, automated workflows, and secure storage, ensuring a seamless experience from start to finish.

-

Can airSlate SignNow integrate with other tax software for the Kentucky K1 E form?

Yes, airSlate SignNow can integrate with various tax software platforms, enhancing the user experience when completing the Kentucky K1 E form. This functionality allows users to easily import and export data, streamlining the filing process and minimizing the risk of errors.

-

What are the benefits of using airSlate SignNow for the Kentucky K1 E form?

Using airSlate SignNow for the Kentucky K1 E form provides numerous benefits, including ease of use, quick turnaround for getting signatures, and enhanced document security. Additionally, the platform's features can save time and reduce stress during tax season.

-

Is it easy to track the status of the Kentucky K1 E form with airSlate SignNow?

Absolutely! airSlate SignNow offers tracking features that allow users to monitor the status of the Kentucky K1 E form throughout the signing process. This transparency helps users stay informed and ensures they are not left waiting for necessary approvals.

Get more for Kentucky K1 Form

Find out other Kentucky K1 Form

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile