DEPARTMENT of REVENUE Important Please See Instructions 2021-2026

Understanding the Kentucky Farm Fuel Tax Exempt Form

The Kentucky farm fuel tax exempt form is essential for farmers seeking to purchase fuel without incurring state fuel taxes. This form allows eligible farmers to benefit from tax exemptions on fuel used for agricultural purposes. The form is recognized by the Kentucky Department of Revenue and must be filled out accurately to ensure compliance with state regulations. Understanding the requirements and implications of this form is crucial for farmers aiming to maximize their operational efficiency.

Eligibility Criteria for the Kentucky Farm Fuel Tax Exempt Form

To qualify for the Kentucky farm fuel tax exempt form, applicants must meet specific eligibility criteria. Generally, this includes being a registered farmer in Kentucky who uses fuel for farming activities. The applicant may need to provide proof of agricultural production, such as a valid farm identification number or proof of sales tax exemption. Understanding these criteria helps ensure that only eligible applicants benefit from the tax exemption, maintaining the integrity of the program.

Steps to Complete the Kentucky Farm Fuel Tax Exempt Form

Completing the Kentucky farm fuel tax exempt form involves several key steps:

- Gather necessary documentation, including proof of farming activities.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions that could lead to processing delays.

- Submit the completed form to the appropriate state department, either online or via mail.

Following these steps carefully can help facilitate a smooth application process and ensure compliance with state regulations.

Form Submission Methods

The Kentucky farm fuel tax exempt form can be submitted through various methods, providing flexibility for applicants. Farmers can choose to submit their forms online through the Kentucky Department of Revenue's website or send them via traditional mail. In-person submissions may also be possible at designated state offices. Each method has its advantages, and applicants should choose the one that best suits their needs and ensures timely processing.

Legal Use of the Kentucky Farm Fuel Tax Exempt Form

Using the Kentucky farm fuel tax exempt form legally requires adherence to state laws and regulations. Farmers must ensure that the fuel purchased with the exemption is solely for agricultural use. Misuse of the form, such as using exempt fuel for non-farming activities, can lead to penalties and loss of eligibility. It is important for farmers to understand the legal implications of the form and to maintain accurate records of fuel usage to support compliance.

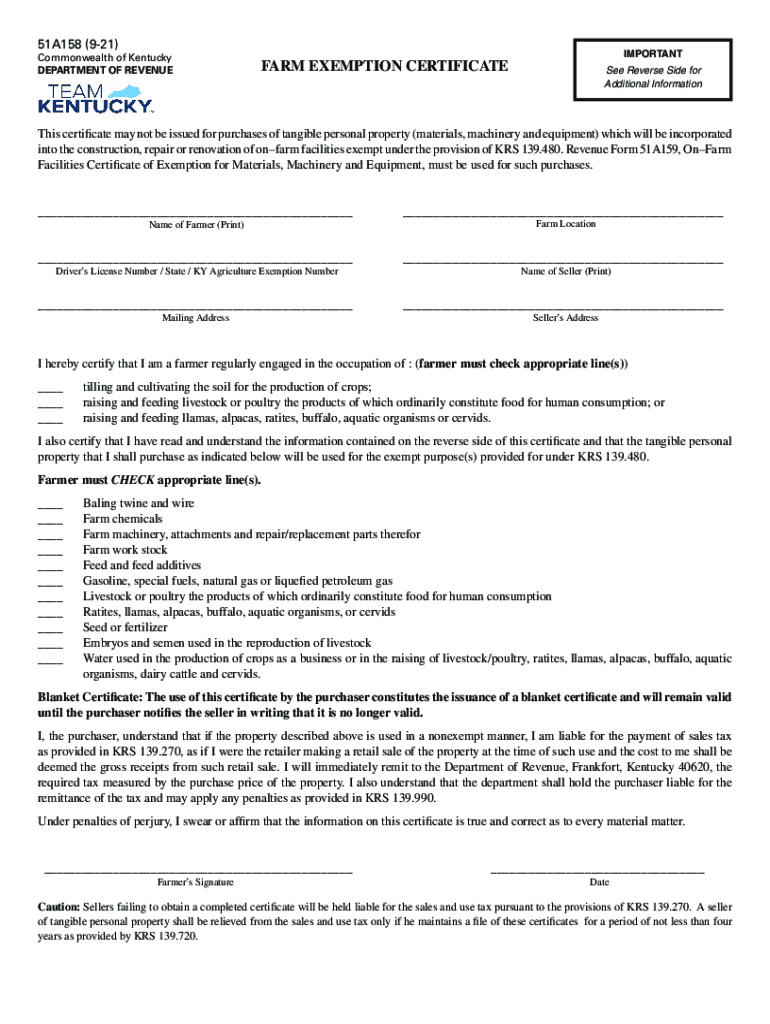

Key Elements of the Kentucky Farm Fuel Tax Exempt Form

The Kentucky farm fuel tax exempt form includes several key elements that applicants must complete:

- Applicant Information: Name, address, and contact details of the farmer.

- Farm Identification: Farm ID number or other identifying information.

- Fuel Usage Details: Description of how the fuel will be used in farming operations.

- Signature: The applicant's signature certifying the accuracy of the information provided.

Each element plays a critical role in the processing of the form and helps ensure that the tax exemption is granted appropriately.

Quick guide on how to complete department of revenue important please see instructions

Effortlessly Prepare DEPARTMENT OF REVENUE Important Please See Instructions on Any Device

The management of documents online has gained signNow traction among both companies and individuals. It serves as an excellent environment-friendly alternative to traditional printed and signed materials, enabling you to obtain the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage DEPARTMENT OF REVENUE Important Please See Instructions on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centered process today.

The Most Efficient Way to Modify and eSign DEPARTMENT OF REVENUE Important Please See Instructions with Ease

- Locate DEPARTMENT OF REVENUE Important Please See Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or black out confidential information using the tools airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign DEPARTMENT OF REVENUE Important Please See Instructions to guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of revenue important please see instructions

Create this form in 5 minutes!

How to create an eSignature for the department of revenue important please see instructions

How to create an e-signature for a PDF document online

How to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

How to generate an e-signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a KY farm fuel tax exempt form?

A KY farm fuel tax exempt form is a document that allows farmers in Kentucky to purchase fuel without paying state fuel taxes. By submitting this form, you can ensure signNow savings on fuel costs, vital for running agricultural operations.

-

How can airSlate SignNow help me manage my KY farm fuel tax exempt form?

With airSlate SignNow, you can easily create, send, and eSign your KY farm fuel tax exempt form in a matter of minutes. Our platform streamlines the signing process, ensuring you get your documents where they need to be quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the KY farm fuel tax exempt form?

airSlate SignNow offers a variety of pricing plans that fit different business needs. You can find an affordable option that allows you to efficiently manage your KY farm fuel tax exempt form without breaking your budget.

-

What features does airSlate SignNow offer for managing tax exempt forms?

Our platform includes features such as customizable templates, real-time status tracking, and secure cloud storage, making managing your KY farm fuel tax exempt form effortless. These features enhance productivity and ensure compliance with state requirements.

-

Can I integrate airSlate SignNow with other business applications?

Yes, airSlate SignNow seamlessly integrates with various business applications like Google Drive, Salesforce, and others. This allows you to enhance your workflow while managing your KY farm fuel tax exempt form and other documents efficiently.

-

What are the benefits of using airSlate SignNow for farm-related documents?

By using airSlate SignNow, you can streamline your document management process, increase efficiency, and ensure compliance for forms like the KY farm fuel tax exempt form. This ultimately allows you to focus more on your agricultural operations and less on paperwork.

-

Is my data secure when using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes data security by implementing robust encryption methods and compliance with privacy regulations. You can confidently manage your KY farm fuel tax exempt form, knowing your information is well-protected.

Get more for DEPARTMENT OF REVENUE Important Please See Instructions

- Exclusion of uncompensated officials for workers compensation colorado form

- Petition to modify for workers compensation colorado form

- Objection petition colorado form

- Colorado workers compensation 497300802 form

- Request for offset of liability for workers compensation colorado form

- Colorado workers compensation form

- Settlement order for workers compensation colorado form

- Colorado notice contest workers compensation form

Find out other DEPARTMENT OF REVENUE Important Please See Instructions

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online