51a158 2014

What is the 51a158?

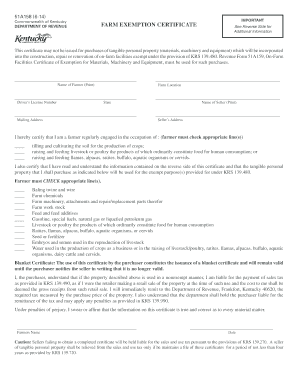

The 51a158 is a farm exemption certificate used in Kentucky. This form allows eligible farmers to claim exemption from sales and use tax on certain purchases related to agricultural production. It is essential for businesses and individuals engaged in farming activities to understand the significance of this form, as it helps reduce operational costs by exempting specific purchases from taxation.

How to use the 51a158

To utilize the 51a158 effectively, one must first determine eligibility based on the criteria set forth by the Kentucky Department of Revenue. Eligible items typically include feed, seed, and other materials directly used in agricultural production. Once eligibility is confirmed, the farmer must complete the form accurately, ensuring all necessary information is provided. This completed form should be presented to the seller at the time of purchase to claim the tax exemption.

Steps to complete the 51a158

Completing the 51a158 involves several key steps:

- Gather necessary information about your farming operation, including your farm's address and tax identification number.

- Identify the items you wish to purchase that qualify for the exemption.

- Fill out the 51a158 form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Present the completed form to your vendor at the time of purchase.

Legal use of the 51a158

The legal use of the 51a158 is governed by Kentucky state law, which outlines the types of purchases that qualify for tax exemption. It is crucial for users to comply with these regulations to avoid penalties. The form must be used only for eligible agricultural purchases, and misuse can lead to legal consequences, including fines or back taxes owed.

Eligibility Criteria

Eligibility for the 51a158 is primarily determined by the nature of the farming operation. To qualify, an applicant must be engaged in the production of agricultural products for sale. Additionally, the items purchased must be directly related to farming activities. It is advisable to consult the Kentucky Department of Revenue for specific eligibility guidelines to ensure compliance.

Required Documents

When applying for the 51a158, several documents may be required to substantiate your eligibility. These typically include:

- Proof of farming operation, such as a business license or tax identification number.

- Documentation of purchases made for agricultural production.

- Any prior tax exemption certificates, if applicable.

Form Submission Methods

The 51a158 can be submitted in various ways, depending on the vendor's preferences. Common methods include:

- Presenting a physical copy of the completed form at the point of sale.

- Submitting an electronic version if the vendor accepts digital documentation.

- Mailing the form to the vendor if required by their policy.

Quick guide on how to complete 51a158

Complete 51a158 effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle 51a158 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and electronically sign 51a158 without effort

- Access 51a158 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, exhausting form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign 51a158 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 51a158

Create this form in 5 minutes!

How to create an eSignature for the 51a158

The way to make an electronic signature for your PDF online

The way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is ky 51a158 and how does it relate to airSlate SignNow?

Ky 51a158 is a unique identifier that can help users easily locate and reference important documents within airSlate SignNow. This feature enhances organization and retrieval, simplifying the eSigning process for businesses using our platform.

-

How does airSlate SignNow pricing work for ky 51a158 users?

airSlate SignNow offers competitive pricing options tailored for businesses, including a plan specifically suitable for users managing documents linked to ky 51a158. You can choose from monthly or annual subscriptions to find the best option for your company's needs.

-

What are the key features of airSlate SignNow associated with ky 51a158?

The key features of airSlate SignNow related to ky 51a158 include easy eSigning, collaboration tools, and robust document management capabilities. These features are designed to streamline your document workflows, enhancing productivity and efficiency.

-

What benefits does airSlate SignNow offer for managing documents like ky 51a158?

Using airSlate SignNow for documents such as ky 51a158 provides numerous benefits, including improved turnaround times for document approvals, enhanced security through encryption, and the ability to track document status. It empowers businesses to maintain better control over their essential documents.

-

Can airSlate SignNow integrate with other software when handling ky 51a158?

Yes, airSlate SignNow can seamlessly integrate with various software applications, allowing you to manage documents like ky 51a158 more effectively. Whether it’s CRM systems or project management tools, integrations enhance your workflow and improve overall efficiency.

-

Is airSlate SignNow suitable for small businesses using ky 51a158?

Absolutely! airSlate SignNow is designed to be user-friendly and affordable, making it an ideal choice for small businesses utilizing documents like ky 51a158. The flexibility and scalability of our solution allow small teams to benefit from professional document management without breaking the bank.

-

What types of documents can be managed using airSlate SignNow related to ky 51a158?

AirSlate SignNow can manage various document types associated with ky 51a158, including contracts, agreements, and regulatory forms. This versatility ensures that your organization can efficiently handle all necessary documentation, streamlining your operations.

Get more for 51a158

Find out other 51a158

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast