Form W 8BEN E Rev October Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities 2021-2026

What is the W-8BEN-E Form?

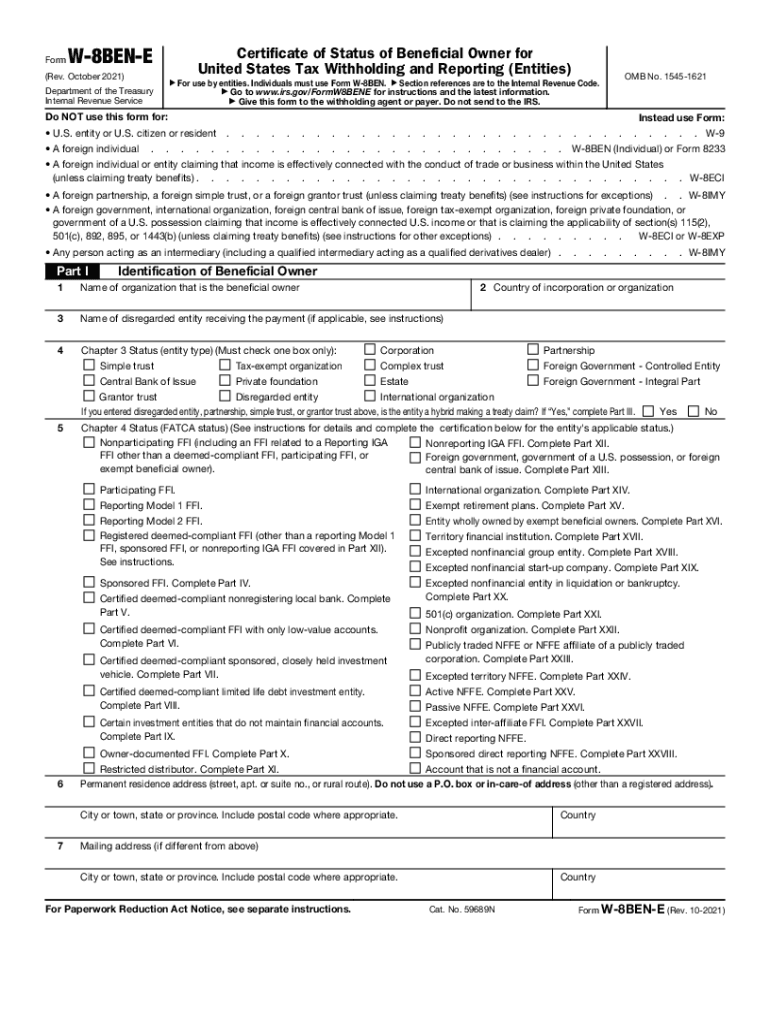

The W-8BEN-E form, officially titled the Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities, is a crucial document for foreign entities receiving income from U.S. sources. This form is used to certify the entity's foreign status and claim any applicable tax treaty benefits. By completing the W-8BEN-E, foreign entities can avoid or reduce U.S. tax withholding on certain types of income, including dividends, interest, and royalties. It is essential for compliance with U.S. tax laws and helps ensure that the correct amount of tax is withheld from payments made to foreign entities.

Steps to Complete the W-8BEN-E Form

Completing the W-8BEN-E form involves several key steps to ensure accuracy and compliance. First, gather all necessary information about the entity, including its name, address, and taxpayer identification number (TIN) if applicable. Next, identify the type of entity, as different classifications may require specific sections of the form to be filled out. After that, complete the relevant parts of the form, ensuring that all information is accurate and up-to-date. Finally, the form must be signed and dated by an authorized representative of the entity, certifying that the information provided is correct. It is advisable to review the form thoroughly before submission to avoid any potential issues.

Legal Use of the W-8BEN-E Form

The W-8BEN-E form serves a legal purpose in the context of U.S. tax compliance. By submitting this form, foreign entities can assert their status as non-U.S. persons, which is essential for determining the correct withholding tax rate on income sourced from the United States. The form must be provided to the withholding agent or financial institution that requests it, and it is valid until the information changes or until the form expires, typically after three years. Proper use of the W-8BEN-E helps entities avoid unnecessary tax liabilities and ensures compliance with IRS regulations.

IRS Guidelines for the W-8BEN-E Form

The IRS provides specific guidelines regarding the completion and submission of the W-8BEN-E form. Entities must ensure that the form is filled out accurately and that all required sections are completed based on the entity's classification. The IRS also emphasizes the importance of submitting the form to the correct withholding agent or financial institution. Additionally, entities should be aware of the potential penalties for providing false information or failing to submit the form when required. Regular updates to IRS guidelines may affect the form's requirements, so staying informed is essential for compliance.

Eligibility Criteria for the W-8BEN-E Form

To be eligible to use the W-8BEN-E form, the entity must be a foreign organization or a foreign government. This includes corporations, partnerships, and trusts that are not established under U.S. law. The entity must also be the beneficial owner of the income for which the form is being submitted. Furthermore, the entity must not be a U.S. person, as defined by the IRS. Understanding these eligibility criteria is vital for ensuring that the correct form is used and that the entity can benefit from any applicable tax treaty provisions.

Form Submission Methods

The W-8BEN-E form can be submitted through various methods depending on the requirements of the withholding agent or financial institution. Typically, the form can be submitted electronically via secure online portals or through email if permitted. Alternatively, entities may opt to send a paper copy of the completed form via mail. It is important to confirm the preferred submission method with the requesting party to ensure that the form is received and processed correctly. Keeping a copy of the submitted form for record-keeping purposes is also advisable.

Quick guide on how to complete form w 8ben e rev october 2021 certificate of status of beneficial owner for united states tax withholding and reporting

Prepare Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities effortlessly on any device

Web-based document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the right template and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without any hold-ups. Manage Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities with ease

- Obtain Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities and then select Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and then click the Done button to save your modifications.

- Select how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities while ensuring outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 8ben e rev october 2021 certificate of status of beneficial owner for united states tax withholding and reporting

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben e rev october 2021 certificate of status of beneficial owner for united states tax withholding and reporting

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the w 8ben e form?

The w 8ben e form is a tax certification form used by foreign entities to signNow their foreign status and claim beneficial tax treatment under U.S. tax laws. It is essential for entities receiving income from U.S. sources. Understanding this form is crucial for compliance and ensuring proper tax withholding.

-

How does airSlate SignNow facilitate the completion of the w 8ben e form?

airSlate SignNow provides an intuitive platform that simplifies the process of filling out the w 8ben e form. Users can easily create, fill out, and electronically sign documents with seamless integration into existing workflows. The cloud-based solution ensures that your forms are secured and accessible anytime.

-

What are the benefits of using airSlate SignNow for the w 8ben e form?

Using airSlate SignNow for the w 8ben e form offers several key benefits, including improved efficiency and reduced processing times. The platform automates document workflows, enabling quicker approvals and signings. Additionally, it ensures compliance with legal requirements, providing peace of mind for businesses.

-

Is there a cost associated with using airSlate SignNow for the w 8ben e form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on your chosen plan, you can access features that allow for easy management of the w 8ben e form. Additionally, using this platform can save money in administrative costs and paper usage over time.

-

Can I store my completed w 8ben e forms securely with airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all completed w 8ben e forms. With robust encryption and secure access controls, you can ensure your documents are safe and comply with data protection regulations, giving you reliable peace of mind.

-

What integrations does airSlate SignNow support for handling the w 8ben e form?

airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow related to the w 8ben e form. Integrations with tools such as Google Drive, Salesforce, and Dropbox allow for streamlined document management. This connectivity ensures you can manage your forms efficiently across different platforms.

-

How can I track the status of my w 8ben e form in airSlate SignNow?

airSlate SignNow provides a tracking feature that allows you to monitor the status of your w 8ben e form in real time. You can view whether the document has been sent, opened, or signed. This transparency keeps you informed and helps you manage your document workflow effectively.

Get more for Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities

- Siding contract for contractor connecticut form

- Refrigeration contract for contractor connecticut form

- Drainage contract for contractor connecticut form

- Foundation contract for contractor connecticut form

- Plumbing contract for contractor connecticut form

- Brick mason contract for contractor connecticut form

- Roofing contract for contractor connecticut form

- Electrical contract for contractor connecticut form

Find out other Form W 8BEN E Rev October Certificate Of Status Of Beneficial Owner For United States Tax Withholding And Reporting Entities

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online