W 8ben E 2017

What is the W-8BEN-E?

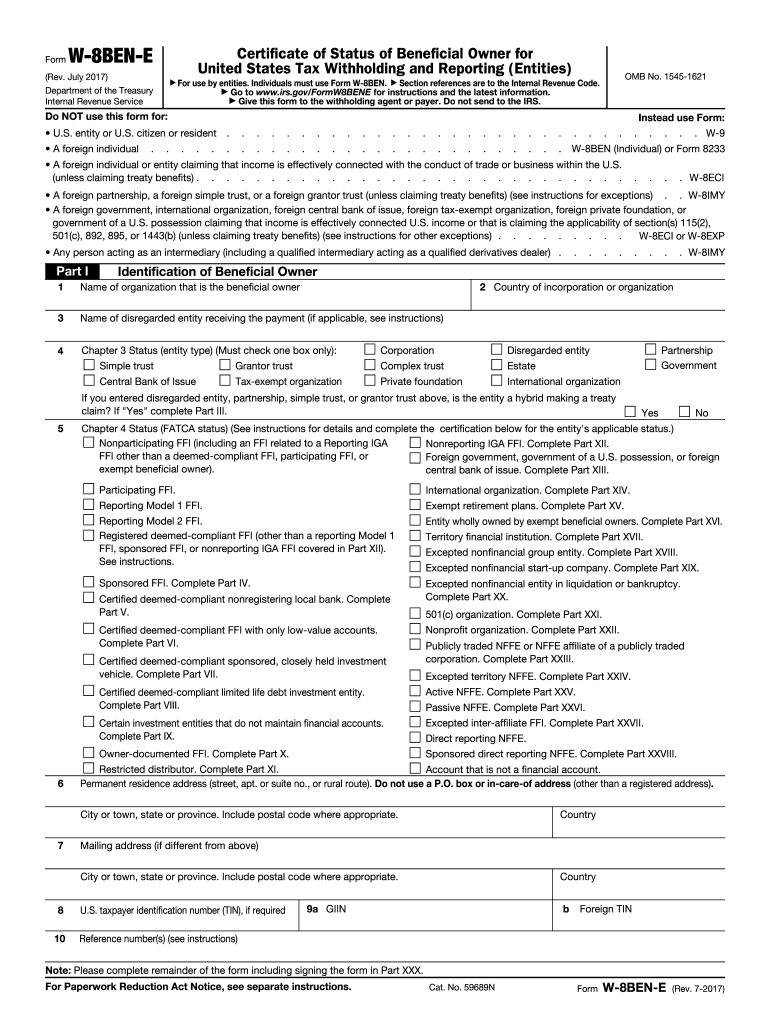

The W-8BEN-E form is an IRS document used by foreign entities to certify their status for tax purposes in the United States. This form is essential for non-U.S. businesses and organizations that receive income from U.S. sources, such as dividends, interest, or royalties. By submitting the W-8BEN-E, these entities can claim a reduced rate of withholding tax under an applicable tax treaty between their home country and the United States. This form is specifically designed for use by entities, as opposed to individuals, who must use the W-8BEN form instead.

How to Obtain the W-8BEN-E

To obtain the W-8BEN-E form, individuals can visit the official IRS website where the form is available for download. The form is typically provided in a PDF format, allowing users to print it for completion. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted by financial institutions or the IRS. Additionally, many tax professionals and legal advisors can provide guidance on obtaining and completing the form correctly.

Steps to Complete the W-8BEN-E

Completing the W-8BEN-E involves several key steps:

- Identify the entity type: Determine if the entity is a corporation, partnership, or another type of organization.

- Provide basic information: Fill in the entity's name, country of incorporation, and address.

- Claim tax treaty benefits: If applicable, indicate the country of residence and the specific tax treaty benefits being claimed.

- Sign and date: An authorized representative must sign and date the form, certifying that the information provided is accurate.

It is advisable to review the completed form for accuracy before submission to avoid delays or issues with processing.

Legal Use of the W-8BEN-E

The W-8BEN-E must be used in compliance with IRS regulations to ensure that the entity qualifies for reduced withholding tax rates. Misuse of the form, such as providing false information or using an outdated version, can lead to penalties and increased withholding tax rates. Entities should maintain proper records of the submitted form and any supporting documentation, as the IRS may request these during audits or reviews. Understanding the legal implications of the W-8BEN-E is crucial for compliance and to avoid potential legal issues.

IRS Guidelines for the W-8BEN-E

The IRS provides specific guidelines for completing and submitting the W-8BEN-E form. These guidelines include instructions on who should use the form, how to fill it out, and the importance of providing accurate information. Entities are encouraged to refer to the IRS instructions that accompany the form for detailed information on each section. Adhering to these guidelines helps ensure that the form is processed efficiently and that the entity can benefit from any applicable tax treaty provisions.

Form Submission Methods

The W-8BEN-E can be submitted through various methods, depending on the requirements of the withholding agent or financial institution. Common submission methods include:

- Online submission: Some institutions allow electronic submission of the form through secure portals.

- Mail: The form can be printed and mailed directly to the withholding agent.

- In-person: In certain cases, the form may be submitted in person at the financial institution's office.

It is essential to follow the specific instructions provided by the withholding agent regarding submission methods to ensure compliance.

Quick guide on how to complete w 8ben e 2017 2019 form

Discover the most efficient method to complete and endorse your W 8ben E

Are you still spending time preparing your official paperwork on paper instead of handling it online? airSlate SignNow provides a superior approach to complete and endorse your W 8ben E and related forms for public services. Our intelligent electronic signature solution equips you with all necessary tools to manage documents swiftly and in line with official standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities all accessible within a user-friendly interface.

Only a few steps are required to finish filling out and signing your W 8ben E:

- Insert the fillable template into the editor using the Get Form button.

- Review the information you need to input in your W 8ben E.

- Move between fields with the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the required details.

- Modify the content using Text boxes or Images from the upper toolbar.

- Emphasize what is truly important or Obscure fields that are no longer relevant.

- Select Sign to create a legally recognized electronic signature utilizing any preferred method.

- Insert the Date alongside your signature and conclude your tasks with the Done button.

Store your completed W 8ben E in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our service also enables flexible file sharing. There’s no need to print your documents when you need to submit them to the relevant public office - accomplish it using email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a go today!

Create this form in 5 minutes or less

Find and fill out the correct w 8ben e 2017 2019 form

FAQs

-

How can you fill out the W-8BEN form (no tax treaty)?

A payer of a reportable payment may treat a payee as foreign if the payer receives an applicable Form W-8 from the payee. Provide this Form W-8BEN to the requestor if you are a foreign individual that is a participating payee receiving payments in settlement of payment card transactions that are not effectively connected with a U.S. trade or business of the payee.As stated by Mr. Ivanov below, Since Jordan is not one of the countries listed as a tax treaty country, it appears that you would only complete Part I of the Form W-8BEN, Sign your name and date the Certification in Part III.http://www.irs.gov/pub/irs-pdf/i...Hope this is helpful.

-

As a Canadian working in the US on a TN-1 visa should I fill out the IRS Form W-8BEN or W9?

Use the W-9. The W-8BEN is used for cases where you are not working in the U.S., but receiving income relating to a U.S. Corporation, Trust or Partnership.

-

Why do I have to fill out a W-8BEN form, sent by TD Bank, if I am an F1-student (from Canada) that is not working?

Of course you are not working. But the bank needs to notify the IRS of the account and it using the W-8BEN for to get the info it needs about you.

Create this form in 5 minutes!

How to create an eSignature for the w 8ben e 2017 2019 form

How to create an electronic signature for the W 8ben E 2017 2019 Form in the online mode

How to create an eSignature for the W 8ben E 2017 2019 Form in Chrome

How to create an electronic signature for putting it on the W 8ben E 2017 2019 Form in Gmail

How to create an electronic signature for the W 8ben E 2017 2019 Form right from your smartphone

How to generate an eSignature for the W 8ben E 2017 2019 Form on iOS devices

How to create an eSignature for the W 8ben E 2017 2019 Form on Android devices

People also ask

-

What is the W 8ben E form and who needs it?

The W 8ben E form is a tax document used by foreign entities to signNow their foreign status and claim tax treaty benefits. Businesses that receive income from U.S. sources, such as dividends or royalties, typically need to submit the W 8ben E to avoid withholding tax. Ensure your organization completes this form correctly to comply with IRS regulations.

-

How can airSlate SignNow help with completing the W 8ben E form?

airSlate SignNow simplifies the process of completing the W 8ben E form by providing an easy-to-use platform for document signing and management. You can quickly fill out, sign, and send the W 8ben E electronically, streamlining your workflow and ensuring compliance with tax rules. With our intuitive interface, handling tax forms has never been easier.

-

Is there a cost associated with using airSlate SignNow for the W 8ben E form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing the W 8ben E form and other documents. You can choose from monthly or annual subscriptions, allowing you to find the best fit for your budget. Check our pricing page for detailed information on features included in each plan.

-

What features does airSlate SignNow offer for managing the W 8ben E form?

With airSlate SignNow, you gain access to features that enhance the management of the W 8ben E form, including eSignature capabilities, template creation, and secure cloud storage. Our platform allows you to track the status of your documents in real-time, ensuring you know when the W 8ben E form has been signed and returned. This streamlines your document workflows signNowly.

-

Can airSlate SignNow integrate with other software for managing the W 8ben E form?

Yes, airSlate SignNow offers seamless integrations with popular business applications such as Google Drive, Salesforce, and Microsoft Office. This means you can easily manage your W 8ben E form and other documents directly within the tools you already use. Our integration capabilities help you maintain efficiency and productivity across your organization.

-

What are the benefits of using airSlate SignNow for the W 8ben E form?

Using airSlate SignNow for the W 8ben E form provides numerous benefits, including reduced processing time, increased accuracy, and enhanced security. Our electronic signature technology ensures that your documents are legally binding, while our secure platform protects sensitive information. This makes managing tax forms like the W 8ben E both efficient and secure.

-

Is airSlate SignNow compliant with IRS regulations for the W 8ben E form?

Absolutely. airSlate SignNow is designed to comply with IRS regulations, ensuring that your W 8ben E form is completed and signed in accordance with legal standards. Our platform prioritizes compliance, giving you peace of mind that your tax documents are handled correctly and securely.

Get more for W 8ben E

- Idph vaccine management plan template illinois department of idph state il form

- Iowa statewide universal practitioner recredentialing namssorg form

- Form gn 3120 wisconsin court system wicourts

- Safety template form

- Eagle recommendation letter form

- Naui online card replacement store form

- Cvac mail in application checklist form

- Kc zip codes map form

Find out other W 8ben E

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free