W 8BEN E Short Form Emory Finance Finance Emory 2016

What is the W-8BEN-E Short Form?

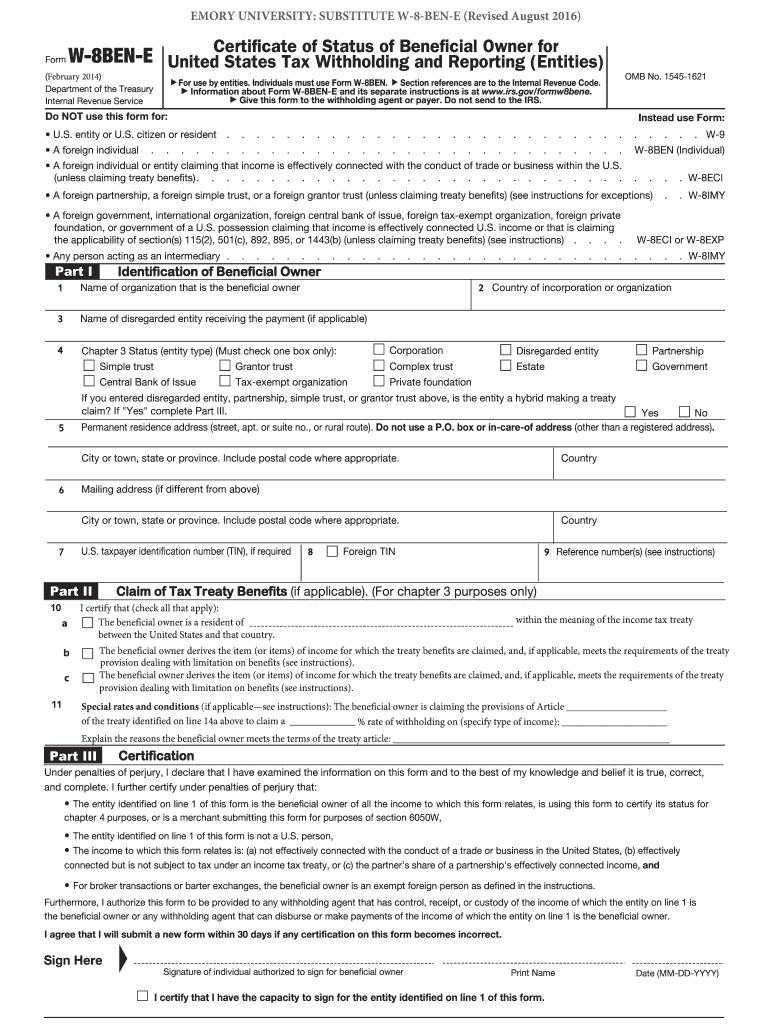

The W-8BEN-E Short Form is a tax document utilized by foreign entities to certify their status for withholding tax purposes in the United States. This form is essential for non-U.S. businesses that receive income from U.S. sources, such as dividends, interest, and royalties. By submitting the W-8BEN-E, foreign entities can claim a reduced rate of withholding tax or exemption from withholding under an applicable tax treaty. This form helps ensure compliance with U.S. tax regulations while allowing foreign entities to benefit from tax treaty provisions.

How to Use the W-8BEN-E Short Form

Using the W-8BEN-E Short Form involves several key steps. First, the entity must accurately complete the form, providing essential information such as its name, country of incorporation, and type of entity. Next, the entity must indicate its claim for tax treaty benefits, if applicable. After completing the form, it should be submitted to the U.S. withholding agent or financial institution that requests it. This submission allows the entity to assert its status and claim any applicable benefits under U.S. tax law.

Steps to Complete the W-8BEN-E Short Form

Completing the W-8BEN-E Short Form requires careful attention to detail. Here are the steps involved:

- Provide the name of the foreign entity and its country of incorporation.

- Indicate the type of entity, such as corporation, partnership, or trust.

- Fill in the entity's permanent address outside the United States.

- Complete the section related to the entity's U.S. taxpayer identification number, if applicable.

- Claim any applicable tax treaty benefits by specifying the relevant article and country.

- Sign and date the form, certifying that the information provided is accurate.

Legal Use of the W-8BEN-E Short Form

The legal use of the W-8BEN-E Short Form is crucial for foreign entities to ensure compliance with U.S. tax laws. By properly completing and submitting this form, entities can avoid unnecessary withholding taxes on U.S. source income. It is important to understand that the form must be kept up to date; if any information changes, a new form should be submitted. Additionally, the form must be provided to the withholding agent or financial institution, as it serves as evidence of the entity's foreign status and eligibility for tax treaty benefits.

Filing Deadlines / Important Dates

Filing deadlines for the W-8BEN-E Short Form can vary based on the specific circumstances of the entity and the type of income involved. Generally, the form should be submitted before the first payment of U.S. source income to avoid withholding. It is advisable for entities to keep track of any changes in tax regulations or treaty agreements that may affect their filing requirements. Regularly reviewing and updating the form ensures compliance and maximizes potential tax benefits.

Eligibility Criteria

To be eligible to use the W-8BEN-E Short Form, the entity must be a foreign organization that is not a U.S. person. This includes corporations, partnerships, and other entities formed outside the United States. The entity must also provide accurate information regarding its foreign status and any applicable tax treaty benefits. Understanding the eligibility criteria is essential for ensuring that the form is completed correctly and that the entity can take advantage of any available tax benefits.

Quick guide on how to complete w 8ben e short form emory finance finance emory

Complete W 8BEN E Short Form Emory Finance Finance Emory easily on any device

Managing documents online has gained popularity with businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the appropriate form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage W 8BEN E Short Form Emory Finance Finance Emory on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign W 8BEN E Short Form Emory Finance Finance Emory effortlessly

- Obtain W 8BEN E Short Form Emory Finance Finance Emory and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to preserve your changes.

- Decide how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign W 8BEN E Short Form Emory Finance Finance Emory and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 8ben e short form emory finance finance emory

Create this form in 5 minutes!

How to create an eSignature for the w 8ben e short form emory finance finance emory

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is the W 8BEN E Short Form used for in Emory Finance?

The W 8BEN E Short Form is utilized in Emory Finance to signNow foreign status and claim tax treaty benefits. It helps non-U.S. entities avoid excessive tax withholding on income earned from U.S. sources. Understanding this form is essential for compliance in financial transactions related to Finance Emory.

-

How does airSlate SignNow facilitate the completion of the W 8BEN E Short Form?

airSlate SignNow streamlines the process of completing the W 8BEN E Short Form through an intuitive platform that allows for easy document uploads and eSigning. Our solution is designed to simplify paperwork, ensuring that entities in Emory Finance can complete necessary forms swiftly and efficiently.

-

Are there any costs associated with using airSlate SignNow for the W 8BEN E Short Form?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to different business needs, including features for managing the W 8BEN E Short Form. Our subscription options are designed to provide great value while empowering businesses in Emory Finance to manage documents easily.

-

What features does airSlate SignNow offer for managing the W 8BEN E Short Form?

airSlate SignNow includes features such as customizable templates, secure storage, and real-time tracking for the W 8BEN E Short Form. These features are tailored to ensure that professionals in Finance Emory can effectively manage their documentation process without hassle.

-

Can I integrate airSlate SignNow with other tools for handling the W 8BEN E Short Form?

Absolutely! airSlate SignNow supports integrations with a variety of software tools, enabling seamless workflow management for the W 8BEN E Short Form. This is particularly beneficial for organizations in Emory Finance that rely on multiple platforms for their operations.

-

What benefits does using airSlate SignNow provide for the W 8BEN E Short Form?

Using airSlate SignNow for the W 8BEN E Short Form offers signNow benefits, including improved efficiency and reduced errors in document handling. This results in faster turnaround times and enhanced compliance for businesses operating in Finance Emory.

-

Is airSlate SignNow secure for handling sensitive information like the W 8BEN E Short Form?

Yes, airSlate SignNow prioritizes security and uses advanced encryption measures to protect sensitive information such as the W 8BEN E Short Form. Businesses in Emory Finance can trust that their documents are kept safe and confidential throughout the signing process.

Get more for W 8BEN E Short Form Emory Finance Finance Emory

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts effective 497304559 form

- Marital legal separation and property settlement agreement for persons with no children no joint property or debts effective 497304560 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts where divorce 497304561 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497304562 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497304563 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective 497304564 form

- Hawaii corporation 497304565 form

- Hawaii dissolution form

Find out other W 8BEN E Short Form Emory Finance Finance Emory

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed