Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version 2021

What is the Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

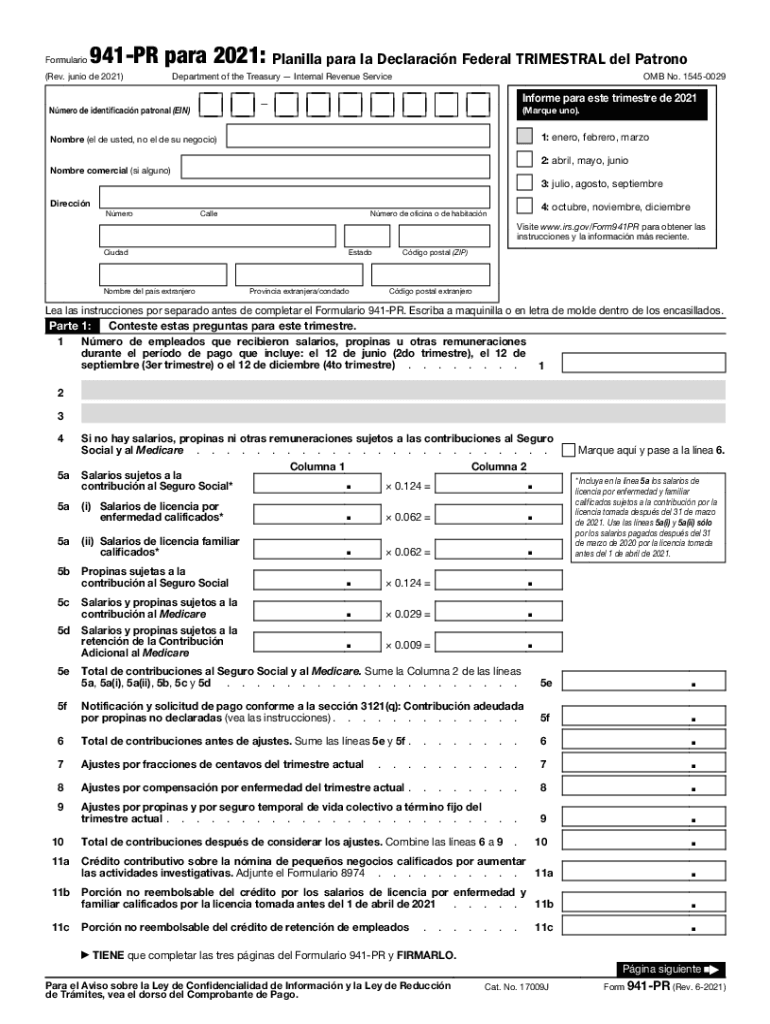

The Form 941 PR Rev June is a specific version of the Employer's Quarterly Federal Tax Return, tailored for employers in Puerto Rico. This form is essential for reporting income taxes withheld from employee wages, as well as the employer's share of Social Security and Medicare taxes. It is crucial for businesses operating in Puerto Rico to use this version to ensure compliance with local tax regulations. The form is designed to capture relevant data specific to the Puerto Rican tax system, making it distinct from the standard Form 941 used in the mainland United States.

Steps to complete the Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

Completing the Form 941 PR involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the quarter, including total wages paid and taxes withheld. Next, fill out the form by entering the employer identification number (EIN), business name, and address. Report the total number of employees and the taxable wages for the quarter. Calculate the total taxes owed, including income tax withheld and Social Security and Medicare taxes. Finally, review the form for accuracy before submitting it to the IRS.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 941 PR is essential for maintaining compliance. The form must be filed quarterly, with specific deadlines for each quarter. For the first quarter (January to March), the deadline is typically April 30. The second quarter (April to June) is due by July 31, the third quarter (July to September) by October 31, and the fourth quarter (October to December) by January 31 of the following year. Employers should mark these dates on their calendars to avoid penalties for late submission.

Penalties for Non-Compliance

Failure to file the Form 941 PR on time or inaccuracies in the form can lead to significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, if taxes are not paid by the due date, interest will accrue on the unpaid balance. It is crucial for employers to ensure timely and accurate submissions to avoid these financial repercussions and maintain good standing with the IRS.

Digital vs. Paper Version

Employers have the option to file Form 941 PR either digitally or via paper submission. Filing electronically is often more efficient, allowing for quicker processing and immediate confirmation of receipt. Digital submissions also reduce the risk of errors associated with manual entry. Conversely, some employers may prefer paper forms for record-keeping purposes. Regardless of the method chosen, it is essential to ensure that all information is accurate and submitted by the deadline.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 941 PR. These guidelines include detailed instructions on how to fill out each section of the form, the types of payments that should be reported, and the necessary documentation required for submission. Employers should refer to these guidelines to ensure compliance with federal regulations and to avoid common mistakes that could lead to penalties.

Quick guide on how to complete form 941 pr rev june 2021 employers quarterly federal tax return puerto rican version

Complete Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without any hold-ups. Manage Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version without hassle

- Locate Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 pr rev june 2021 employers quarterly federal tax return puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the form 941 pr rev june 2021 employers quarterly federal tax return puerto rican version

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The best way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the difference between form 944 vs 941?

The main difference between form 944 vs 941 lies in their filing frequency. Form 944 is designed for smaller employers with lower payroll tax responsibilities and is filed annually, whereas form 941 is for employers who report quarterly. Businesses should assess their payroll size to determine which form suits their needs.

-

Which businesses should use form 944 vs 941?

Form 944 is ideal for small businesses that have an annual tax liability of $1,000 or less, allowing them to file just once a year. On the other hand, form 941 is suitable for businesses that have a higher payroll tax obligation, requiring more regular reporting. Assessing your business size and tax liabilities will help in choosing the correct form.

-

How does airSlate SignNow assist with form 944 vs 941 filings?

airSlate SignNow facilitates the completion and submission of both form 944 and form 941 through its easy-to-use electronic signatures and document management features. This streamlines the paperwork process, ensuring that businesses meet their tax obligations efficiently. Using airSlate SignNow can save time and reduce errors when filing.

-

Are there any costs associated with using airSlate SignNow for form 944 vs 941?

Yes, airSlate SignNow does have pricing plans that cater to various business needs. The cost-effective nature of the platform means that you can handle forms like 944 vs 941 without incurring excessive expenses. This makes it an excellent investment for businesses looking to simplify their document handling.

-

Can I integrate airSlate SignNow with my existing accounting software for form 944 vs 941?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll systems that can help streamline your form 944 vs 941 filings. This means you can manage your financial documents in one platform, which simplifies your processes and improves efficiency.

-

What features of airSlate SignNow are essential for managing form 944 vs 941?

Key features of airSlate SignNow that support form 944 vs 941 management include electronic signatures, document templates, and secure storage. These tools not only facilitate quick and efficient document processing but also ensure that your filings are kept safe and compliant with regulations.

-

How can airSlate SignNow save me time on form 944 vs 941 filings?

Using airSlate SignNow allows for faster completion and submission of form 944 vs 941 by automating tedious processes like document routing and signatures. This means less time spent on paperwork and more time for your core business activities. Moreover, the user-friendly interface makes even complex filings straightforward.

Get more for Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

- Amendment to prenuptial or premarital agreement connecticut form

- Financial statements only in connection with prenuptial premarital agreement connecticut form

- Revocation of premarital or prenuptial agreement connecticut form

- Ct uncontested form

- Notice of appearance 5th connecticut form

- Notice of appearance 6th connecticut form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497300927 form

- Notice of appearance 7th connecticut form

Find out other Form 941 PR Rev June Employer's Quarterly Federal Tax Return Puerto Rican Version

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation