Form 8879 EMP Rev December 2024-2026

What is the Form 8879 EMP Rev December

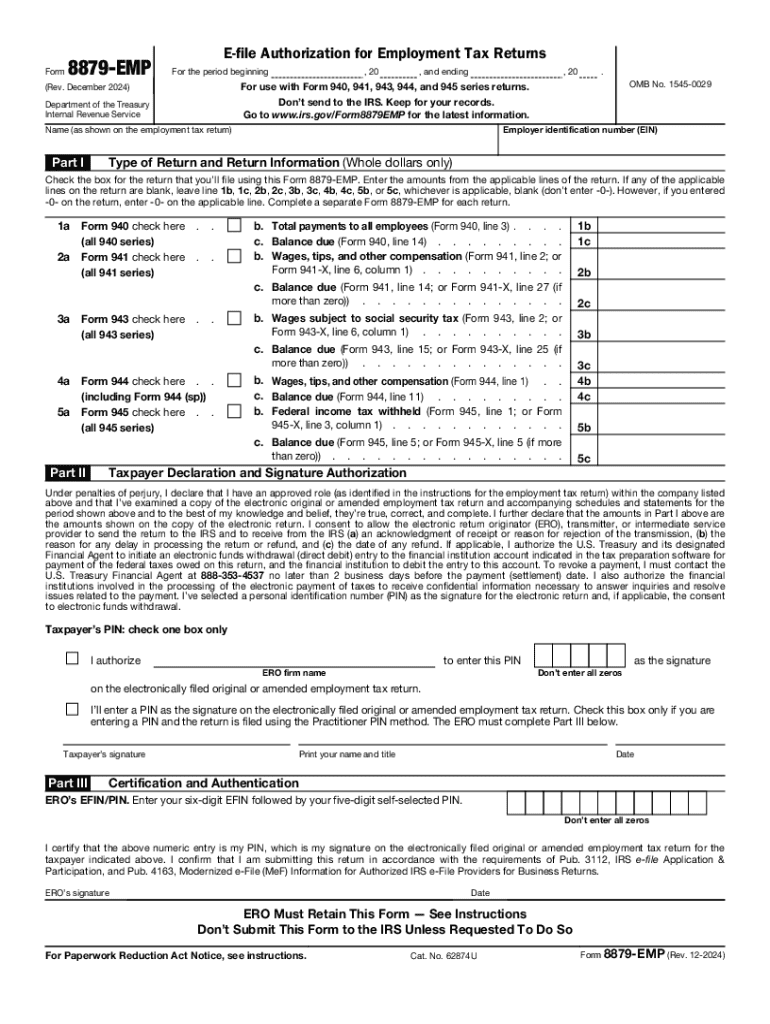

The Form 8879 EMP Rev December is a crucial document used by employers to authorize the electronic filing of their employment tax returns. This form serves as a declaration that the information provided in the tax return is accurate and complete. By signing this form, employers give permission for their tax returns to be filed electronically with the Internal Revenue Service (IRS).

How to use the Form 8879 EMP Rev December

To use the Form 8879 EMP Rev December, employers must first complete their employment tax return. After filling out the return, they should print the Form 8879 and review it for accuracy. The employer must then sign the form, confirming that they authorize the electronic submission of their return. This form should be kept on file for record-keeping purposes, as it may be requested by the IRS during audits.

Steps to complete the Form 8879 EMP Rev December

Completing the Form 8879 EMP Rev December involves several steps:

- Gather all necessary information from your employment tax return.

- Fill out the Form 8879 with the required details, including the employer's name, address, and Employer Identification Number (EIN).

- Review the completed form for any errors or omissions.

- Sign and date the form to authorize the electronic filing.

- Keep a copy of the signed form for your records.

Legal use of the Form 8879 EMP Rev December

The legal use of the Form 8879 EMP Rev December is essential for compliance with IRS regulations. By signing this form, employers affirm that they understand the implications of electronic filing and that the information provided is true to the best of their knowledge. Failure to properly complete or retain this form can result in penalties or issues during audits.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines when submitting their employment tax returns using the Form 8879 EMP Rev December. Generally, employment tax returns are due quarterly or annually, depending on the employer's filing schedule. It is crucial to check the IRS guidelines for the exact dates to ensure timely submission and avoid penalties.

Required Documents

Before completing the Form 8879 EMP Rev December, employers should gather the following documents:

- Completed employment tax return.

- Employer Identification Number (EIN).

- Any supporting documentation related to employment taxes.

Form Submission Methods (Online / Mail / In-Person)

The Form 8879 EMP Rev December can be submitted electronically along with the employment tax return. Employers may also choose to keep a physical copy of the signed form for their records. It is important to ensure that the electronic submission is completed through an authorized e-filing service to comply with IRS requirements.

Create this form in 5 minutes or less

Find and fill out the correct form 8879 emp rev december

Create this form in 5 minutes!

How to create an eSignature for the form 8879 emp rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a planilla anual omb?

A planilla anual omb is a comprehensive annual report that businesses must submit to comply with regulatory requirements. It includes essential financial and operational data, ensuring transparency and accountability. Using airSlate SignNow, you can easily create, send, and eSign your planilla anual omb, streamlining the submission process.

-

How can airSlate SignNow help with my planilla anual omb?

airSlate SignNow simplifies the process of preparing and submitting your planilla anual omb. With our user-friendly interface, you can quickly fill out forms, gather necessary signatures, and send documents securely. This efficiency saves you time and reduces the risk of errors in your submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Whether you're a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have the tools necessary to manage your planilla anual omb effectively. Visit our pricing page for detailed information on each plan.

-

Are there any features specifically for managing planilla anual omb?

Yes, airSlate SignNow includes features tailored for managing your planilla anual omb, such as customizable templates, automated workflows, and secure eSigning. These features help you streamline the preparation and submission process, ensuring compliance and efficiency. You can also track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for my planilla anual omb?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to connect your existing tools seamlessly. This means you can easily import data for your planilla anual omb from your accounting software or CRM, enhancing your workflow and reducing manual entry.

-

What are the benefits of using airSlate SignNow for my planilla anual omb?

Using airSlate SignNow for your planilla anual omb provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored securely and are easily accessible when needed. Additionally, the eSigning feature speeds up the approval process, allowing you to meet deadlines with ease.

-

Is airSlate SignNow secure for handling sensitive planilla anual omb data?

Yes, airSlate SignNow prioritizes the security of your sensitive data, including your planilla anual omb. We implement advanced encryption protocols and comply with industry standards to protect your information. You can trust that your documents are safe and secure while using our platform.

Get more for Form 8879 EMP Rev December

Find out other Form 8879 EMP Rev December

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself