Form 8932 Rev December Credit for Employer Differential Wage Payments 2021-2026

What is the Form 8932 Credit for Employer Differential Wage Payments?

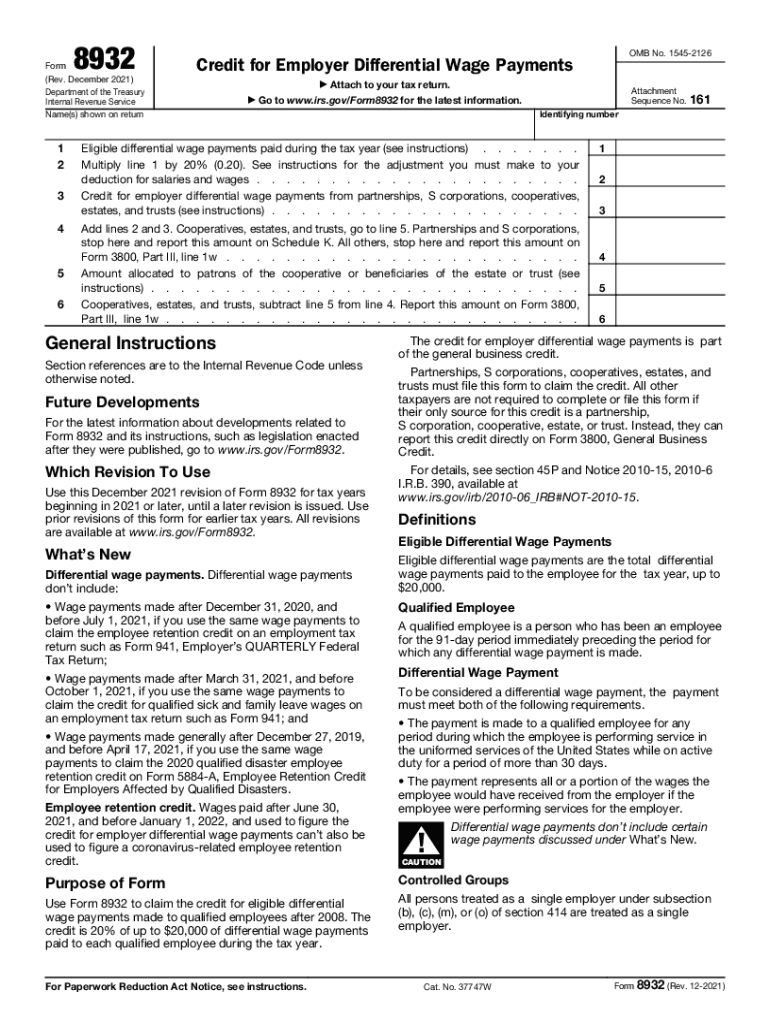

The Form 8932 is a tax form used by employers to claim a credit for differential wage payments made to employees who are called to active duty in the military. This form is specifically designed to provide financial relief to businesses that continue to pay their employees while they are serving in the military. The credit can help offset the costs associated with maintaining payroll for these employees, thereby supporting both the workforce and the business during challenging times.

Eligibility Criteria for Form 8932

To qualify for the credit claimed on Form 8932, employers must meet specific criteria. These include:

- The employer must be a business entity that pays differential wages to employees who are active duty members of the military.

- The differential wage payments must be made for periods when the employee is on active duty for more than 30 days.

- Employers must have a valid Employer Identification Number (EIN) and be compliant with all relevant tax regulations.

Steps to Complete the Form 8932

Completing Form 8932 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information, including the total amount of differential wage payments made during the tax year.

- Fill out the form, providing details such as the employer's name, address, and EIN.

- Calculate the credit amount based on the differential wages paid, following the IRS guidelines.

- Review the completed form for accuracy before submission.

How to Obtain the Form 8932

Employers can obtain Form 8932 from the IRS website. The form is available in PDF format, allowing for easy download and printing. Additionally, it may be accessible through various tax preparation software that supports IRS forms. It is important to ensure that you are using the most current version of the form to comply with tax regulations.

Filing Deadlines for Form 8932

Filing deadlines for Form 8932 align with the employer's tax return deadlines. Generally, the form must be filed by the due date of the employer's tax return, including extensions. Employers should keep track of these dates to ensure timely submission and avoid penalties. It is advisable to consult the IRS guidelines or a tax professional for specific deadlines related to your business type.

Legal Use of the Form 8932

The legal use of Form 8932 is governed by IRS regulations regarding tax credits for differential wage payments. Employers must ensure that the information provided is accurate and that they are eligible to claim the credit. Misuse of the form or incorrect claims can lead to penalties, including fines or disqualification from future credits. Adhering to the IRS guidelines is crucial for maintaining compliance.

Quick guide on how to complete form 8932 rev december 2021 credit for employer differential wage payments

Easily Prepare Form 8932 Rev December Credit For Employer Differential Wage Payments on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow provides all the resources required to generate, modify, and eSign your documents promptly and without interruptions. Handle Form 8932 Rev December Credit For Employer Differential Wage Payments on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The Easiest Way to Edit and eSign Form 8932 Rev December Credit For Employer Differential Wage Payments Effortlessly

- Locate Form 8932 Rev December Credit For Employer Differential Wage Payments and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 8932 Rev December Credit For Employer Differential Wage Payments and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8932 rev december 2021 credit for employer differential wage payments

Create this form in 5 minutes!

How to create an eSignature for the form 8932 rev december 2021 credit for employer differential wage payments

How to generate an electronic signature for your PDF file in the online mode

How to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is Form 8932 and why is it important?

Form 8932 is used by eligible small businesses to claim a tax credit for certain employee retention and other employment-related expenses. Completing Form 8932 accurately is crucial as it can signNowly affect your business's tax obligations and potential savings.

-

How can airSlate SignNow help with completing Form 8932?

AirSlate SignNow simplifies the process of completing Form 8932 by providing an efficient way to fill out, sign, and send your documents securely. Our user-friendly platform allows you to collaborate with team members seamlessly, ensuring that your Form 8932 is completed without hassle.

-

What features does airSlate SignNow offer for managing Form 8932?

AirSlate SignNow offers features like eSignature capabilities, document templates, and real-time collaboration tools specifically designed to streamline the management of Form 8932. These features help ensure you stay organized and compliant while completing the required steps.

-

Is airSlate SignNow cost-effective for businesses needing to file Form 8932?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to file Form 8932 by offering various subscription plans that fit different budgets. Our platform helps you save money by eliminating paper and printing costs while increasing efficiency in document management.

-

Can I integrate airSlate SignNow with other applications for Form 8932 processing?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Salesforce, and Dropbox to facilitate easier access and management of your Form 8932. These integrations enhance your workflow and ensure that all necessary documents are easily accessible.

-

What benefits does using airSlate SignNow provide for filing Form 8932?

Using airSlate SignNow to file Form 8932 provides numerous benefits, including reduced processing times, improved accuracy, and enhanced security of your sensitive documents. Our platform ensures that you can complete and send your Form 8932 with confidence and efficiency.

-

How secure is the information I provide when using airSlate SignNow for Form 8932?

AirSlate SignNow prioritizes security when processing your Form 8932, utilizing encryption protocols to protect your data. Our platform complies with industry standards to ensure that your confidential information remains safe and secure at all times.

Get more for Form 8932 Rev December Credit For Employer Differential Wage Payments

- Statutory durable power of attorney colorado form

- Hunting forms package colorado

- Identity theft recovery package colorado form

- Medical durable power of attorney colorado form

- Revocation of medical durable power of attorney colorado form

- Beneficiary agreement colorado form

- Aging parent package colorado form

- Sale of a business package colorado form

Find out other Form 8932 Rev December Credit For Employer Differential Wage Payments

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement