8932 2019

What is the IRS 8932 Form?

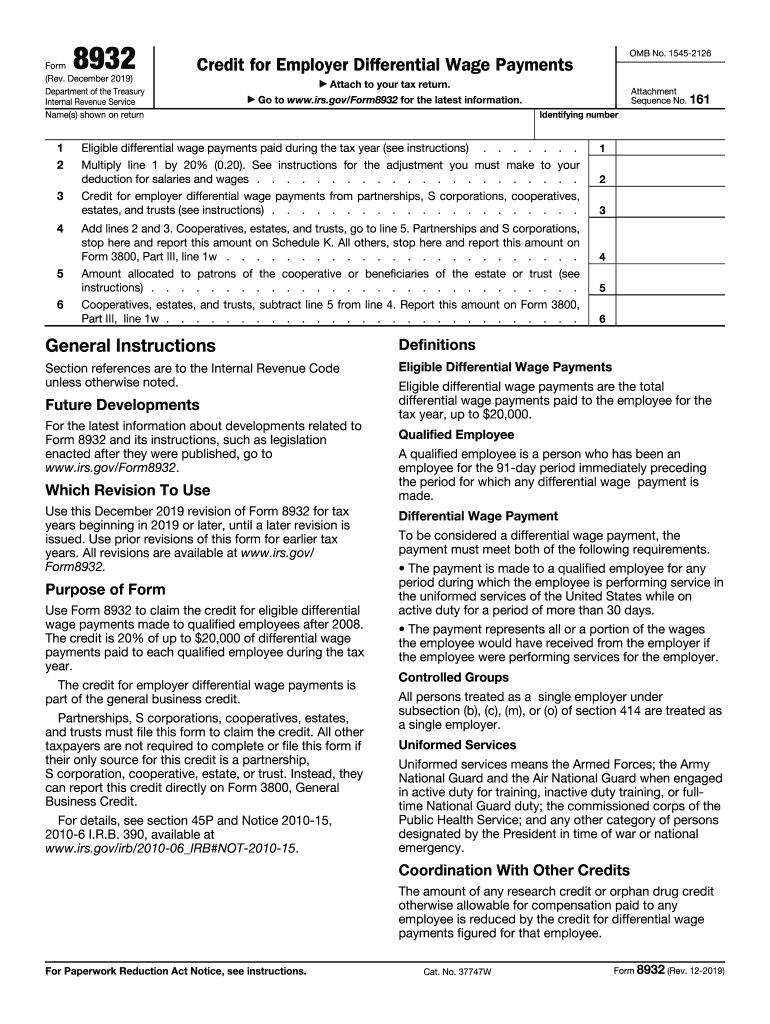

The IRS 8932 form, also known as the Form 8932 Credit for Employer Differential Wage Payments, is utilized by employers to claim a tax credit for differential wage payments made to employees who are called to active duty in the military. This form is essential for businesses that support their employees during military service, allowing them to receive a credit for the wages paid while the employee is away.

How to Obtain the IRS 8932 Form

The IRS 8932 form can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as tax regulations can change annually. You can also request a paper copy by contacting the IRS directly.

Steps to Complete the IRS 8932 Form

Completing the IRS 8932 form involves several key steps:

- Gather necessary information about your business and the employees for whom you are claiming the credit.

- Fill out the identification section, including your Employer Identification Number (EIN) and business name.

- Provide details of the differential wage payments made to eligible employees during the tax year.

- Calculate the total credit amount based on the wages paid and the applicable tax credit rate.

- Review the form for accuracy and completeness before submission.

Legal Use of the IRS 8932 Form

The IRS 8932 form is legally binding when completed accurately and submitted in accordance with IRS guidelines. It is crucial for employers to ensure that they meet all eligibility criteria and maintain proper documentation to support their claims. This helps prevent issues related to non-compliance and ensures that the submitted claims are valid and can withstand scrutiny.

Filing Deadlines and Important Dates

Employers should be aware of the filing deadlines associated with the IRS 8932 form. Typically, the form must be submitted along with your annual tax return. It is advisable to check the IRS website for the specific due dates for the current tax year, as these dates may vary and can impact the eligibility for claiming the credit.

Eligibility Criteria for the IRS 8932 Form

To be eligible to use the IRS 8932 form, employers must meet certain criteria:

- The employer must be a business that pays differential wages to employees who are active duty military personnel.

- The employee must be eligible for the credit, which typically includes those called to active duty for more than thirty days.

- Employers must maintain accurate records of the differential wage payments made during the tax year.

Quick guide on how to complete form 8932 rev december 2019 internal revenue service

Complete 8932 effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed materials, as you can obtain the necessary form and securely retain it online. airSlate SignNow provides all the features required to create, edit, and electronically sign your documents quickly and without complications. Handle 8932 on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

The easiest method to edit and electronically sign 8932 without hassle

- Locate 8932 and click on Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or inaccuracies that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 8932 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8932 rev december 2019 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8932 rev december 2019 internal revenue service

How to create an electronic signature for your Form 8932 Rev December 2019 Internal Revenue Service in the online mode

How to create an eSignature for your Form 8932 Rev December 2019 Internal Revenue Service in Google Chrome

How to generate an electronic signature for putting it on the Form 8932 Rev December 2019 Internal Revenue Service in Gmail

How to make an electronic signature for the Form 8932 Rev December 2019 Internal Revenue Service from your smartphone

How to create an eSignature for the Form 8932 Rev December 2019 Internal Revenue Service on iOS devices

How to make an electronic signature for the Form 8932 Rev December 2019 Internal Revenue Service on Android

People also ask

-

What is the IRS 8932 form and why is it important?

The IRS 8932 form is a crucial document that allows businesses to elect to be treated as an S corporation for tax purposes. Completing this form correctly can save companies signNow money on taxes. Understanding its significance can help businesses navigate tax responsibilities effectively.

-

How can airSlate SignNow help in completing the IRS 8932 form?

airSlate SignNow simplifies the process of completing the IRS 8932 form by providing easy-to-use templates and an intuitive eSignature feature. This ensures that users can fill out, sign, and send the form securely and efficiently. Our platform minimizes errors, making tax filing smoother.

-

Are there costs associated with using airSlate SignNow for the IRS 8932 form?

Yes, airSlate SignNow offers various subscription plans to suit different business needs. Pricing is competitive and includes features that ensure the secure processing of documents like the IRS 8932 form. A cost-effective solution helps businesses manage their paperwork without breaking the bank.

-

What features does airSlate SignNow offer for IRS 8932 form management?

airSlate SignNow provides features such as document templates, eSigning, real-time tracking, and secure cloud storage. These tools streamline the process of handling the IRS 8932 form, making compliance easier for businesses. The user-friendly interface ensures that anyone can use it without extensive training.

-

Can airSlate SignNow integrate with other software to manage IRS 8932 forms?

Absolutely! airSlate SignNow offers seamless integrations with popular business software, such as Google Drive, Salesforce, and Zapier. These integrations help automate workflows, making it easy to handle the IRS 8932 form and other documents in one cohesive environment.

-

What benefits can I expect from using airSlate SignNow for my IRS 8932 form?

By using airSlate SignNow for your IRS 8932 form, you benefit from enhanced efficiency, reduced errors, and greater compliance assurance. Our platform saves time and resources, allowing businesses to focus on core activities rather than paperwork. Experience a hassle-free process that ensures your forms are filed correctly.

-

Is airSlate SignNow secure for submitting IRS 8932 forms?

Yes, airSlate SignNow prioritizes the security of your documents, including the IRS 8932 form. Our platform uses advanced encryption and complies with industry standards to protect sensitive information. You can confidently submit your forms knowing they are safeguarded against unauthorized access.

Get more for 8932

- Form 400 microsoft word download

- Cpsedustudent records form

- Third claim form

- State of wyoming application for certificate of title form

- Humana pharmacy refill form

- Form at2 for use only by a landlord private rented housing panel

- Blank death certificate form 40879334

- State of georgia vessel registration application long county form

Find out other 8932

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word