GovForm8932 for the Latest Information 2017

What is the GovForm8932 For The Latest Information

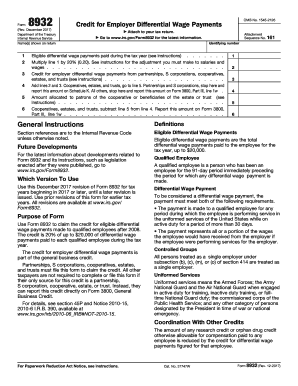

The GovForm8932 for the latest information is a tax form used by eligible businesses to claim specific tax credits. This form is particularly relevant for organizations seeking to reduce their tax liabilities through available credits. Understanding the purpose of this form is crucial for businesses aiming to optimize their tax filings and ensure compliance with IRS regulations.

How to use the GovForm8932 For The Latest Information

Using the GovForm8932 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents and data related to the tax credits being claimed. Next, fill out the form by providing detailed information about your business, including its structure and the specific credits being claimed. After completing the form, review it for accuracy and ensure all required signatures are present before submission.

Steps to complete the GovForm8932 For The Latest Information

Completing the GovForm8932 involves a systematic approach:

- Collect necessary documentation, such as financial statements and prior tax returns.

- Enter your business information, including name, address, and Employer Identification Number (EIN).

- Detail the specific tax credits you are claiming, ensuring you meet all eligibility requirements.

- Review all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the GovForm8932 For The Latest Information

The legal use of the GovForm8932 is governed by IRS guidelines, which stipulate that the form must be completed accurately to claim tax credits. Misrepresentation or errors can lead to penalties or disqualification from receiving credits. It is essential for businesses to maintain compliance with all applicable laws and regulations when using this form.

Filing Deadlines / Important Dates

Filing deadlines for the GovForm8932 are crucial for businesses to avoid penalties. Typically, the form must be submitted by the tax filing deadline for the respective tax year. Businesses should also be aware of any extensions or specific dates related to the credits being claimed, as these can vary from year to year.

Required Documents

To complete the GovForm8932, businesses must gather various supporting documents. These may include:

- Financial statements that demonstrate eligibility for tax credits.

- Previous tax returns to provide context for the current filing.

- Any additional documentation required by the IRS for specific credits.

Who Issues the Form

The GovForm8932 is issued by the Internal Revenue Service (IRS). This federal agency is responsible for tax collection and enforcement of tax laws in the United States. Businesses must ensure they are using the most current version of the form as provided by the IRS to remain compliant with tax regulations.

Quick guide on how to complete govform8932 for the latest information

Complete GovForm8932 For The Latest Information effortlessly on any device

Online document management has become widely adopted by companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage GovForm8932 For The Latest Information on any platform using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The simplest way to modify and eSign GovForm8932 For The Latest Information without hassle

- Locate GovForm8932 For The Latest Information and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign GovForm8932 For The Latest Information and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct govform8932 for the latest information

Create this form in 5 minutes!

How to create an eSignature for the govform8932 for the latest information

How to create an electronic signature for the Govform8932 For The Latest Information in the online mode

How to make an eSignature for the Govform8932 For The Latest Information in Google Chrome

How to create an electronic signature for putting it on the Govform8932 For The Latest Information in Gmail

How to make an electronic signature for the Govform8932 For The Latest Information right from your smart phone

How to generate an eSignature for the Govform8932 For The Latest Information on iOS

How to make an electronic signature for the Govform8932 For The Latest Information on Android OS

People also ask

-

What is GovForm8932 and why is it important?

GovForm8932 is a crucial form for businesses looking to claim certain tax credits. Understanding how to utilize GovForm8932 For The Latest Information is essential for maximizing your financial benefits and ensuring compliance with IRS requirements.

-

How can airSlate SignNow help with GovForm8932?

airSlate SignNow streamlines the process of sending and eSigning GovForm8932, ensuring that you can complete it quickly and accurately. By using airSlate SignNow, you gain access to tools that help manage and track your documents efficiently, enabling you to focus on your business.

-

What features does airSlate SignNow offer for GovForm8932?

Key features of airSlate SignNow include customizable templates, secure document storage, and real-time tracking. These features enhance the user experience while working with GovForm8932 For The Latest Information, making it easier to handle important forms.

-

Is there a cost associated with using airSlate SignNow for GovForm8932?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. The cost is competitive, especially when considering the efficiency and convenience it provides for managing GovForm8932 For The Latest Information.

-

Can I integrate airSlate SignNow with other applications for managing GovForm8932?

Absolutely! airSlate SignNow offers numerous integrations with popular applications, allowing you to seamlessly manage your workflows. This makes it easier to handle GovForm8932 For The Latest Information along with other essential business processes.

-

What are the benefits of using airSlate SignNow for GovForm8932?

Using airSlate SignNow for GovForm8932 streamlines your document management process, saving you time and reducing errors. Its user-friendly interface and secure storage options ensure that you can focus on completing your forms accurately and efficiently.

-

Is airSlate SignNow secure for handling GovForm8932?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. You can confidently use airSlate SignNow to manage GovForm8932 For The Latest Information without worrying about the safety of your sensitive data.

Get more for GovForm8932 For The Latest Information

- Gsis form no

- Three day notice to quit for nuisance nrs 402514 storey county storeycounty form

- Uk bank statement template pdffiller form

- Montana public defenders adams county colorado form

- Volusia county adult drug court participant handbook seventh circuit7 form

- Auburndale cove picnic permit application newton ma homepage newtonma form

- Complete this form and send to the nsd nacvsoorg

- Clearfield county emergency custody form

Find out other GovForm8932 For The Latest Information

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format