Form ST 104G, Sales Tax Exemption Claim Cash Purchases by

What is the Form ST-104G, Sales Tax Exemption Claim Cash Purchases

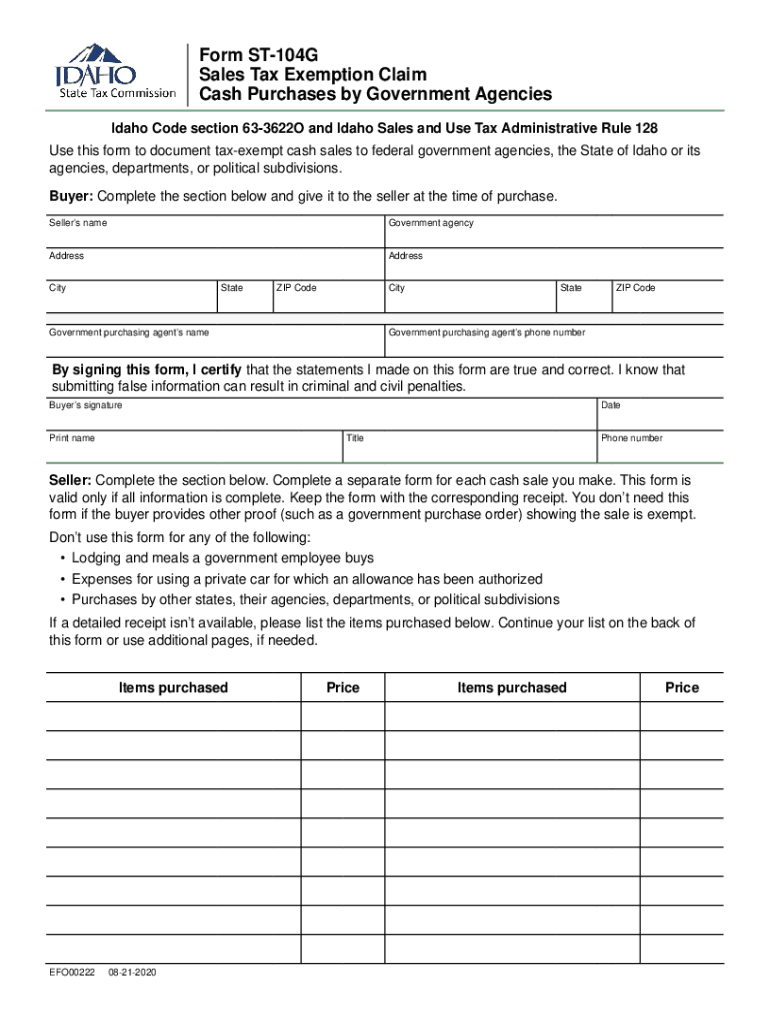

The Form ST-104G is a crucial document used in Idaho for claiming sales tax exemptions on cash purchases. This form allows eligible purchasers to assert their right to a sales tax exemption for specific transactions, particularly in cases where the purchase is made for exempt purposes. Understanding the purpose and application of this form is essential for individuals and businesses seeking to navigate Idaho's sales tax regulations effectively.

Steps to Complete the Form ST-104G

Completing the Form ST-104G requires careful attention to detail to ensure compliance with Idaho tax regulations. Here are the steps to follow:

- Obtain the Form ST-104G from an authorized source, such as the Idaho State Tax Commission website.

- Fill in the required information, including your name, address, and the nature of the exemption claim.

- Clearly specify the items purchased and their intended use to justify the exemption.

- Sign and date the form to validate your claim.

- Submit the completed form to the appropriate tax authority as instructed.

Legal Use of the Form ST-104G

The legal use of the Form ST-104G is governed by Idaho's sales tax laws. This form is legally binding and must be filled out accurately to ensure that the exemption is recognized. Misrepresentation or errors in the form can lead to penalties or denial of the exemption. It is essential to familiarize yourself with the specific legal requirements surrounding exemptions to ensure compliance.

Eligibility Criteria for the Form ST-104G

To qualify for using the Form ST-104G, certain eligibility criteria must be met. Generally, the purchaser must be engaged in activities that are recognized as exempt under Idaho law. This includes purchases made for educational, charitable, or governmental purposes. Additionally, businesses must demonstrate that the items purchased are directly related to their exempt functions. Understanding these criteria is vital for ensuring that your claim is valid.

Required Documents for Submission

When submitting the Form ST-104G, you may need to provide additional documentation to support your claim. This could include:

- Proof of the exempt status of the purchaser, such as a tax-exempt certificate.

- Receipts or invoices for the purchases made.

- Any relevant correspondence with tax authorities regarding the exemption.

Having these documents on hand can facilitate a smoother submission process and help substantiate your claim.

Form Submission Methods

The Form ST-104G can be submitted through various methods, depending on the preferences of the taxpayer and the requirements of the Idaho State Tax Commission. Typically, submissions can be made:

- Online through the Idaho State Tax Commission's electronic filing system.

- By mail, sending the completed form to the designated tax office.

- In-person at local tax commission offices.

Choosing the right submission method can help ensure timely processing of your exemption claim.

Quick guide on how to complete form st 104g sales tax exemption claim cash purchases by

Complete Form ST 104G, Sales Tax Exemption Claim Cash Purchases By with ease on any gadget

Web-based document management has gained traction with companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Form ST 104G, Sales Tax Exemption Claim Cash Purchases By on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Form ST 104G, Sales Tax Exemption Claim Cash Purchases By effortlessly

- Find Form ST 104G, Sales Tax Exemption Claim Cash Purchases By and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Form ST 104G, Sales Tax Exemption Claim Cash Purchases By and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 104g sales tax exemption claim cash purchases by

How to make an e-signature for a PDF document online

How to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

The best way to make an e-signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the Idaho exemption claim form, and how can airSlate SignNow help?

The Idaho exemption claim form allows taxpayers to claim exemptions for their property. With airSlate SignNow, users can easily fill out, send, and eSign the Idaho exemption claim form, ensuring a hassle-free process for managing important tax documents.

-

Are there any costs associated with using airSlate SignNow for the Idaho exemption claim form?

AirSlate SignNow offers a variety of pricing plans to suit different business needs. Users can start with a free trial to explore features available for the Idaho exemption claim form before committing to a paid plan, ensuring they find the best fit for their requirements.

-

Can I integrate airSlate SignNow with other applications for processing the Idaho exemption claim form?

Yes, airSlate SignNow integrates seamlessly with several popular applications like Google Drive, Microsoft Office, and Dropbox. This allows users to manage their Idaho exemption claim form efficiently alongside other important documents and workflows.

-

Is it safe to eSign the Idaho exemption claim form using airSlate SignNow?

Absolutely! AirSlate SignNow prioritizes security and compliance, offering features like encrypted signatures and secure document storage. You can confidently eSign your Idaho exemption claim form knowing your data is protected.

-

What features does airSlate SignNow offer for managing the Idaho exemption claim form?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders. These tools make managing the Idaho exemption claim form efficient and ensure you never miss submission deadlines.

-

How can I access my Idaho exemption claim form after signing it with airSlate SignNow?

Once you eSign your Idaho exemption claim form, it's automatically saved in your airSlate SignNow account. You can access, download, or share your signed documents at any time, providing you with easy retrieval and management options.

-

Can I collaborate with others on the Idaho exemption claim form using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration on documents. You can invite team members or stakeholders to review and eSign the Idaho exemption claim form, streamlining the process and ensuring everyone is on the same page.

Get more for Form ST 104G, Sales Tax Exemption Claim Cash Purchases By

- Connecticut marital property 497301203 form

- Marital legal separation and property settlement agreement no children parties may have joint property or debts effective 497301204 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497301205 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective form

- Ct package form

- Ct dissolve form

- Living trust for husband and wife with no children connecticut form

- Living trust for individual who is single divorced or widow or widower with no children connecticut form

Find out other Form ST 104G, Sales Tax Exemption Claim Cash Purchases By

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online