Federal Employer Quarterly Tax Forms" Keyword Found

Understanding the R 941 Allocation Aggregate

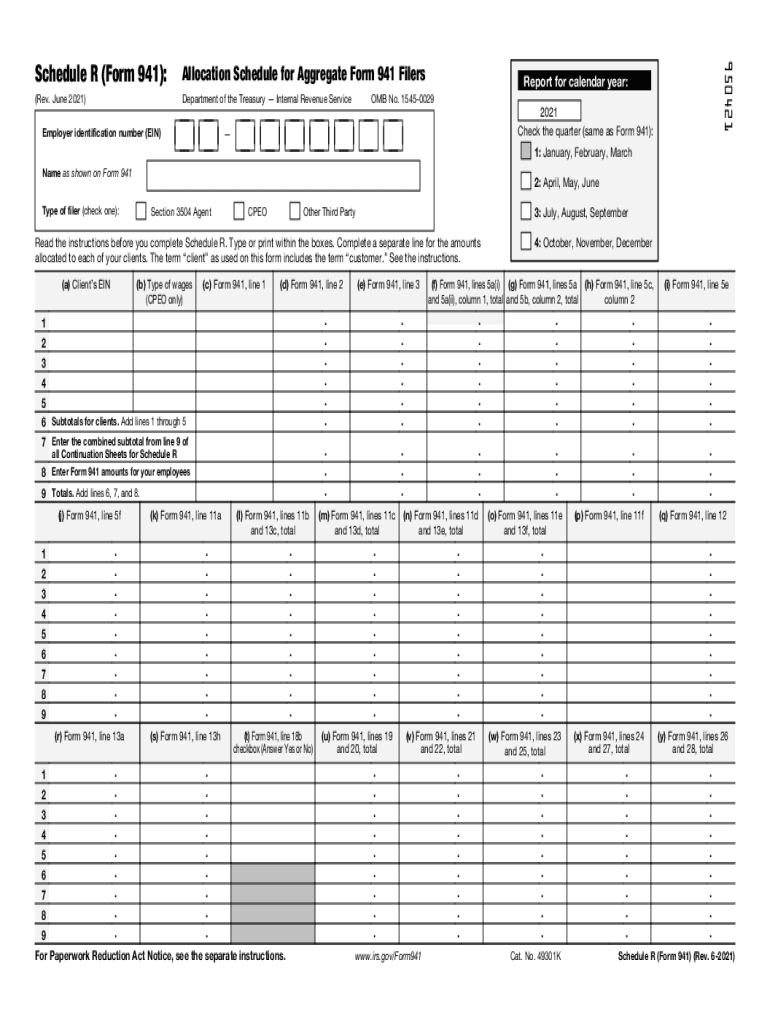

The R 941 allocation aggregate is a critical form used by employers to report federal payroll taxes. This form consolidates the information from multiple employees, allowing for a streamlined submission of tax liabilities. It is essential for businesses to understand how to accurately complete this form to ensure compliance with IRS regulations. The R 941 form captures details such as wages paid, taxes withheld, and any adjustments that may need to be reported throughout the quarter.

Steps to Complete the R 941 Allocation Aggregate

Completing the R 941 allocation aggregate involves several key steps:

- Gather all necessary employee payroll records for the quarter.

- Calculate total wages paid to employees, including any bonuses or overtime.

- Determine the total amount of federal income tax withheld from employee wages.

- Include any adjustments for prior quarters, if applicable.

- Double-check all calculations for accuracy before submission.

Following these steps will help ensure that the form is filled out correctly and submitted on time.

IRS Guidelines for the R 941 Form

The IRS provides specific guidelines for completing the R 941 allocation aggregate. Employers must adhere to these guidelines to avoid penalties. Key points include:

- Ensure all employee information is accurate and up-to-date.

- Report any changes in business structure or ownership that may affect tax liabilities.

- Submit the form by the designated deadlines to avoid late fees.

Staying informed about IRS guidelines can help businesses maintain compliance and avoid unnecessary complications.

Filing Deadlines for the R 941 Allocation Aggregate

Timely filing of the R 941 allocation aggregate is crucial for compliance. The IRS typically requires this form to be submitted quarterly. The deadlines are as follows:

- For the first quarter (January to March): April 30

- For the second quarter (April to June): July 31

- For the third quarter (July to September): October 31

- For the fourth quarter (October to December): January 31 of the following year

Employers should mark these dates on their calendars to ensure timely submissions.

Legal Use of the R 941 Allocation Aggregate

The R 941 allocation aggregate serves a legal purpose in documenting an employer's payroll tax obligations. It is essential for maintaining compliance with federal tax laws. Inaccuracies or late submissions can lead to penalties, including fines or increased scrutiny from the IRS. Therefore, understanding the legal implications of this form is vital for all employers.

Common Penalties for Non-Compliance

Failure to comply with the requirements of the R 941 allocation aggregate can result in significant penalties. Common consequences include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall liability.

- Potential audits by the IRS, leading to further complications.

Employers should prioritize compliance to avoid these penalties and maintain a good standing with the IRS.

Quick guide on how to complete federal employer quarterly tax formsampquot keyword found

Complete Federal Employer Quarterly Tax Forms" Keyword Found effortlessly on any device

Digital document organization has gained signNow traction among businesses and individuals. It presents an ideal environmentally friendly alternative to conventional printed and signed documentation, allowing you to obtain the required form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Federal Employer Quarterly Tax Forms" Keyword Found on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and electronically sign Federal Employer Quarterly Tax Forms" Keyword Found with ease

- Obtain Federal Employer Quarterly Tax Forms" Keyword Found and then click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your document, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Federal Employer Quarterly Tax Forms" Keyword Found and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the federal employer quarterly tax formsampquot keyword found

How to make an e-signature for your PDF online

How to make an e-signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is the r 941 allocation aggregate feature in airSlate SignNow?

The r 941 allocation aggregate feature in airSlate SignNow allows businesses to efficiently manage and distribute their resources across different areas. This feature streamlines the document signing process, making it easier to track allocations and ensure compliance with financial regulations.

-

How does airSlate SignNow help with r 941 allocation aggregate reporting?

airSlate SignNow simplifies r 941 allocation aggregate reporting by providing users with tools to easily compile and organize necessary documentation. This ensures that all allocation data is accurately captured and readily available for auditors or team members requiring access.

-

What are the pricing options for using the r 941 allocation aggregate feature?

airSlate SignNow offers several pricing plans tailored to fit various business needs, with options that include access to the r 941 allocation aggregate feature. Our competitive pricing ensures that companies can invest in an effective eSigning solution without breaking the bank.

-

Are there any integrations available for the r 941 allocation aggregate feature?

Yes, airSlate SignNow provides integrations with various third-party applications that complement the r 941 allocation aggregate feature. This allows for seamless workflows, enabling you to connect with popular tools like CRMs and project management software, enhancing overall efficiency.

-

What are the main benefits of using airSlate SignNow for r 941 allocation aggregate management?

Using airSlate SignNow for r 941 allocation aggregate management brings numerous benefits, including improved accuracy in documentation, quicker turnaround times, and enhanced compliance. With its user-friendly interface, businesses can efficiently manage multiple allocations within the platform.

-

Is there a mobile app for managing r 941 allocation aggregates?

Yes, airSlate SignNow offers a mobile app that allows users to manage r 941 allocation aggregates on-the-go. This means you can send, sign, and manage documents from your smartphone or tablet, ensuring that critical tasks are completed without delay.

-

How secure is airSlate SignNow when handling r 941 allocation aggregate documents?

Security is a priority for airSlate SignNow; all r 941 allocation aggregate documents are protected with advanced encryption and multiple authentication methods. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Federal Employer Quarterly Tax Forms" Keyword Found

- Ct trust 497301219 form

- Letter to lienholder to notify of trust connecticut form

- Connecticut timber sale contract connecticut form

- Connecticut forest products timber sale contract connecticut form

- Connecticut easement form

- Conservation easement agreement form

- Easement utility agreement form

- Assumption agreement of mortgage and release of original mortgagors connecticut form

Find out other Federal Employer Quarterly Tax Forms" Keyword Found

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney