Www Irs Govpubirs Pdfand Losses Capital Gains Internal Revenue Service Form

Key elements of the IRS Schedule D instructions

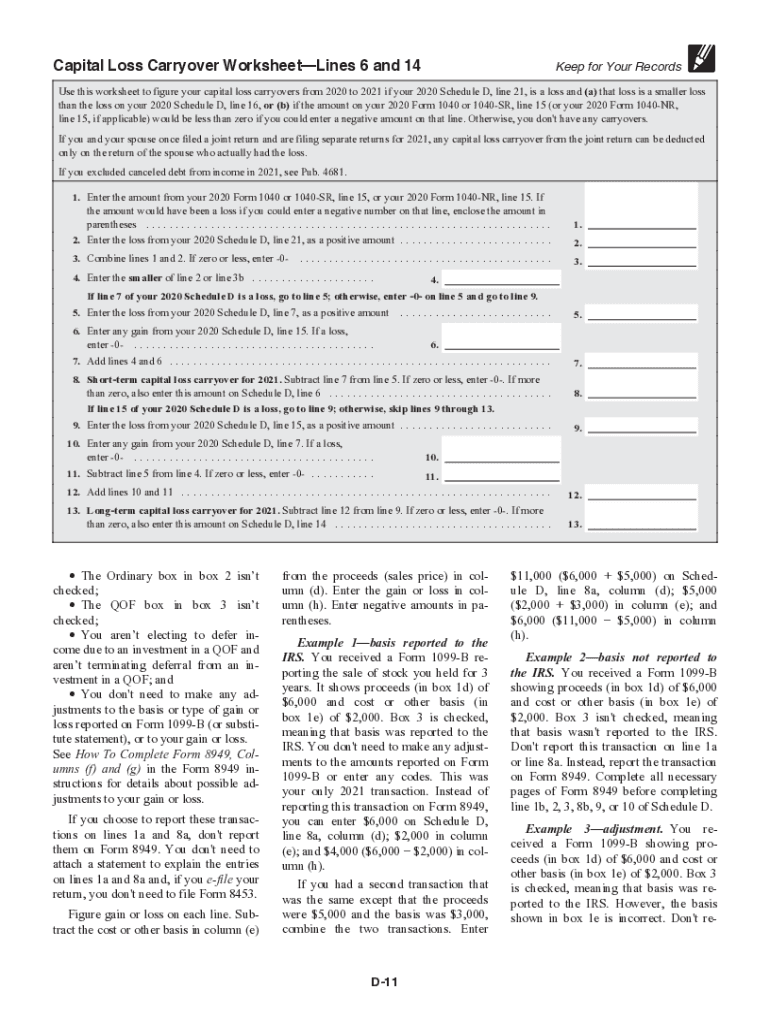

The IRS Schedule D instructions provide essential guidance on reporting capital gains and losses on your tax return. Understanding these key elements is crucial for accurate filing. The instructions outline:

- Eligibility Criteria: Guidelines on who must file Schedule D based on their capital transactions.

- Types of Transactions: Information on various transactions that need to be reported, including sales, exchanges, and certain gifts.

- Tax Rates: Details on how different types of gains are taxed, including long-term versus short-term capital gains.

- Record-Keeping: Recommendations for maintaining records of transactions to support your reported figures.

Steps to complete the IRS Schedule D instructions

Completing the IRS Schedule D involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather all relevant documents, including brokerage statements and records of asset purchases and sales.

- Determine the nature of each transaction (long-term or short-term) based on the holding period of the assets.

- Calculate your capital gains and losses for each transaction, ensuring to account for any adjustments such as wash sales.

- Fill out the Schedule D form, entering your totals in the appropriate sections.

- Transfer the final amounts to your Form 1040, ensuring all figures are consistent across documents.

Filing deadlines and important dates

Filing deadlines for the IRS Schedule D are crucial to avoid penalties. Typically, the deadline for submitting your federal tax return, including Schedule D, is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you file for an extension, you may have until October 15 to submit your return, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form submission methods

You can submit the IRS Schedule D through various methods, depending on your preference and needs:

- Online Filing: Many taxpayers choose to file electronically using tax software, which often includes built-in guidance for completing Schedule D.

- Mail: You can also print your completed Schedule D and mail it to the IRS along with your Form 1040.

- In-Person: Some taxpayers prefer to file in person at designated IRS offices, where assistance may be available.

IRS guidelines for capital gains and losses

The IRS provides specific guidelines for reporting capital gains and losses, which are essential for accurate tax reporting. Key points include:

- Holding Period: Understanding the difference between short-term and long-term capital gains based on the asset holding period is vital.

- Netting Gains and Losses: Taxpayers must net their short-term and long-term gains and losses separately before reporting them on Schedule D.

- Special Rules: Certain transactions, such as those involving collectibles or real estate, may have unique reporting requirements.

Penalties for non-compliance

Failure to comply with IRS Schedule D instructions can result in significant penalties. Common penalties include:

- Accuracy-Related Penalties: If the IRS determines that you underreported your income or overstated your losses, you may face a penalty of up to twenty percent of the underpayment.

- Failure to File Penalties: Not submitting your Schedule D by the deadline can lead to additional fines, which increase the longer you delay.

Quick guide on how to complete wwwirsgovpubirs pdfand losses capital gains internal revenue service

Easily Create Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly and without issues. Manage Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric procedure today.

How to Edit and eSign Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service Effortlessly

- Obtain Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service and click on Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Mark signNow sections of your documents or conceal confidential details with tools designed by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you would like to send your form, either via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdfand losses capital gains internal revenue service

The best way to create an e-signature for a PDF document in the online mode

The best way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

The way to generate an e-signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What are the IRS D instructions for eSigning tax documents?

IRS D instructions provide guidelines on how to eSign and submit tax documents electronically. By using airSlate SignNow, you can ensure that your eSigned documents comply with IRS regulations, making the process seamless and efficient.

-

How does airSlate SignNow simplify the IRS D instructions compliance?

airSlate SignNow simplifies compliance with IRS D instructions by offering an intuitive platform for eSigning documents. Our solution integrates with existing workflows, ensuring that your tax-related documents are securely signed and stored in accordance with IRS guidelines.

-

What features does airSlate SignNow offer for IRS D instructions?

airSlate SignNow includes features like document templates, secure signatures, and audit trails, all aligned with IRS D instructions. These tools help you manage your paperwork efficiently while ensuring compliance with the necessary regulations.

-

Is there a cost associated with using airSlate SignNow for IRS D instructions?

Yes, there is a cost to use airSlate SignNow, but it is a cost-effective solution compared to traditional methods of eSigning documents. Our pricing plans are designed to cater to businesses of all sizes, allowing you to efficiently handle IRS D instructions without breaking the bank.

-

Can I integrate airSlate SignNow with other software for IRS D instructions?

Absolutely! airSlate SignNow supports multiple integrations with popular software, allowing you to streamline your processes related to IRS D instructions. This seamless integration ensures that your eSigning efforts are not only efficient but also compatible with your existing tools.

-

What benefits does airSlate SignNow provide for IRS D instructions?

The primary benefit of airSlate SignNow is its ability to simplify the eSigning process for IRS D instructions. This leads to quicker turnaround times, reduced paper usage, and enhanced security for your sensitive tax documents, ultimately contributing to increased productivity.

-

How secure is airSlate SignNow when handling IRS D instructions?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and authentication methods to ensure that all documents signed in accordance with IRS D instructions are protected against unauthorized access and tampering.

Get more for Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service

- Legal last will and testament form for widow or widower with minor children connecticut

- Legal last will form for a widow or widower with no children connecticut

- Legal last will and testament form for a widow or widower with adult and minor children connecticut

- Legal last will and testament form for divorced and remarried person with mine yours and ours children connecticut

- Legal last will and testament form with all property to trust called a pour over will connecticut

- Written revocation of will connecticut form

- Last will and testament for other persons connecticut form

- Notice to beneficiaries of being named in will connecticut form

Find out other Www irs govpubirs pdfand Losses Capital Gains Internal Revenue Service

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer