Form 13614 C IntakeInterview & Quality Review Sheet OMB

What is the Form 13614 C Intake Interview & Quality Review Sheet OMB?

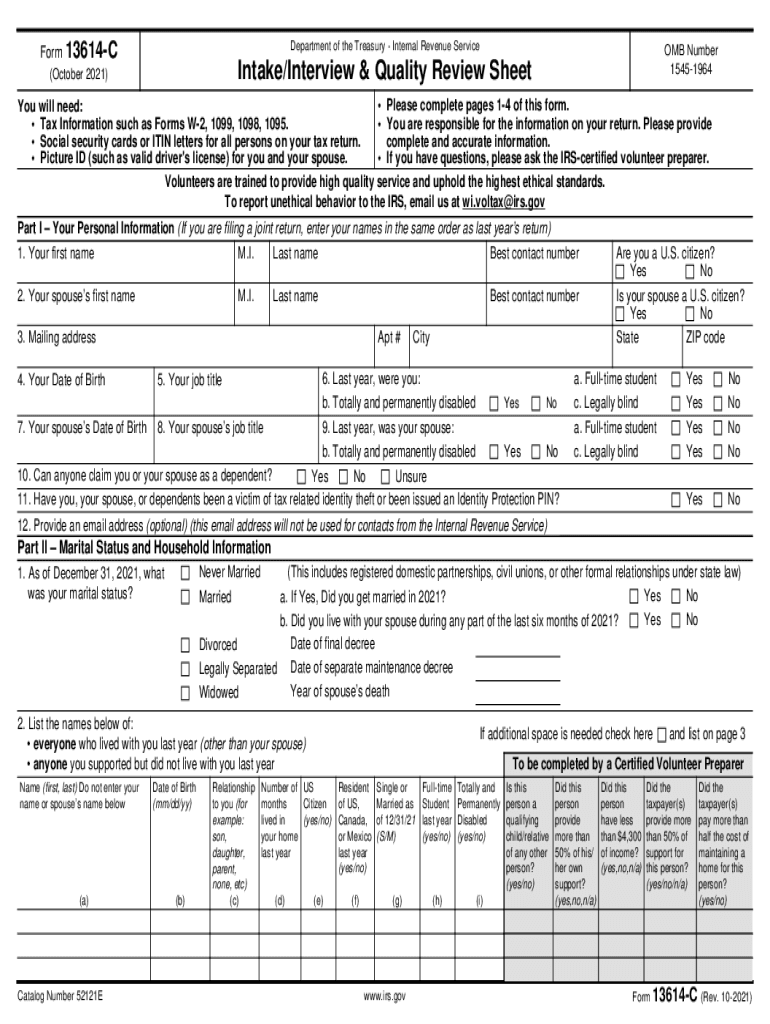

The Form 13614 C Intake Interview & Quality Review Sheet, often referred to as the 13614 C, is a crucial document used by the Internal Revenue Service (IRS) to collect essential information from taxpayers during the intake process. This form is designed to facilitate an effective interview and ensure that all relevant data is gathered for accurate tax preparation. It includes sections that cover personal information, income sources, deductions, and credits, which are vital for determining an individual's tax liability. The OMB number associated with this form signifies its approval for use in federal programs, ensuring compliance with government regulations.

Steps to Complete the Form 13614 C Intake Interview & Quality Review Sheet OMB

Completing the Form 13614 C requires careful attention to detail to ensure that all necessary information is accurately reported. Here are the steps to follow:

- Begin by filling out your personal information, including your name, address, and Social Security number.

- Provide details about your filing status, such as whether you are single, married, or head of household.

- List all sources of income, including wages, self-employment income, and any other earnings.

- Document any deductions or credits you may be eligible for, such as education credits or mortgage interest deductions.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the Form 13614 C Intake Interview & Quality Review Sheet OMB

The Form 13614 C can be obtained directly from the IRS website or through various tax preparation offices that utilize this form in their processes. It is available in a downloadable PDF format, allowing taxpayers to print and complete the form at their convenience. Additionally, many tax software programs may include this form as part of their offerings, providing an integrated approach to tax preparation.

Legal Use of the Form 13614 C Intake Interview & Quality Review Sheet OMB

The legal use of the Form 13614 C is paramount for ensuring compliance with IRS regulations. This form serves as a foundational document for tax preparation, helping to establish the taxpayer's eligibility for various credits and deductions. It is essential that the information provided on this form is accurate and truthful, as discrepancies can lead to penalties or audits. By utilizing this form, taxpayers can ensure that they are meeting their legal obligations while maximizing their potential tax benefits.

Key Elements of the Form 13614 C Intake Interview & Quality Review Sheet OMB

Several key elements are included in the Form 13614 C that are critical for effective tax preparation:

- Personal Information: Essential details such as name, address, and Social Security number.

- Filing Status: Information regarding whether the taxpayer is single, married, or filing jointly.

- Income Sources: A comprehensive list of all income types, including wages and self-employment earnings.

- Deductions and Credits: Sections dedicated to documenting eligible deductions and credits.

- Signature and Date: Acknowledgment by the taxpayer that the information provided is accurate.

IRS Guidelines for Completing the Form 13614 C Intake Interview & Quality Review Sheet OMB

The IRS provides specific guidelines for completing the Form 13614 C to ensure taxpayers accurately report their information. It is advised to read the accompanying instructions carefully, as they outline the requirements for each section of the form. Additionally, the IRS emphasizes the importance of providing complete and truthful information, as this can impact the processing of tax returns and eligibility for refunds or credits.

Quick guide on how to complete form 13614 c intakeinterview ampamp quality review sheet omb

Complete Form 13614 C IntakeInterview & Quality Review Sheet OMB effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without any hold-ups. Manage Form 13614 C IntakeInterview & Quality Review Sheet OMB on any platform using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The easiest way to modify and eSign Form 13614 C IntakeInterview & Quality Review Sheet OMB seamlessly

- Obtain Form 13614 C IntakeInterview & Quality Review Sheet OMB and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important portions of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors necessitating new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Form 13614 C IntakeInterview & Quality Review Sheet OMB and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 13614 c intakeinterview ampamp quality review sheet omb

The best way to create an e-signature for your PDF document in the online mode

The best way to create an e-signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The way to make an e-signature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The way to make an e-signature for a PDF file on Android devices

People also ask

-

What are the key features of airSlate SignNow for the intake 2021 latest?

airSlate SignNow offers a range of powerful features tailored for the intake 2021 latest, such as document signing, templates, and automated workflows. Users can easily manage and send documents for eSignature, saving time and increasing productivity. With advanced tracking and reminders, keeping your processes smooth and efficient has never been easier.

-

How does airSlate SignNow compare in pricing for intake 2021 latest?

When considering the intake 2021 latest, airSlate SignNow stands out as a cost-effective solution. Our pricing plans are designed to accommodate businesses of all sizes, offering straightforward monthly subscriptions without hidden fees. You can start with a free trial to explore our features before committing to a plan.

-

What benefits does airSlate SignNow provide for the intake 2021 latest?

The intake 2021 latest with airSlate SignNow allows businesses to streamline document workflows, ensuring faster turnaround times and improved accuracy. By reducing the reliance on paper documents, companies can not only save costs but also contribute to environmental sustainability. eSigning also enhances customer satisfaction by providing a convenient experience.

-

Can airSlate SignNow integrate with other tools for the intake 2021 latest?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms relevant to the intake 2021 latest. Whether you use CRM systems, cloud storage services, or productivity tools, our integrations help you centralize your document processes. This connectivity enhances overall efficiency and keeps your team aligned.

-

Is airSlate SignNow user-friendly for the intake 2021 latest?

Absolutely! airSlate SignNow is designed to be intuitive and requires minimal training, making it ideal for users looking to manage their intake 2021 latest effortlessly. With a clean interface and easy navigation, both tech-savvy individuals and those less familiar with technology can use it without difficulty. Plus, our support team is always available for additional assistance.

-

What kind of customer support does airSlate SignNow offer for intake 2021 latest?

For the intake 2021 latest, airSlate SignNow provides dedicated customer support including live chat, email assistance, and extensive online resources. Our team is committed to ensuring users are fully supported every step of the way, whether you have technical inquiries or need help with account management. We also offer a comprehensive knowledge base for self-service assistance.

-

How secure is airSlate SignNow for handling the intake 2021 latest?

Security is a top priority at airSlate SignNow, especially for the intake 2021 latest. We utilize industry-standard encryption protocols and comply with GDPR and HIPAA regulations to protect your sensitive data. With features such as two-factor authentication and secure cloud storage, you can trust that your documents are safe and confidential.

Get more for Form 13614 C IntakeInterview & Quality Review Sheet OMB

- General notice of default for contract for deed district of columbia form

- Sellers disclosure of forfeiture rights for contract for deed district of columbia form

- District of columbia form

- Contract for deed sellers annual accounting statement district of columbia form

- Notice of default for past due payments in connection with contract for deed district of columbia form

- Final notice of default for past due payments in connection with contract for deed district of columbia form

- Assignment of contract for deed by seller district of columbia form

- Notice of assignment of contract for deed district of columbia form

Find out other Form 13614 C IntakeInterview & Quality Review Sheet OMB

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now