Form IRS 3520 a Fill Online, Printable, Fillable

What is the Form IRS 3520 A Fill Online, Printable, Fillable

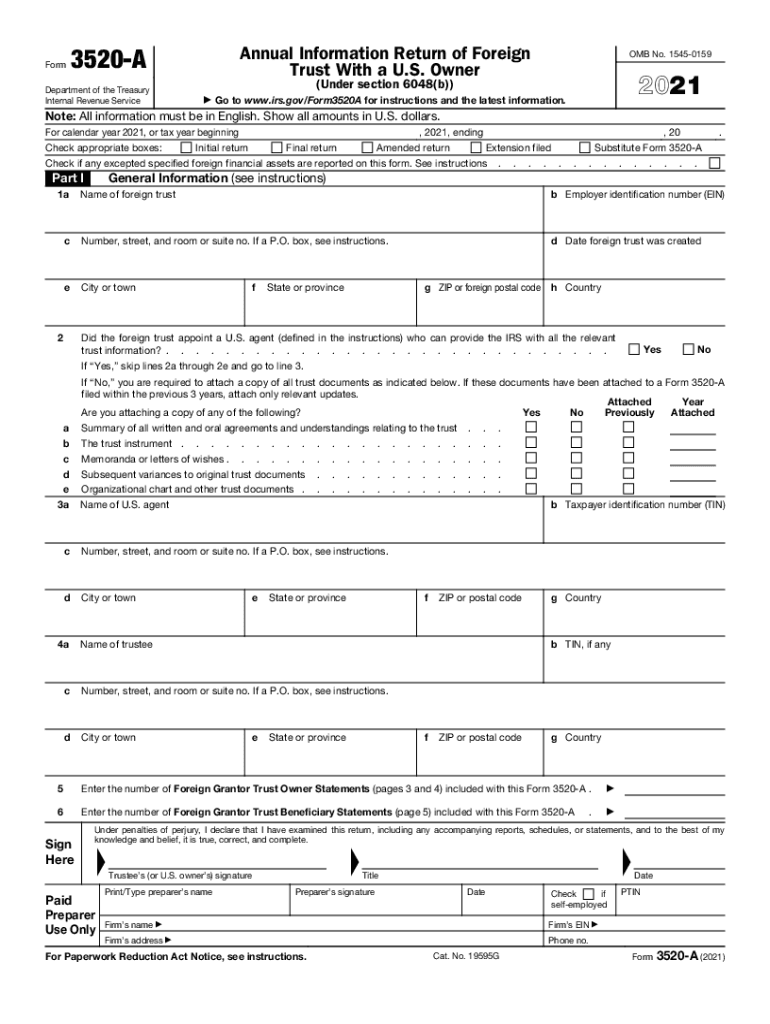

The IRS Form 3520-A is a crucial document for U.S. taxpayers who have foreign trusts. This form provides the IRS with information about the trust and its beneficiaries. It is essential for reporting the trust's activities and ensuring compliance with U.S. tax laws. The form can be filled out online or printed for manual completion. Utilizing a digital platform for this process can streamline the experience, making it easier to manage and submit the necessary information accurately.

How to use the Form IRS 3520 A Fill Online, Printable, Fillable

To effectively use the IRS Form 3520-A, begin by accessing a reliable digital platform that allows for online completion. Once you have the form open, carefully enter all required information, including details about the trust and its beneficiaries. Ensure that you review each section for accuracy before submission. Digital tools often provide features such as auto-save and error-checking, which can enhance the accuracy and efficiency of the filing process.

Steps to complete the Form IRS 3520 A Fill Online, Printable, Fillable

Completing the IRS Form 3520-A involves several key steps:

- Access the form through a trusted digital platform.

- Fill in the identification information for the trust and its beneficiaries.

- Provide detailed financial information regarding the trust's activities.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, depending on your preference.

Filing Deadlines / Important Dates

It is vital to adhere to the filing deadlines for the IRS Form 3520-A to avoid penalties. The form is typically due on the fifteenth day of the third month following the end of the trust's tax year. For trusts operating on a calendar year basis, this means the deadline is March 15. If you miss this deadline, you may incur penalties, so timely submission is essential.

Penalties for Non-Compliance

Failure to file the IRS Form 3520-A on time can result in significant penalties. The IRS imposes a penalty of five percent of the trust's gross value for each month the form is late, up to a maximum of twenty-five percent. Additionally, if the form is not filed at all, the IRS may impose further penalties based on the circumstances. Understanding these penalties emphasizes the importance of timely and accurate filing.

Legal use of the Form IRS 3520 A Fill Online, Printable, Fillable

The IRS Form 3520-A serves a legal purpose in the context of U.S. tax compliance. It is essential for reporting foreign trusts and ensuring that all income and distributions are properly accounted for. Utilizing a digital platform to complete and submit this form can enhance its legal standing, as many platforms provide secure eSignature options that comply with federal regulations, ensuring that the document is legally binding.

Quick guide on how to complete 2020 form irs 3520 a fill online printable fillable

Complete Form IRS 3520 A Fill Online, Printable, Fillable with ease on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form IRS 3520 A Fill Online, Printable, Fillable across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form IRS 3520 A Fill Online, Printable, Fillable effortlessly

- Obtain Form IRS 3520 A Fill Online, Printable, Fillable and then click Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only a few seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form IRS 3520 A Fill Online, Printable, Fillable and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form irs 3520 a fill online printable fillable

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The way to make an e-signature for a PDF document on Android OS

People also ask

-

What is the 3520 2021 IRS form, and why is it important?

The 3520 2021 IRS form is a tax document that U.S. taxpayers must file when they receive certain foreign gifts or inheritances. It is crucial for compliance to ensure that you avoid potential penalties from the IRS. Filing this form helps to report these transactions accurately and maintains transparency with the IRS.

-

How does airSlate SignNow help with the 3520 2021 IRS filing process?

airSlate SignNow simplifies the completion and submission of the 3520 2021 IRS form by enabling users to electronically sign and send documents securely. Our intuitive platform reduces the complexities involved in the filing process, ensuring that all necessary information is captured accurately before submission.

-

What are the pricing plans for using airSlate SignNow for documents related to the 3520 2021 IRS?

airSlate SignNow offers a variety of pricing plans to fit your business needs, allowing you to access features tailored to managing IRS forms like the 3520 2021. Whether you’re a small business or a large enterprise, we provide plans that are cost-effective and designed to maximize your document management efficiency.

-

Are there specific features in airSlate SignNow that cater to the needs of filing the 3520 2021 IRS?

Yes, airSlate SignNow includes features like automatic reminders, eSignature capabilities, and document templates that make it easier to manage your 3520 2021 IRS submissions. These tools help ensure your forms are completed correctly and on time, enhancing your filing experience.

-

Can I integrate airSlate SignNow with my existing software for processing the 3520 2021 IRS forms?

Absolutely! airSlate SignNow offers seamless integrations with various software tools commonly used in financial and tax processing, allowing for smooth data transfer and efficiency when handling the 3520 2021 IRS form. This capability enhances your workflow and helps keep your documents organized.

-

What benefits can businesses expect when using airSlate SignNow for their 3520 2021 IRS documentation?

Using airSlate SignNow for your 3520 2021 IRS documentation brings numerous benefits, including increased efficiency, reduced errors, and improved compliance. Our platform ensures that all parties involved can review and eSign documents quickly, saving time and streamlining the filing process.

-

Is airSlate SignNow secure for filing sensitive documents like the 3520 2021 IRS?

Yes, airSlate SignNow employs top-notch security measures to protect your sensitive information when filing documents like the 3520 2021 IRS. Our encryption protocols, secure servers, and compliance with industry standards ensure your data remains confidential at all times.

Get more for Form IRS 3520 A Fill Online, Printable, Fillable

- Amendment to prenuptial or premarital agreement district of columbia form

- Financial statements only in connection with prenuptial premarital agreement district of columbia form

- Revocation of premarital or prenuptial agreement district of columbia form

- Dc divorce packet form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497301484 form

- Dc business form

- Agreement shareholders 497301486 form

- District of columbia directors form

Find out other Form IRS 3520 A Fill Online, Printable, Fillable

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF