Colorado Department of Revenue Sales Tax Reporting 2021-2026

Understanding the Colorado Excise Tax

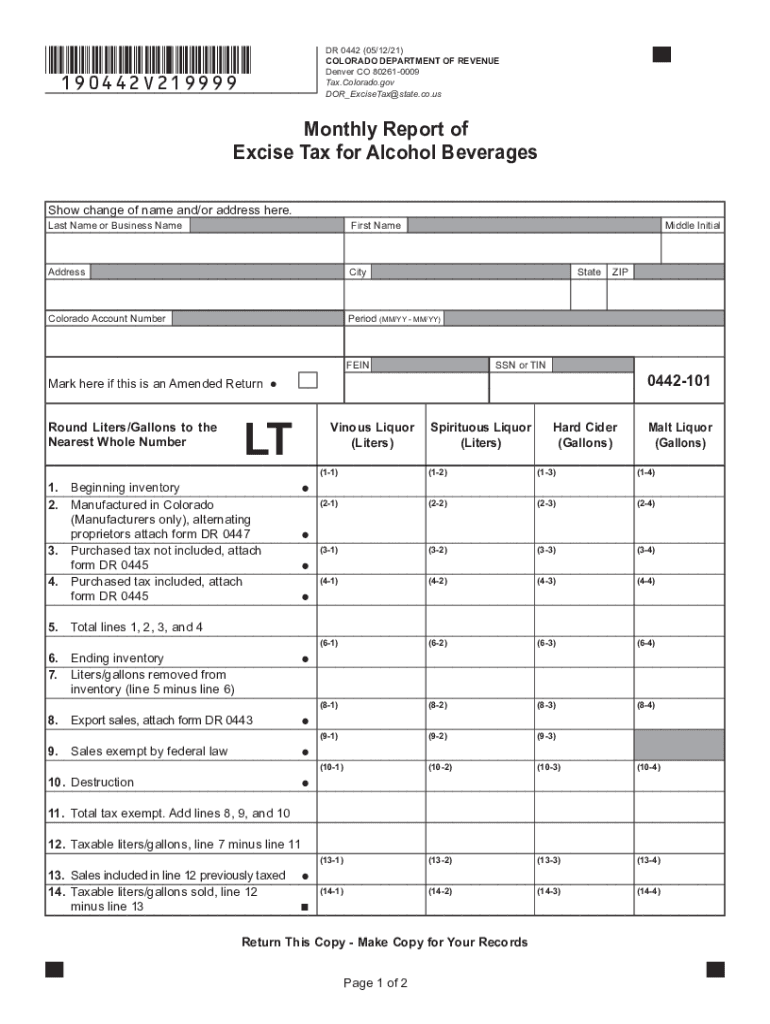

The Colorado excise tax is a specific tax levied on certain goods, particularly alcoholic beverages. This tax is imposed at the state level and is crucial for businesses involved in the sale or distribution of these products. The rate of the excise tax can vary based on the type of alcohol, such as beer, wine, or spirits. Understanding this tax is essential for compliance and effective financial planning for businesses operating in Colorado.

Steps to Complete the Colorado Excise Tax Form

Completing the Colorado excise tax form, often referred to as the DR 0442, involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including sales records and inventory details. Next, accurately calculate the amount of excise tax owed based on the applicable rates for the specific types of alcohol sold. Once calculations are complete, fill out the DR 0442 form, ensuring all sections are completed correctly. Finally, submit the form either online or via mail, adhering to the deadlines set by the Colorado Department of Revenue.

Required Documents for Filing

When filing the Colorado excise tax, certain documents are essential to support your submission. These include sales records that detail the quantity and type of alcoholic beverages sold, inventory records to track stock levels, and any previous tax returns related to excise tax. Keeping accurate and organized documentation is vital, as it will facilitate the completion of the DR 0442 form and ensure compliance with state regulations.

Filing Deadlines for Colorado Excise Tax

Timely filing of the Colorado excise tax is crucial to avoid penalties. The filing deadlines for the DR 0442 form typically occur on a monthly basis, with specific due dates set by the Colorado Department of Revenue. It is important for businesses to mark these dates on their calendars and ensure that all necessary documentation is prepared in advance. Missing a deadline can result in late fees and increased scrutiny from tax authorities.

Penalties for Non-Compliance

Failure to comply with Colorado excise tax regulations can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. Businesses should be aware of the consequences of non-compliance and take proactive measures to ensure they meet all filing requirements. Regular audits of financial records and timely submissions can help mitigate the risk of penalties.

Digital Submission of the Colorado Excise Tax Form

Submitting the Colorado excise tax form online offers several advantages, including convenience and faster processing times. The Colorado Department of Revenue provides an online platform for businesses to complete and submit the DR 0442 form electronically. This method not only streamlines the filing process but also allows for easier tracking of submissions and payments. Ensuring that you have access to a reliable internet connection and the necessary documents will facilitate a smooth digital filing experience.

Quick guide on how to complete colorado department of revenue sales tax reporting

Complete Colorado Department Of Revenue Sales Tax Reporting effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and electronically sign your documents swiftly without delays. Manage Colorado Department Of Revenue Sales Tax Reporting on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Colorado Department Of Revenue Sales Tax Reporting without difficulty

- Obtain Colorado Department Of Revenue Sales Tax Reporting and then click Get Form to begin.

- Use the tools provided to fill out your form.

- Mark important sections of the documents or obscure confidential information with functionalities specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Colorado Department Of Revenue Sales Tax Reporting and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct colorado department of revenue sales tax reporting

Create this form in 5 minutes!

How to create an eSignature for the colorado department of revenue sales tax reporting

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an e-signature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the cost of airSlate SignNow for managing colorado alcohol-related documents?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes dealing with colorado alcohol documentation. Our plans are designed to be cost-effective, ensuring you can manage your colorado alcohol forms efficiently without incurring hefty expenses. Choose the plan that best suits your needs and enjoy a range of features.

-

What features does airSlate SignNow offer for colorado alcohol compliance?

airSlate SignNow provides essential features to ensure compliance with state regulations related to colorado alcohol. Users can seamlessly create, manage, and eSign documents that meet legal requirements. With customizable templates and audit trails, you can ensure that all colorado alcohol forms are properly handled.

-

Is airSlate SignNow easy to integrate with other software for colorado alcohol management?

Yes, airSlate SignNow integrates easily with various business software solutions, facilitating efficient management of colorado alcohol documentation. With seamless API capabilities, you can connect SignNow to your existing systems, streamlining your workflow while ensuring compliance. This enhances productivity and saves time in managing your colorado alcohol-related processes.

-

Can I use airSlate SignNow on mobile devices for colorado alcohol transactions?

Absolutely! airSlate SignNow is fully compatible with mobile devices, allowing you to manage colorado alcohol documentation on-the-go. Whether you're out in the field or in the office, you can easily send, sign, and store important colorado alcohol documents from your smartphone or tablet. This flexibility enhances your operational efficiency.

-

What are the benefits of using airSlate SignNow for colorado alcohol licensing?

Using airSlate SignNow to manage colorado alcohol licensing streamlines the process signNowly. With electronic signatures and customized templates, you can submit applications and renewals faster than traditional methods. This not only saves time but also reduces the risk of errors associated with handling colorado alcohol paperwork.

-

How secure is airSlate SignNow for handling colorado alcohol documents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive colorado alcohol documents. Our platform employs advanced encryption protocols and complies with industry regulations to ensure your data is safe. You can confidently manage your colorado alcohol documentation knowing that it is protected against unauthorized access.

-

What kind of customer support does airSlate SignNow provide for colorado alcohol-related inquiries?

airSlate SignNow offers comprehensive customer support tailored to assist with your colorado alcohol-related inquiries. Our team is available through multiple channels, including chat and email, to provide prompt assistance and resolve any issues you may encounter. We are committed to ensuring you have a smooth experience while managing your colorado alcohol documentation.

Get more for Colorado Department Of Revenue Sales Tax Reporting

- Commercial building or space lease district of columbia form

- District of columbia legal form

- Temporary guardian legal form

- Dc bankruptcy online form

- Bill of sale with warranty by individual seller district of columbia form

- Bill of sale with warranty for corporate seller district of columbia form

- Bill of sale without warranty by individual seller district of columbia form

- Bill of sale without warranty by corporate seller district of columbia form

Find out other Colorado Department Of Revenue Sales Tax Reporting

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple