Dr 0442 2018

What is the DR 0442?

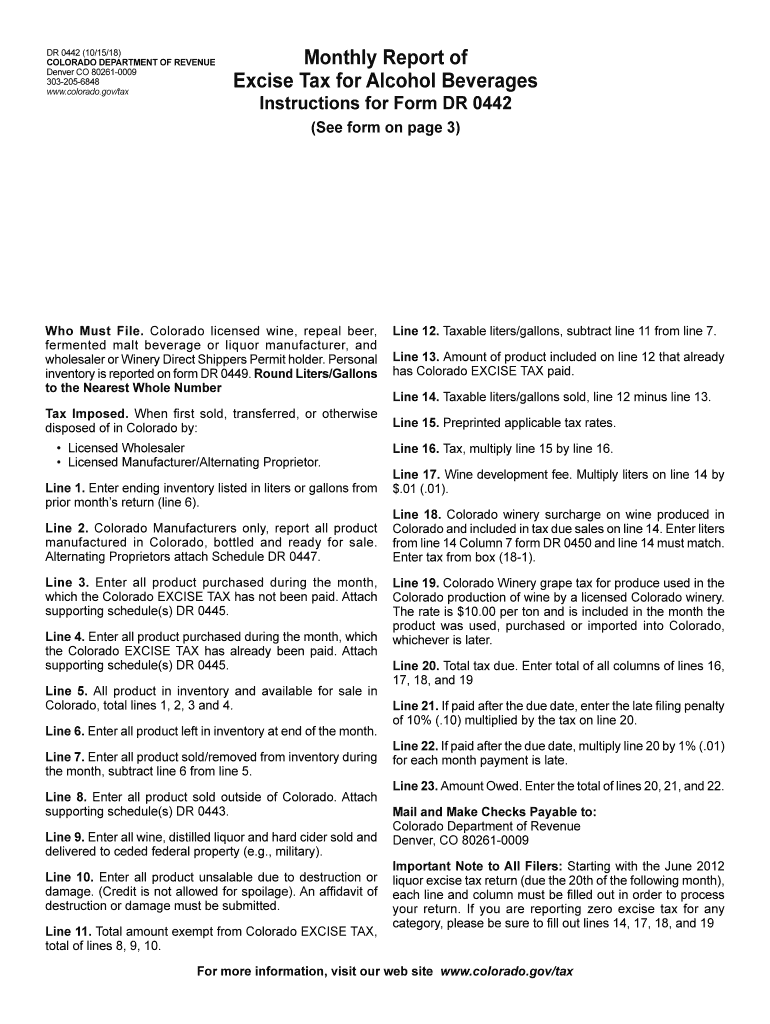

The DR 0442 is the Colorado Excise Tax Form, specifically designed for businesses to report and pay excise taxes related to specific activities, such as the sale of certain goods. This form is essential for compliance with Colorado state tax regulations and ensures that businesses fulfill their tax obligations accurately. It is particularly relevant for industries that are subject to excise taxes, including those dealing with alcohol, tobacco, and motor fuel.

Steps to Complete the DR 0442

Completing the DR 0442 requires careful attention to detail to ensure accuracy. Follow these steps to fill out the form correctly:

- Gather necessary information, including your business details and the specific excise tax rates applicable to your products.

- Access the DR 0442 form online or obtain a physical copy from the Colorado Department of Revenue.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Calculate the total excise tax owed based on your reported sales.

- Review the completed form for any errors or omissions before signing.

- Submit the form electronically or via mail, following the submission guidelines provided by the state.

Legal Use of the DR 0442

The DR 0442 is legally binding when completed and submitted according to Colorado state laws. It is crucial for businesses to ensure that they are using the most current version of the form and adhering to all filing requirements. Failure to comply with the legal stipulations surrounding the DR 0442 can result in penalties, including fines or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the DR 0442 are typically set by the Colorado Department of Revenue. Businesses must be aware of these dates to avoid late fees or penalties. Generally, excise tax forms are due on a quarterly basis, but it is essential to verify specific deadlines for your business type and tax obligations to ensure timely submission.

Form Submission Methods

The DR 0442 can be submitted through various methods to accommodate different business needs. Options include:

- Online submission through the Colorado Department of Revenue's e-filing system.

- Mailing a physical copy of the completed form to the appropriate address provided by the state.

- In-person submission at designated state offices, if necessary.

Key Elements of the DR 0442

Understanding the key elements of the DR 0442 is vital for accurate completion. Important components include:

- Business identification information, including name and address.

- Details of the excise tax calculation, including rates and amounts.

- Signature of the authorized representative certifying the accuracy of the information provided.

Examples of Using the DR 0442

Businesses in various sectors utilize the DR 0442 for reporting excise taxes. For instance, a brewery would use this form to report taxes on beer sales, while a tobacco retailer would report taxes on cigarette sales. Each industry has specific guidelines regarding what constitutes taxable sales, making it essential for businesses to understand their obligations under Colorado law.

Quick guide on how to complete dr 0442 101518

Aiding guide on how to prepare your Dr 0442

If you’re uncertain about how to finalize and submit your Dr 0442, here are some straightforward instructions to simplify your tax filing process.

Initially, all you need to do is create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and complete your income tax forms with ease. Utilizing its editor, you can alternate between text, check boxes, and eSignatures and revisit to amend responses as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Adhere to the steps below to complete your Dr 0442 in moments:

- Establish your account and begin working on PDFs in a few minutes.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Hit Get form to launch your Dr 0442 in our editor.

- Populate the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if required).

- Examine your document and correct any mistakes.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically file your taxes with airSlate SignNow. Be aware that submitting on paper can lead to increased return mistakes and delayed refunds. Naturally, before e-filing your taxes, consult the IRS website for submission rules relevant to your state.

Create this form in 5 minutes or less

Find and fill out the correct dr 0442 101518

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How can I fill out an improvement exam form for session 17-18 online?

first of all this time improvement form will be available in 3rd week of October.when the form is available then you have to open that link and fill your board roll no. and year of passing. after that you have to verify your details and then it will ask which subjects you want to apply for improvement. in this you can choose all subjects or a particular subject of your choice then you have to pay some amount for the improvement form. i think you have to generate a challan and pay it in a bank after that you have to send some documents to cbse regional office. the documents are your acknowledgement page, 12th marksheet xerox ,challan xerox then you have to download your admit card which will be available in month of February. you will get your marksheet at your address by post so please fill the correct address in form because according to that you will get the exam centre and regional office .

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

Is it possible to find the formula for this pattern: 10, 12, 15, 18, 22, 26, 31? How?

There will be many possible formulas that will produce that sequence. There will, for example, be a unique polynomial [math]ax^6+bx^5+cx^4+dx^3+ex^2+fx+g[/math] that will produce these seven values for [math]x=1, 2, 3, 4, 5, 6, 7[/math]. There will be infinitely many higher-order polynomials that will produce these seven values, and there will be other formulas of various types too.A useful resource for this kind of thing is The On-Line Encyclopedia of Integer Sequences® (OEIS®). A search for “10,12,15,18,22,26,31” will produce known sequences that include these values. I notice that the search results include A094983, and this suggests the following answer:[math]\lfloor \left( \frac{6}{5} \right) ^ {x+12} \rfloor[/math]where [math]\lfloor\cdots\rfloor[/math] means “round down to the nearest integer”.When [math]x=1[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 10.699\ldots[/math]When [math]x=2[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 12.839\ldots[/math]When [math]x=3[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 15.407\ldots[/math]When [math]x=4[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 18.488\ldots[/math]When [math]x=5[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 22.186\ldots[/math]When [math]x=6[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 26.623\ldots[/math]When [math]x=7[/math], [math]\left( \frac{6}{5} \right) ^ {x+12} = 31.947\ldots[/math]Addendum:As Timothy Frank points out, we can consider the differences between successive values, which increase on every *alternate* turn. This suggests the sequence [math]0, 1, 2, 4, 6, 9, 12, 16, 20, 25, \ldots[/math], which is the basic pattern. See A002620. This is approximated by quarter squares, and this fact can be manipulated to give the following formula:[math]6 + \lfloor \frac{1}{4}(x+3)^2 \rfloor[/math]The main point here is that there are many, many formulas we can come up with that produce these same seven numbers. They will each differ in what other numbers come out of them. This is why even a question such as “What comes next?” is problematic: it cannot be answered without making big assumptions about what rule the values we’ve been given are supposed to be following.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

Create this form in 5 minutes!

How to create an eSignature for the dr 0442 101518

How to make an electronic signature for your Dr 0442 101518 online

How to create an electronic signature for the Dr 0442 101518 in Chrome

How to make an eSignature for putting it on the Dr 0442 101518 in Gmail

How to make an eSignature for the Dr 0442 101518 right from your smart phone

How to create an electronic signature for the Dr 0442 101518 on iOS

How to create an eSignature for the Dr 0442 101518 on Android OS

People also ask

-

What is Dr 0442 and how does it relate to airSlate SignNow?

Dr 0442 is a designation for specific compliance and regulatory standards that airSlate SignNow adheres to. This ensures that all eSigning and document management processes are secure, efficient, and legally binding. By choosing airSlate SignNow, you can be confident that your digital transactions meet the requirements set forth by Dr 0442.

-

How much does airSlate SignNow cost in relation to Dr 0442 compliance?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes while maintaining compliance with Dr 0442 standards. Our pricing is transparent, and you can choose from various subscription options based on your needs. This ensures that your investment not only provides you with a robust eSigning solution but also keeps you compliant with Dr 0442.

-

What features does airSlate SignNow offer to support Dr 0442 compliance?

airSlate SignNow includes a variety of features designed to support Dr 0442 compliance, such as secure document storage, advanced authentication methods, and detailed audit trails. These functionalities help businesses ensure that their eSigning processes are not only efficient but also compliant with necessary regulations. By utilizing these features, you can confidently manage your documents while adhering to Dr 0442.

-

Can airSlate SignNow integrate with other software systems for Dr 0442 compliance?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow while maintaining Dr 0442 compliance. Whether you use CRM systems, project management tools, or cloud storage platforms, our integrations allow for smooth data transfer and document management. This flexibility ensures that you can efficiently manage your documents in compliance with Dr 0442.

-

What benefits does airSlate SignNow provide for businesses focused on Dr 0442 compliance?

By using airSlate SignNow, businesses can streamline their eSigning processes while ensuring compliance with Dr 0442. The platform's user-friendly interface makes it easy to send and sign documents, reducing turnaround times signNowly. Additionally, the security features help protect sensitive information, making it an ideal solution for organizations prioritizing compliance with Dr 0442.

-

Is airSlate SignNow suitable for small businesses concerned about Dr 0442 compliance?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it perfect for small businesses focused on Dr 0442 compliance. Our platform allows smaller teams to manage their document signing needs without sacrificing security or compliance. This means you can scale your operations confidently while adhering to Dr 0442.

-

How does airSlate SignNow ensure the security of documents related to Dr 0442?

airSlate SignNow employs state-of-the-art security measures, including encryption and multi-factor authentication, to protect documents and ensure compliance with Dr 0442. This robust security framework safeguards your sensitive data throughout the eSigning process. By choosing airSlate SignNow, you can trust that your compliance with Dr 0442 is supported by top-tier security features.

Get more for Dr 0442

- Form 14 studentamp39s health record

- Form nc 1099 itin nc department of revenue dor state nc

- Depression what you need to know as you age form

- Lesson 1 problem solving practice answer key form

- Firearms dealer registration virginia state police form

- Printable form rev 1220 as 05 17

- Kid allowance contract template form

- Kids contract template form

Find out other Dr 0442

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer