COLORADO DEPARTMENT of REVENUE Monthly Report of Excise Colorado 2015

What is the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

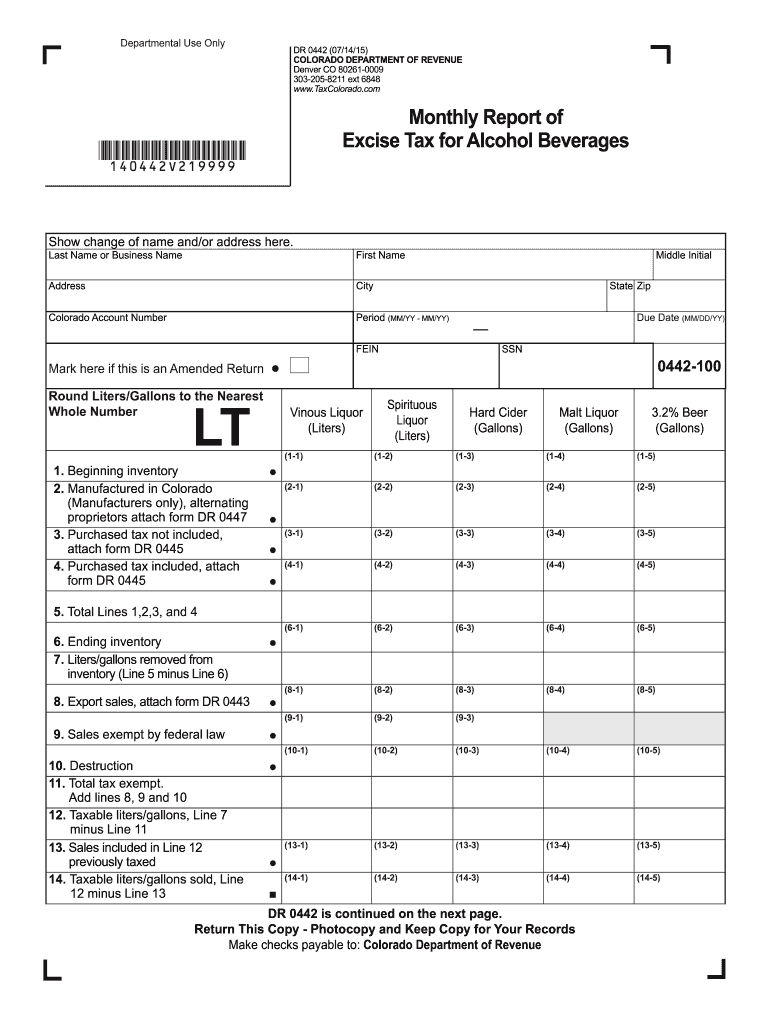

The COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado is an essential document for businesses engaged in the sale of excise-taxable products, such as alcohol, tobacco, and fuel. This report provides a comprehensive summary of the excise taxes collected during the month, ensuring compliance with state regulations. It serves as a crucial tool for both the state and businesses to track tax liabilities and maintain accurate financial records.

Steps to complete the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

Completing the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado involves several key steps:

- Gather all relevant sales data for the month, including quantities sold and applicable tax rates.

- Fill out the report form accurately, ensuring all required fields are completed.

- Calculate the total excise tax owed based on the sales data.

- Review the completed report for accuracy and completeness.

- Sign the report electronically using a secure eSignature solution, ensuring compliance with legal standards.

- Submit the report by the designated filing deadline through the appropriate submission method.

Legal use of the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

The legal use of the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado is vital for businesses to fulfill their tax obligations. This report must be completed in accordance with state laws and regulations. Accurate reporting helps avoid penalties and ensures that businesses remain in good standing with the state. Utilizing eSignatures for this report is legally recognized, providing a secure and efficient way to submit tax information.

Filing Deadlines / Important Dates

Filing deadlines for the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado are critical for compliance. Typically, the report is due on the last day of the month following the reporting period. For example, the report for January must be submitted by February 28. It is essential for businesses to stay informed about these deadlines to avoid late fees and potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado can be submitted through various methods:

- Online: Businesses can complete and submit the report electronically through the Colorado Department of Revenue's online portal.

- Mail: The completed report can be printed and mailed to the appropriate address provided by the Department of Revenue.

- In-Person: Businesses may also choose to submit the report in person at designated Department of Revenue offices.

Key elements of the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

Key elements of the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado include:

- Business Information: Name, address, and tax identification number of the business.

- Sales Data: Detailed information on excise-taxable products sold during the month.

- Tax Calculations: Total excise tax due based on sales data and applicable rates.

- Signature: An electronic or handwritten signature to validate the report.

Examples of using the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

Examples of using the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado include:

- A brewery reporting the excise tax on beer sales for the month.

- A tobacco retailer detailing sales and calculating taxes owed for the reporting period.

- A fuel distributor summarizing fuel sales and associated excise taxes.

Quick guide on how to complete colorado department of revenue monthly report of excise colorado

Your assistance manual on preparing your COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

If you’re curious about how to finalize and submit your COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado, here are some brief guidelines to simplify tax processing.

To start, you only need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and powerful document solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures, allowing for easy updates where necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado in just a few minutes:

- Establish your account and begin editing PDFs in no time.

- Utilize our catalog to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado in our editor.

- Complete the mandatory fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Be aware that filing on paper can increase return errors and slow down refunds. It goes without saying, before electronically filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct colorado department of revenue monthly report of excise colorado

FAQs

-

How was Sol Pais able to purchase a shotgun in Colorado if she had an out of state ID?

“How was Sol Pais able to purchase a shotgun in Colorado if she had an out of state ID?”Who? Sol Pais? Rapper? Hippie? That’s a Democratic name if I ever heard it.OH, the fruit loop who wanted to honor Columbine with another shooting. Well, ten to one, she’s one of the love struck nutjobs who wrote to the mother of one of the shooters, professing her love to him.Well, until her stunt, it was perfectly legal to purchase a rifle or shotgun out of state, IF you passed a background check. And, as you can see, she had no criminal record. Now, maybe if her letters had been reported to the police and the police had checked into each and every one of them, she might have been caught before the threat was made? Then, with a meeting, her mental illness might have been caught and she wouldn’t have been able to purchase anything. And, this would make a nice case for the DNC increasing surveillance on EVERYONE in the US, by increasing the NSA’s power. Opening every letter mailed, to read and censor it, reading every email, watching every download, all to make America more secure.You see, background checks only work if you have a criminal record. Or, in some cases, if you’re declared dangerous, which is much, much easier in our corrupted system. One lie, a moron for a pretend judge, and a person’s life is ruined. But, with the right connections, you can be insane and still purchase firearms.Now, handguns are a different story, thanks to the paranoia of concealed weapons, the DNCs first attack, before “assault rifles.” And, my guess is, the hype over “assault rifles” is why she picked a shotgun, since the DNC hasn’t targeted them, yet. She couldn’t get a handgun, being under 21 and out of state. But, a shotgun, something that even the most controlling of governments don’t worry too much about, is something else. Especially with the recoil issues, that make them “unfit for women to use.”Of course, given the hype over this anniversary of the shooting anyway, it could be expected. That’s all that has been on my news page, how sad and upsetting it was. This only helps give ideas to such mentally ill people. If they want 15 minutes of fame, how about 20 years of fame?

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How much of the increased tax revenue from legalized marijuana (say in Colorado) goes to general public programs vs just increased law enforcement and regulatory costs?

There isn't increased law enforcement costs. Why would there be?Further, There was zero revenue beforehand, when pot was iloegal. So any net revenue is a boon. Even $1. And it's much more than that. Colorado cracks a billion in annual marijuana sales in record time, generating $200M in tax revenue.Managing the regulations probably costs around $20 million.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

-

Is it illegal in Colorado or unsafe to drive without a passenger seat? I have a 4 month old and it’s a beast trying to get the car seat in and out of the backseat.

I don't care if it is illegal or not as a parent I would make sure I had a proper fitting seat for my baby/toddler and if you even have to think about it then you really need to look at yourself in the mirror…

-

If a party who got a civil judgment against me in Colorado sent out interrogatories to my old address and I was no longer living in Colorado, how should I handle this so I don't get a charge of contempt?

Get a bankruptcy lawyer on retainer right now.I have something similar going on but I check the court record search and case search weekly for my own name. They are required to publish it and if they did not I can fight it. At this point, the judgement is not even on my credit report and I want it to stay that way via bankruptcy.I have a mail forward on my old address. Any document of court appearance requires mail service in addition to process. The mail forward expired so I filed another.They also have my spouses work information and can file an order there as he works for a public company. They have served his workplace in the past so if they fail to do it on a summons thats obvious judicial entrapment of both my spouse and I. If they try to sewer serve we claim entrapment defense and win.That would be the point at which you can get free lawyers to sue them back, even from jail, especially if the judgement was fraudulent as in my case generated because they falsified information and I can prove my innocence as they used fabricated information that grants me full rights to counter sue as the judgement was created by perjury. I get to prosecute them for all the above if they deprive me due process so hopefully they avoid that as they lied to file the lawsuit as I am meticulously checking the docket for any filed case and the court also has my phone number on file. I would also charge for false arrest if that happened as I have not recieved any word and the lawyer with the judgement is quite predatory, breaking many laws himself as well as not having any of our filings published as mandated and he hasn’t yet exhausted his option to file for a wage garnishment at the employer and we can prove he already served our employers once for a summons. If he asks the court for a date and doesnt serve us by mail or file to garnish hes entrapping us both.One of the residents of my former address tried to kill me and I filed charges and subpeonaed him twice so for my own safety they can have only the work address to perform proper service. They cannot serve me at my former address because they own that residence.Also I filed an appeal which the civil courts unlawfully threw out.I recieved all the mail from the former case at current address. If theres a court date and I am not notified, it is by design and an act of entrapment.As of right now no attempt to collect has been made and I was assured the first step is wage garnishment, and we are also in the process of the pre documentation process of filing bankruptcy protection. There’s no way I would miss or fail to appear to any court summons and I have not recieved any court summons and my name is not on the online docket as yet, and I still live in the same jurisdiction as well. This is basically the advice I got from at least one lawyer I already hired for a case lodged by the same party that he resolved.Please file for bankruptcy if it keeps you out of jail. That is why its called bankruptcy protection as it protects you from a judgement default and contempt.

Create this form in 5 minutes!

How to create an eSignature for the colorado department of revenue monthly report of excise colorado

How to create an eSignature for your Colorado Department Of Revenue Monthly Report Of Excise Colorado in the online mode

How to make an eSignature for your Colorado Department Of Revenue Monthly Report Of Excise Colorado in Google Chrome

How to generate an eSignature for putting it on the Colorado Department Of Revenue Monthly Report Of Excise Colorado in Gmail

How to make an electronic signature for the Colorado Department Of Revenue Monthly Report Of Excise Colorado from your smartphone

How to make an electronic signature for the Colorado Department Of Revenue Monthly Report Of Excise Colorado on iOS devices

How to make an electronic signature for the Colorado Department Of Revenue Monthly Report Of Excise Colorado on Android

People also ask

-

What is the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

The COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado is a necessary form that businesses must submit to report their excise tax obligations. This report includes critical information about sales and various taxes collected, ensuring compliance with state regulations.

-

How can airSlate SignNow streamline the process of submitting the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

airSlate SignNow simplifies the submission of the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado by allowing users to eSign and send documents digitally. This process saves time and reduces the risk of errors, ensuring that your reports are submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage their documents, including the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado. Pricing plans are tailored to fit various business needs, ensuring you get the best value for your eSigning requirements.

-

What features does airSlate SignNow offer for managing the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

airSlate SignNow provides robust features such as customizable templates, secure electronic signatures, and real-time tracking for managing the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado. These features help streamline document workflows and enhance efficiency.

-

Can I integrate airSlate SignNow with other apps to handle the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

Absolutely. airSlate SignNow supports integrations with various applications, which allows you to seamlessly manage the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado alongside your existing tools. This integration helps optimize workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

Using airSlate SignNow for the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado enables businesses to reduce paperwork, enhance compliance, and save time. The digital solution is not only eco-friendly but also signNowly decreases the likelihood of submission errors.

-

Is airSlate SignNow user-friendly for submitting the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for businesses of all sizes to prepare and submit the COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado. The intuitive interface ensures that users can navigate the platform without extensive training.

Get more for COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

- Mbombela proof of residence form

- Contra costa pcor form

- Irs form 8824

- Marriott room discount form

- In home supportive services ihss program provider enrollment form dss cahwnet

- Florida general power of attorney formdoc

- Mcgraw hill ryerson chemistry 11 solutions pdf form

- Dichiarazione di conformita doc nauticaferrari

Find out other COLORADO DEPARTMENT OF REVENUE Monthly Report Of Excise Colorado

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement