I 070 Wisconsin Schedule WD, Capital Gains and Losses Fillable 2020

What is the Wisconsin Schedule WD, Capital Gains and Losses?

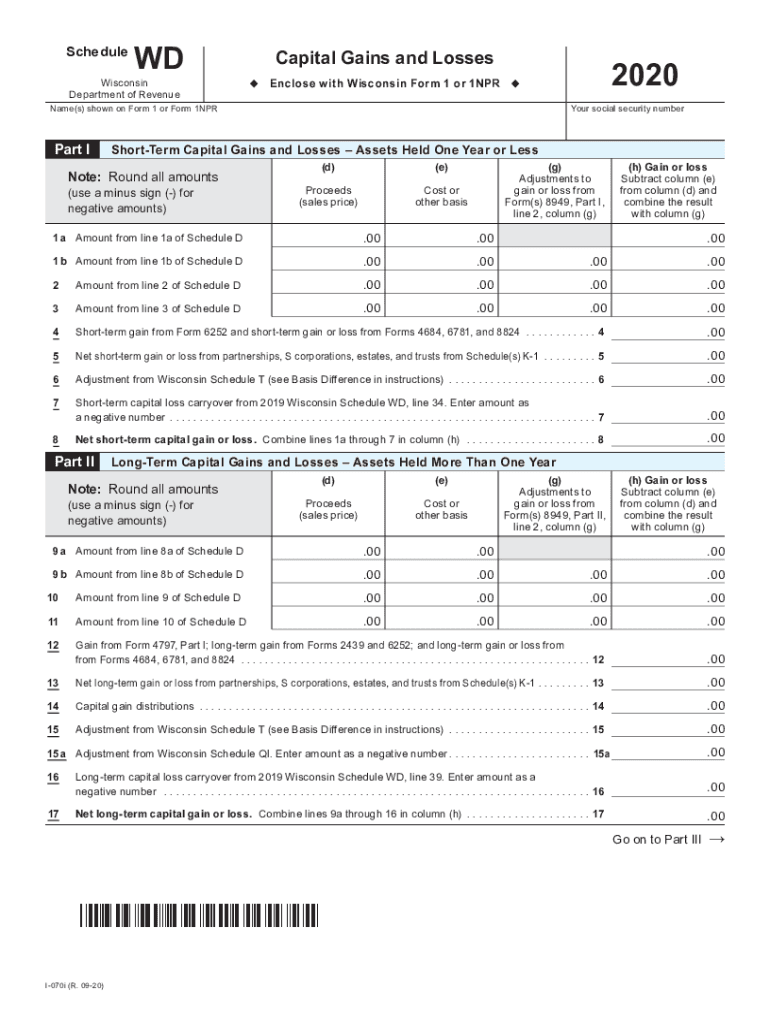

The Wisconsin Schedule WD is a tax form used to report capital gains and losses for Wisconsin residents. This form is essential for individuals who have sold assets such as stocks, real estate, or other investments during the tax year. It helps taxpayers determine the amount of capital gains that are subject to Wisconsin state income tax. The form requires detailed information about each transaction, including the date of sale, the amount received, and the original purchase price.

Steps to Complete the Wisconsin Schedule WD

Completing the Wisconsin Schedule WD involves several key steps to ensure accuracy and compliance with state tax regulations:

- Gather Documentation: Collect all necessary documents related to your capital transactions, including purchase and sale records.

- Report Sales: For each asset sold, provide details such as the date of sale, sale price, and purchase price.

- Calculate Gains or Losses: Determine the capital gain or loss for each transaction by subtracting the purchase price from the sale price.

- Complete the Form: Fill out the Schedule WD form with the calculated gains or losses, ensuring all entries are accurate.

- Review and Submit: Double-check the completed form for errors before submitting it with your Wisconsin tax return.

Key Elements of the Wisconsin Schedule WD

Understanding the key elements of the Wisconsin Schedule WD is crucial for accurate reporting:

- Transaction Details: Each entry must include the type of asset, date acquired, date sold, and the amounts involved.

- Capital Gains Tax Rates: Familiarize yourself with the applicable tax rates for capital gains in Wisconsin, which may differ based on the duration of asset ownership.

- Loss Carryover: If you have capital losses, you may be able to carry them over to future tax years, which can offset future gains.

Legal Use of the Wisconsin Schedule WD

The Wisconsin Schedule WD must be completed accurately to comply with state tax laws. Failure to report capital gains or losses can result in penalties and interest on unpaid taxes. It is important to use the most current version of the form and adhere to all filing requirements set forth by the Wisconsin Department of Revenue to ensure legal compliance.

Filing Deadlines for the Wisconsin Schedule WD

Taxpayers must adhere to specific filing deadlines for the Wisconsin Schedule WD. Generally, the deadline aligns with the federal tax return due date, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to confirm the exact date each tax year and plan accordingly to avoid late fees.

Digital vs. Paper Version of the Wisconsin Schedule WD

Taxpayers have the option to complete the Wisconsin Schedule WD either digitally or on paper. The digital version offers advantages such as ease of use and automatic calculations, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format chosen, ensure that the completed form is submitted according to state guidelines.

Quick guide on how to complete 2020 i 070 wisconsin schedule wd capital gains and losses fillable

Accomplish I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to locate the needed form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without holdups. Manage I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable on any platform with the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest method to alter and eSign I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable without stress

- Locate I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent parts of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your PC.

Put an end to lost or mislaid files, tedious document searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 i 070 wisconsin schedule wd capital gains and losses fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 i 070 wisconsin schedule wd capital gains and losses fillable

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an e-signature for signing PDFs in Gmail

How to make an e-signature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an e-signature for a PDF document on Android devices

People also ask

-

What is the purpose of the Wisconsin Schedule WD?

The Wisconsin Schedule WD is designed to report and calculate nonrefundable tax credits for individuals and businesses in Wisconsin. Understanding how to effectively use the Wisconsin Schedule WD can signNowly enhance your tax filing process. By utilizing airSlate SignNow, you can easily eSign and submit your documents related to this schedule.

-

How can airSlate SignNow assist with completing the Wisconsin Schedule WD?

airSlate SignNow provides a user-friendly platform for filling out and electronically signing the Wisconsin Schedule WD. With features designed for ease of use, you can streamline the tax filing process and ensure accuracy when completing this essential document. This makes managing your tax obligations easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for Wisconsin Schedule WD?

airSlate SignNow offers a range of pricing plans to fit different business needs, including options for those looking to manage the Wisconsin Schedule WD. You can choose a plan that suits your budget while accessing powerful features for document management and eSigning. The cost is often outweighed by the efficiency and time savings gained.

-

What features does airSlate SignNow offer for Wisconsin Schedule WD submissions?

airSlate SignNow offers a variety of features to simplify the submission of the Wisconsin Schedule WD, including eSigning, templates for common tax documents, and secure storage. These features help users organize their tax preparation better and ensure compliance with relevant regulations. This makes the process not only easier but also more secure.

-

Can I integrate airSlate SignNow with my accounting software for the Wisconsin Schedule WD?

Yes, airSlate SignNow offers integration capabilities with popular accounting software, making it easier to manage your Wisconsin Schedule WD alongside your financial reporting. This integration helps automate data flow, reducing the chances of errors and saving time during tax preparation. It's an effective way to keep your financial documentation in sync.

-

What are the benefits of using airSlate SignNow for the Wisconsin Schedule WD?

Using airSlate SignNow to manage your Wisconsin Schedule WD provides signNow benefits, including improved efficiency, enhanced collaboration, and reduced paper clutter. The platform allows for real-time edits and eSigning, which expedites the process of document handling. Ultimately, this streamlines your workflow, making tax time less stressful.

-

Is it safe to eSign the Wisconsin Schedule WD with airSlate SignNow?

Absolutely! airSlate SignNow employs high-level security measures to ensure that your eSignatures and sensitive documents remain protected while completing your Wisconsin Schedule WD. Compliance with industry standards for data security adds an extra layer of trust, allowing you to focus on your business needs without worrying about document safety.

Get more for I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract delaware form

- Notice of intent to enforce forfeiture provisions of contact for deed delaware form

- Final notice of forfeiture and request to vacate property under contract for deed delaware form

- Buyers request for accounting from seller under contract for deed delaware form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed delaware form

- General notice of default for contract for deed delaware form

- Sellers disclosure of forfeiture rights for contract for deed delaware form

- Seller disclosure residential 497301943 form

Find out other I 070 Wisconsin Schedule WD, Capital Gains And Losses fillable

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template