I 070 Schedule WD Capital Gains and Losses Wisconsin Schedule WD Capital Gains and Losses 2022-2026

Understanding the Wisconsin Schedule WD for Capital Gains and Losses

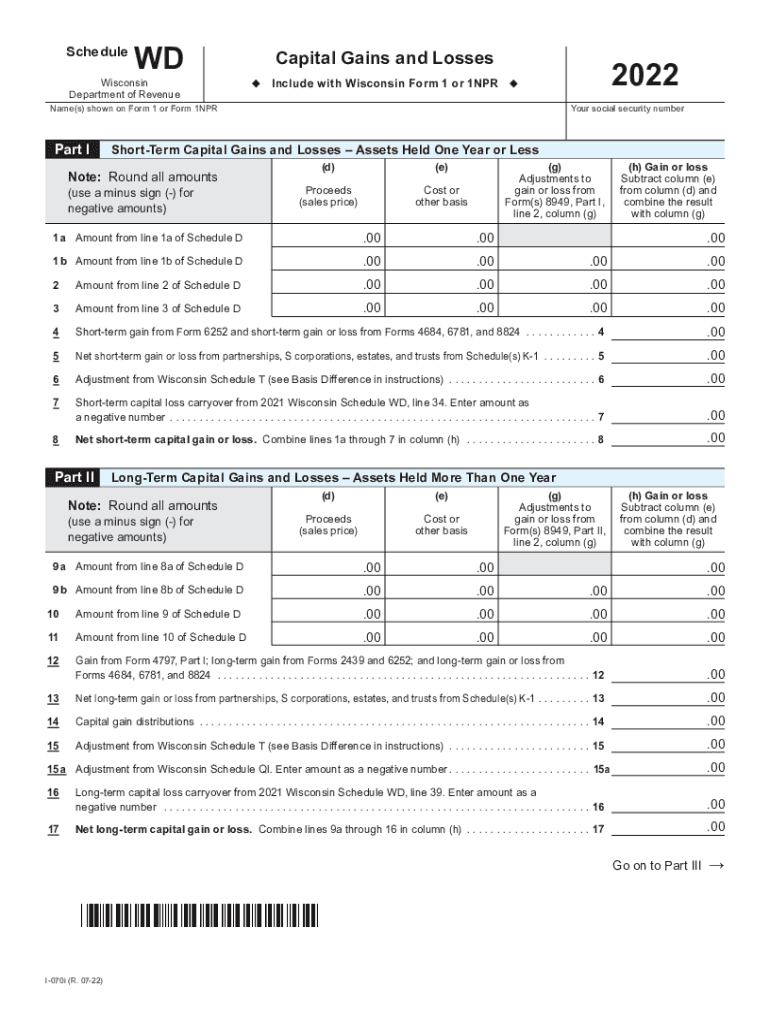

The Wisconsin Schedule WD is a crucial form for taxpayers who need to report capital gains and losses on their state income tax returns. This form allows individuals to detail their financial transactions involving capital assets, such as stocks, bonds, and real estate. The information provided on this form is essential for calculating the correct amount of tax owed or refund due based on capital gains or losses incurred during the tax year.

Steps to Complete the Wisconsin Schedule WD

Completing the Wisconsin Schedule WD involves several key steps to ensure accuracy and compliance with state tax laws. Start by gathering all relevant documentation regarding your capital assets, including purchase and sale records. Next, list each transaction on the form, providing details such as the date of acquisition, date of sale, and the amounts involved. After calculating your total capital gains and losses, transfer these figures to your main state tax return. It is important to double-check all entries for correctness before submission.

Legal Use of the Wisconsin Schedule WD

The Wisconsin Schedule WD is legally recognized for reporting capital gains and losses under state tax regulations. To ensure that your use of the form is compliant, it is essential to follow all instructions provided by the Wisconsin Department of Revenue. This includes adhering to guidelines for reporting specific types of gains and losses, as well as maintaining accurate records of all transactions. Failure to comply with these regulations may result in penalties or additional scrutiny from tax authorities.

Filing Deadlines for the Wisconsin Schedule WD

Timely filing of the Wisconsin Schedule WD is critical to avoid penalties and interest on unpaid taxes. Typically, the deadline for submitting your state income tax return, including the Schedule WD, aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the Wisconsin Department of Revenue’s website for any updates or changes to filing deadlines each tax year.

Required Documents for the Wisconsin Schedule WD

To accurately complete the Wisconsin Schedule WD, you will need several key documents. These include records of all capital transactions, such as purchase and sale receipts, brokerage statements, and any relevant tax documents from previous years. Additionally, it may be beneficial to have your federal tax return on hand, as some information may need to be cross-referenced. Ensuring that you have all necessary documentation will facilitate a smoother filing process.

Examples of Using the Wisconsin Schedule WD

Utilizing the Wisconsin Schedule WD can vary based on individual circumstances. For instance, if a taxpayer sold stocks at a profit, they would report the capital gains on the Schedule WD. Conversely, if they sold a property at a loss, this would also be reported, potentially offsetting other gains. Each scenario will require accurate reporting to reflect the taxpayer's financial situation correctly. Examples of common situations include selling inherited property, liquidating investments, or reporting losses from business-related assets.

Obtaining the Wisconsin Schedule WD

The Wisconsin Schedule WD can be obtained through the Wisconsin Department of Revenue's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many tax preparation software programs include the Schedule WD as part of their offerings, allowing for easier electronic completion and submission. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Quick guide on how to complete 2022 i 070 schedule wd capital gains and losses wisconsin schedule wd capital gains and losses

Accomplish I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses without hassle

- Locate I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to apply your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 i 070 schedule wd capital gains and losses wisconsin schedule wd capital gains and losses

Create this form in 5 minutes!

People also ask

-

What is a wd form and how can it benefit my business?

A wd form is a digital document format that allows you to create, send, and sign legal documents electronically. Using a wd form simplifies the workflow for document management, increases efficiency, and reduces paperwork. By adopting wd forms, businesses can save time and resources while ensuring compliance and security in their document transactions.

-

How much does airSlate SignNow cost for wd form usage?

The pricing for using airSlate SignNow primarily depends on the plan you choose. Plans start at a competitive rate that includes unlimited access to wd form features, allowing your team to manage documents effectively. Additionally, we offer flexible pricing options to suit businesses of all sizes, ensuring you get the best value for your wd form needs.

-

What features does airSlate SignNow provide for creating wd forms?

airSlate SignNow provides robust features for creating wd forms, including customizable templates, drag-and-drop functionality, and advanced editing tools. You can easily add fields for signatures, dates, and text, streamlining the document creation process. These features help ensure that your wd forms are tailored to meet your specific business requirements.

-

Can I integrate airSlate SignNow with other applications for wd forms?

Yes, airSlate SignNow supports integration with various applications to enhance your workflow with wd forms. You can seamlessly connect with popular tools like Google Drive, Salesforce, and Dropbox, making it easier to manage and share your documents. These integrations ensure that your teams can collaborate effectively while using wd forms.

-

Is it secure to send and sign wd forms through airSlate SignNow?

Absolutely, sending and signing wd forms through airSlate SignNow is secure. We utilize industry-leading encryption protocols to protect your documents and personal information. Our platform complies with international security standards, ensuring that your wd forms are safe during the entire signing process.

-

How can I track the status of my wd forms in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your wd forms in real-time. The dashboard provides updates on when your documents are viewed, signed, or completed, enabling you to manage your workflow more efficiently. This tracking feature ensures that you are always informed about the progress of your wd forms.

-

What devices can I use to access and manage wd forms?

You can access and manage wd forms on any device with an internet connection. airSlate SignNow is compatible with desktops, laptops, tablets, and smartphones, allowing you to work seamlessly from anywhere. This flexibility ensures that you can create, send, and sign wd forms without being tied to your office.

Get more for I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

- Nd warranty form

- Quitclaim deed from corporation to llc north dakota form

- Quitclaim deed from corporation to corporation north dakota form

- Warranty deed from corporation to corporation north dakota form

- Quitclaim deed from corporation to two individuals north dakota form

- Warranty deed from corporation to two individuals north dakota form

- Warranty deed from individual to a trust north dakota form

- Warranty deed from husband and wife to a trust north dakota form

Find out other I 070 Schedule WD Capital Gains And Losses Wisconsin Schedule WD Capital Gains And Losses

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement