TY MW506FR PDF EMPLOYER WITHHOLDING FINAL RETURN FORM 2021

What is the MW506FR Employer Withholding Final Return Form?

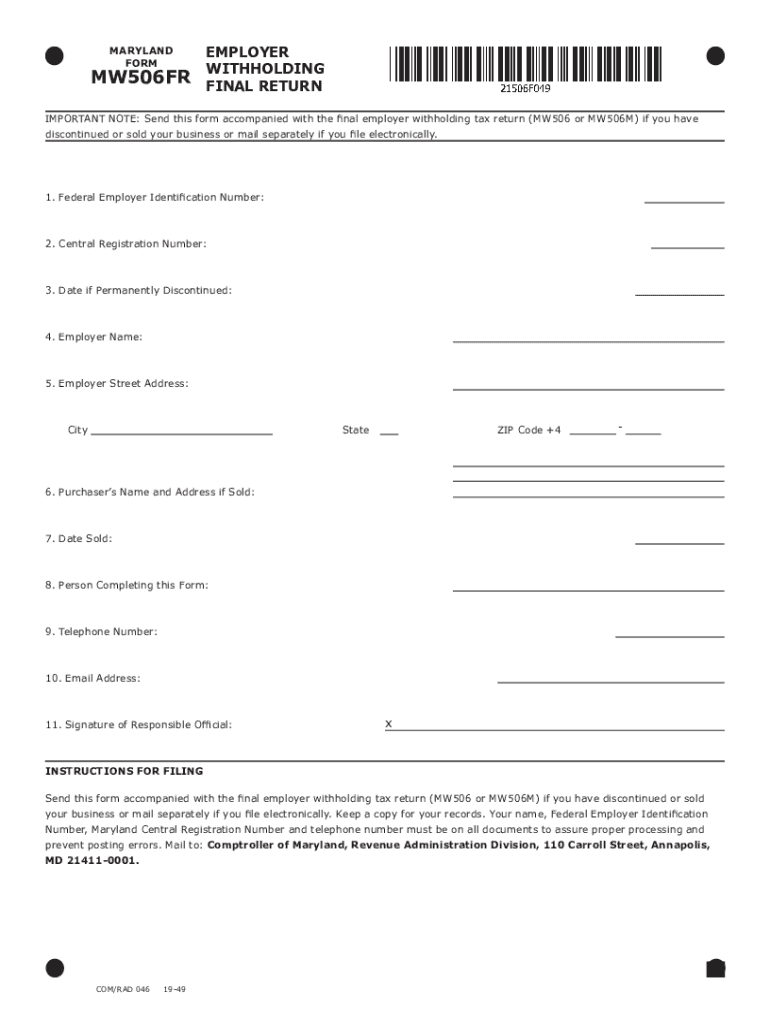

The MW506FR is a crucial document used by employers in Maryland to report and remit the final withholding tax for employees. This form is specifically designed for businesses that have ceased operations or are no longer required to withhold Maryland income tax from employee wages. By submitting the MW506FR, employers ensure compliance with state tax laws and fulfill their obligations to the Maryland Comptroller's office.

How to Use the MW506FR Employer Withholding Final Return Form

To effectively use the MW506FR, employers must first gather all necessary information regarding their employees and withholding amounts. This includes total wages paid, the amount of tax withheld, and any adjustments that may be necessary. The form requires detailed reporting to accurately reflect the employer's final tax obligations. Once completed, the MW506FR can be submitted electronically or via mail, depending on the employer's preference and compliance requirements.

Steps to Complete the MW506FR Employer Withholding Final Return Form

Completing the MW506FR involves several important steps:

- Gather all relevant payroll data, including total wages and withheld taxes.

- Fill in the employer information section accurately, including the business name and tax identification number.

- Report the total wages paid and the total amount of Maryland income tax withheld.

- Ensure all calculations are correct and double-check for any necessary adjustments.

- Sign and date the form to validate the submission.

After completing these steps, employers can submit the form electronically through the Maryland Comptroller's online portal or mail it to the appropriate address.

Legal Use of the MW506FR Employer Withholding Final Return Form

The MW506FR is legally binding when completed and submitted in compliance with Maryland state tax laws. It serves as an official record of the employer's final withholding obligations. Employers must ensure that all information provided is accurate to avoid penalties or legal repercussions. The form must be submitted by the designated deadline to maintain compliance with state regulations.

Filing Deadlines for the MW506FR Employer Withholding Final Return Form

Employers must adhere to specific filing deadlines for the MW506FR to avoid penalties. Generally, the form is due on or before the last day of the month following the end of the tax year. For businesses that cease operations during the year, the form should be submitted within a specified timeframe after the final payroll period. It is essential for employers to stay informed about these deadlines to ensure timely compliance.

Penalties for Non-Compliance with the MW506FR

Failure to file the MW506FR on time or inaccuracies in the form can result in penalties imposed by the Maryland Comptroller's office. These penalties may include fines based on the amount of tax owed or additional charges for late submissions. Employers should prioritize accurate reporting and timely filing to avoid these financial repercussions and maintain good standing with state tax authorities.

Quick guide on how to complete ty 2019 mw506frpdf employer withholding final return form

Complete TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It provides an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM on any device with airSlate SignNow’s Android or iOS applications and enhance any document-centered workflow today.

The easiest way to adjust and eSign TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM seamlessly

- Obtain TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, whether by email, text message (SMS), an invitation link, or by downloading it to your PC.

Forget about lost or misplaced documents, tedious search for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2019 mw506frpdf employer withholding final return form

Create this form in 5 minutes!

How to create an eSignature for the ty 2019 mw506frpdf employer withholding final return form

The way to generate an e-signature for a PDF file in the online mode

The way to generate an e-signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an e-signature from your smartphone

The way to create an e-signature for a PDF file on iOS devices

The best way to generate an e-signature for a PDF file on Android

People also ask

-

What is mw506fr and how does it work with airSlate SignNow?

The mw506fr is an advanced document management code used within the airSlate SignNow platform. It simplifies the process of eSigning and sending documents, ensuring a streamlined experience for users. With mw506fr, you can create, track, and manage documents efficiently.

-

What pricing options are available for the mw506fr feature in airSlate SignNow?

airSlate SignNow offers various pricing plans that include access to the mw506fr feature. Each plan is designed to fit different business needs, from basic functionality to more advanced features. You can choose a plan that best suits your budget and requirements.

-

What are the key features of the mw506fr solution?

The mw506fr solution includes features such as customizable templates, advanced workflow automation, and secure eSigning tools. These features make it easy for businesses to manage their documentation processes effectively. The mw506fr enhances usability, ensuring a user-friendly experience.

-

How does the mw506fr benefit my business?

Utilizing the mw506fr with airSlate SignNow can greatly improve your business's efficiency by reducing paperwork and speeding up the signing process. It allows you to send documents instantly and receive electronic signatures, which can enhance productivity. The streamlined processes can also lead to cost savings.

-

Are there any integrations available with the mw506fr solution?

Yes, the mw506fr feature in airSlate SignNow supports various integrations with popular software applications. These integrations allow users to connect their existing tools and enhance their document management workflow. This flexibility ensures that you can work seamlessly within your preferred environment.

-

Is airSlate SignNow secure when using mw506fr?

Absolutely! The mw506fr solution offered by airSlate SignNow prioritizes security with advanced encryption and authentication protocols. Your documents are protected during the signing process, ensuring confidentiality and compliance with various regulations. Trust in airSlate SignNow to keep your data safe.

-

Can I customize the mw506fr templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize the mw506fr templates to better fit your business needs. You can modify different elements to create documents that align with your branding and requirements. Customization enhances your document management experience and saves you time.

Get more for TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM

Find out other TY MW506FR pdf EMPLOYER WITHHOLDING FINAL RETURN FORM

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter