Withholding Tax Forms West Virginia Tax Division 2023-2026

Understanding the Maryland Form Withholding Return

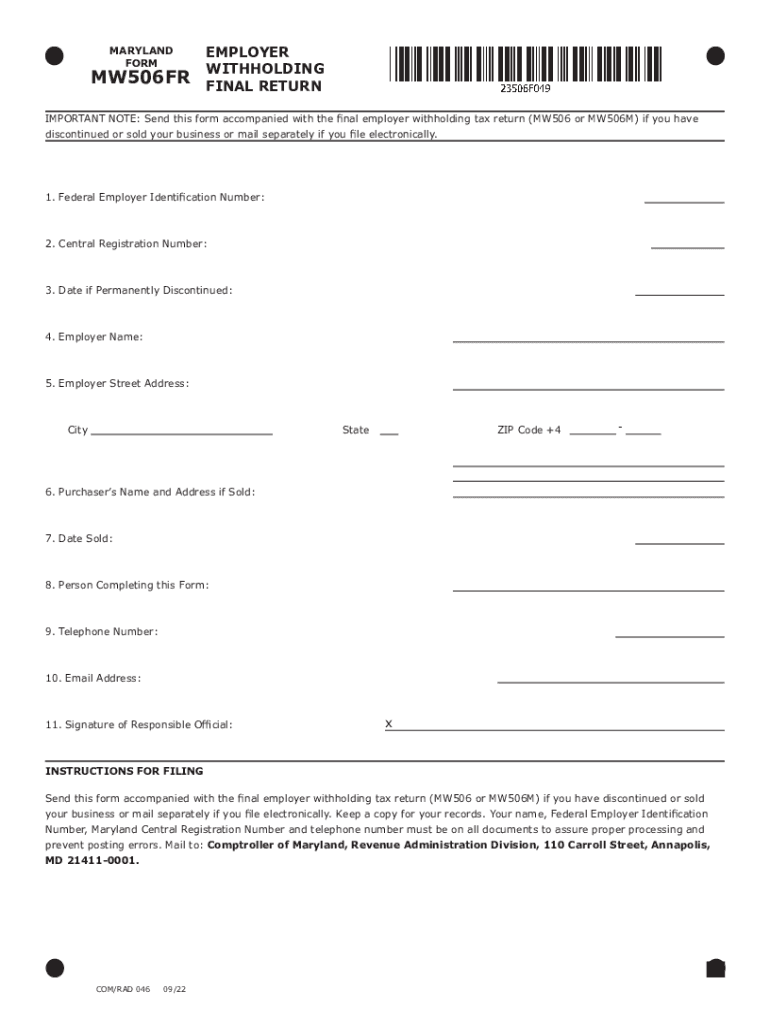

The Maryland Form Withholding Return, also known as the MW506FR form, is essential for employers in Maryland to report income tax withheld from employee wages. This form is crucial for ensuring compliance with state tax laws, as it provides the Maryland Comptroller with necessary information regarding the amount of tax withheld throughout the year. Employers must accurately complete this form to avoid penalties and ensure their employees receive proper credit for the taxes withheld.

Steps to Complete the Maryland Form Withholding Return

Completing the Maryland MW506FR form involves several key steps:

- Gather necessary information, including the total wages paid, the amount of tax withheld, and employee identification details.

- Accurately fill out all required fields on the form, ensuring that all calculations are correct.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines for the Maryland Withholding Return

Employers must be aware of the filing deadlines for the Maryland Form Withholding Return. Typically, the MW506FR form is due quarterly, with specific deadlines for each quarter. It is important to submit the form on time to avoid late fees and interest charges. The deadlines are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Required Documents for Submission

When submitting the Maryland Form Withholding Return, employers should have the following documents ready:

- Payroll records that detail wages paid and taxes withheld.

- Employee W-2 forms for the reporting year.

- Any additional documentation required by the Maryland Comptroller for verification purposes.

Penalties for Non-Compliance

Failure to file the Maryland MW506FR form on time or inaccuracies in reporting can lead to penalties. Employers may face fines based on the amount of tax due and the length of time the form is late. Understanding these penalties is crucial for maintaining compliance and avoiding unnecessary financial burdens.

Digital vs. Paper Version of the MW506FR Form

Employers have the option to complete the Maryland Form Withholding Return digitally or on paper. The digital version offers advantages such as easier calculations, reduced errors, and faster submission. Additionally, using digital tools can streamline the process, making it more efficient for businesses. However, some employers may prefer the traditional paper format for record-keeping purposes.

Quick guide on how to complete withholding tax forms west virginia tax division

Effortlessly Prepare Withholding Tax Forms West Virginia Tax Division on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Withholding Tax Forms West Virginia Tax Division on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Withholding Tax Forms West Virginia Tax Division with Ease

- Locate Withholding Tax Forms West Virginia Tax Division and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Withholding Tax Forms West Virginia Tax Division to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding tax forms west virginia tax division

Create this form in 5 minutes!

How to create an eSignature for the withholding tax forms west virginia tax division

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Maryland form withholding return?

The Maryland form withholding return is a document that employers must submit to report state income taxes withheld from employees' wages. This form helps ensure that the appropriate taxes are remitted to the Maryland government. Understanding how to correctly file this form is crucial for compliance.

-

How can airSlate SignNow assist with filing the Maryland form withholding return?

AirSlate SignNow makes the process easier by allowing you to electronically sign and send documents required for filing your Maryland form withholding return. Our platform streamlines the workflow, ensuring that your documents are securely signed and submitted on time. This reduces the risk of errors and missed deadlines.

-

Is airSlate SignNow cost-effective for managing Maryland form withholding returns?

Yes, airSlate SignNow offers competitive pricing plans that suit businesses of all sizes, making it cost-effective for handling your Maryland form withholding return needs. With our subscription model, you can manage all your document signing and filing processes without incurring high costs. This flexibility allows businesses to save money while remaining compliant.

-

What features does airSlate SignNow provide for document management?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and automated reminders, making it ideal for managing documents like the Maryland form withholding return. These tools enhance efficiency and ensure that you never miss a deadline. The intuitive interface allows for a seamless user experience.

-

Can I integrate airSlate SignNow with other accounting software for Maryland form withholding returns?

Absolutely! AirSlate SignNow supports integrations with various accounting and payroll software that can handle your Maryland form withholding return processes. This allows you to synchronize data across platforms, ensuring accurate reporting and efficiency. By integrating, you can simplify your workflow further.

-

What are the benefits of eSigning the Maryland form withholding return with airSlate SignNow?

eSigning the Maryland form withholding return with airSlate SignNow provides you with several benefits, including enhanced security and faster processing times. Electronic signatures are legally binding and secure, helping to protect your sensitive information. Additionally, the convenience of eSigning ensures your forms are submitted quickly and efficiently.

-

Do I need any technical skills to use airSlate SignNow for my Maryland form withholding return?

No technical skills are required to use airSlate SignNow for your Maryland form withholding return. Our user-friendly platform is designed to be intuitive, allowing anyone to navigate easily. With just a few clicks, you can create, sign, and send documents without any hassle.

Get more for Withholding Tax Forms West Virginia Tax Division

- Sellers disclosure of forfeiture rights for contract for deed south dakota form

- Seller disclosure property 497326067 form

- South dakota contract deed download form

- Notice of default for past due payments in connection with contract for deed south dakota form

- Final notice of default for past due payments in connection with contract for deed south dakota form

- Assignment of contract for deed by seller south dakota form

- Notice of assignment of contract for deed south dakota form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement south dakota form

Find out other Withholding Tax Forms West Virginia Tax Division

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy