MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN 2022

What is the Maryland Employer Form Withholding MW506FR Final Return

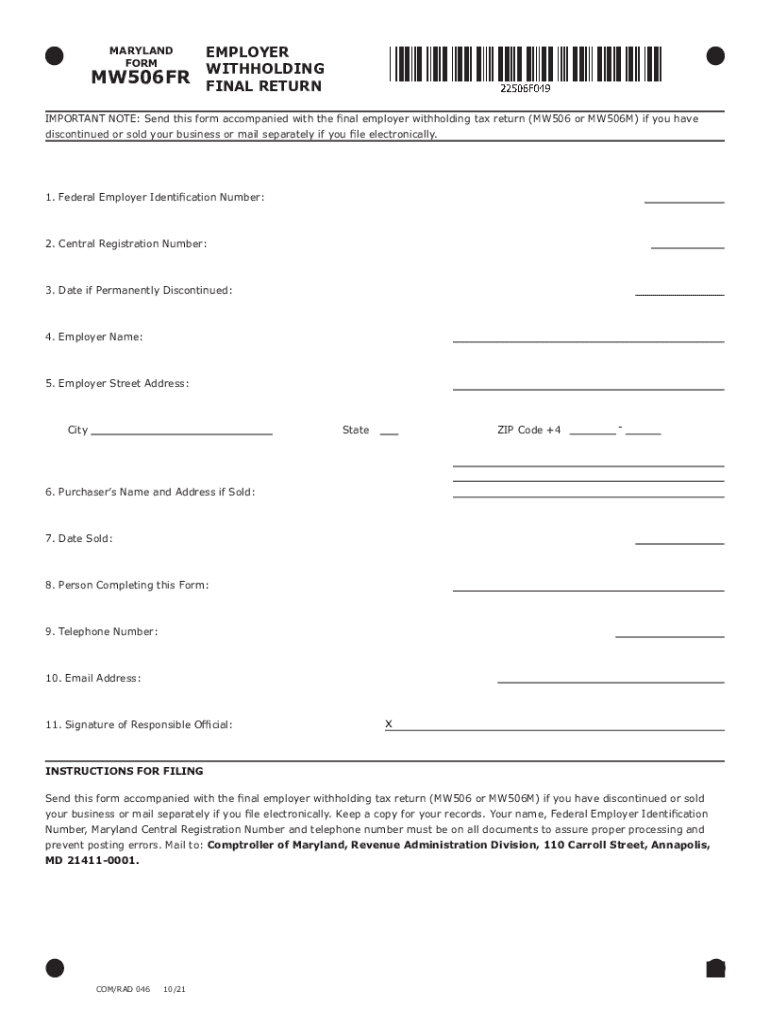

The Maryland Employer Form Withholding MW506FR Final Return is a tax document used by employers in Maryland to report and remit state income tax withheld from employees' wages. This form is essential for businesses that have employees and need to ensure compliance with state tax regulations. It serves as a final report for the tax year, summarizing the total amount of income tax withheld and submitted to the state on behalf of employees. Proper completion and submission of this form help employers fulfill their legal obligations and avoid potential penalties.

Steps to Complete the Maryland Employer Form Withholding MW506FR Final Return

Completing the Maryland Employer Form Withholding MW506FR Final Return involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary payroll records for the tax year, including total wages paid and the amount of state income tax withheld. Next, accurately fill out each section of the form, ensuring that all figures are correct and reflect the total amounts for the year. After completing the form, review it for any errors or omissions. Finally, submit the form to the Maryland Comptroller's office by the designated deadline, ensuring that all required payments are made to avoid penalties.

Legal Use of the Maryland Employer Form Withholding MW506FR Final Return

The Maryland Employer Form Withholding MW506FR Final Return is legally binding when completed and submitted according to state regulations. Employers must ensure that the information provided on the form is truthful and accurate, as false reporting can lead to legal consequences, including fines and penalties. The form must be signed by an authorized representative of the business, affirming the validity of the information reported. Utilizing electronic signature solutions can enhance the legal standing of the form while ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines associated with the Maryland Employer Form Withholding MW506FR Final Return to avoid penalties. The final return is typically due on or before January 31 of the following year after the tax year ends. It is important to check for any updates or changes to deadlines, as these can vary based on state regulations or specific circumstances. Timely submission is crucial to maintaining compliance and avoiding late fees.

Form Submission Methods

The Maryland Employer Form Withholding MW506FR Final Return can be submitted through various methods, including online, by mail, or in person. For online submissions, employers can utilize the Maryland Comptroller's e-file system, which allows for secure and efficient filing. If submitting by mail, ensure that the form is sent to the correct address provided by the Maryland Comptroller's office. In-person submissions can be made at designated state offices, which may offer additional assistance if needed. Each method has its own processing times, so employers should choose the one that best fits their needs.

Penalties for Non-Compliance

Failure to file the Maryland Employer Form Withholding MW506FR Final Return on time can result in significant penalties for employers. These penalties may include late fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for employers to stay informed about their filing responsibilities and ensure that all forms are submitted accurately and on time to avoid these consequences. Regular audits and compliance checks can help mitigate risks associated with non-compliance.

Quick guide on how to complete maryland employer form withholding mw506fr final return

Complete MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly substitute to conventional printed and signed documents, as you can easily access the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files promptly without any hold-ups. Manage MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN without hassle

- Obtain MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Alter and eSign MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maryland employer form withholding mw506fr final return

Create this form in 5 minutes!

People also ask

-

What is the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

The MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN is a tax form used by employers in Maryland to report their final withholding tax for the year. It ensures that all employee withholding has been accurately reported and paid. This form is essential for compliance with Maryland tax laws.

-

How can airSlate SignNow help me with the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

airSlate SignNow simplifies the process of completing and submitting the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN by providing an easy-to-use eSignature platform. With airSlate SignNow, you can fill out the form digitally, collect signatures, and submit it securely, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

Yes, airSlate SignNow offers various pricing plans depending on the features you need. Our plans are cost-effective and designed to provide value, especially for businesses regularly submitting forms like the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN. You can choose a plan that fits your business requirements.

-

What are the main features of airSlate SignNow for managing the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

Key features of airSlate SignNow include a user-friendly interface, customizable templates, secure cloud storage, and real-time tracking of document status. These features streamline the completion and submission process for the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN, allowing for efficient management and compliance.

-

Can I integrate airSlate SignNow with other software for handling the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

Absolutely! airSlate SignNow supports various integrations with popular software and tools, enhancing your workflow for the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN. This means you can effortlessly connect with your existing applications to streamline processes and improve productivity.

-

What benefits does airSlate SignNow offer for businesses that need to file the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

Using airSlate SignNow provides signNow benefits, including reducing paper waste, increasing efficiency, and ensuring secure document handling. Additionally, it helps businesses stay compliant by providing guidance and templates specifically for the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN.

-

How do I get started with airSlate SignNow for the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN?

Getting started with airSlate SignNow is simple. Just sign up for an account, choose the plan that suits your needs, and access our library of templates, including the MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN. From there, you can easily create, sign, and submit your forms.

Get more for MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN

- Montana emancipation form

- Notice of appeal montana 497316516 form

- Petition for hearing industrial injury montana form

- Montana subpoena 497316518 form

- Montana subpoena 497316519 form

- Name change instructions and forms package for an adult montana

- Montana name change instructions and forms package for a minor montana

- Name change instructions and forms package for a family montana

Find out other MARYLAND EMPLOYER FORM WITHHOLDING MW506FR FINAL RETURN

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free