Form or 65 V, Oregon Partnership Return of Income Payment Voucher, 150 101 066 2020

What is the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher

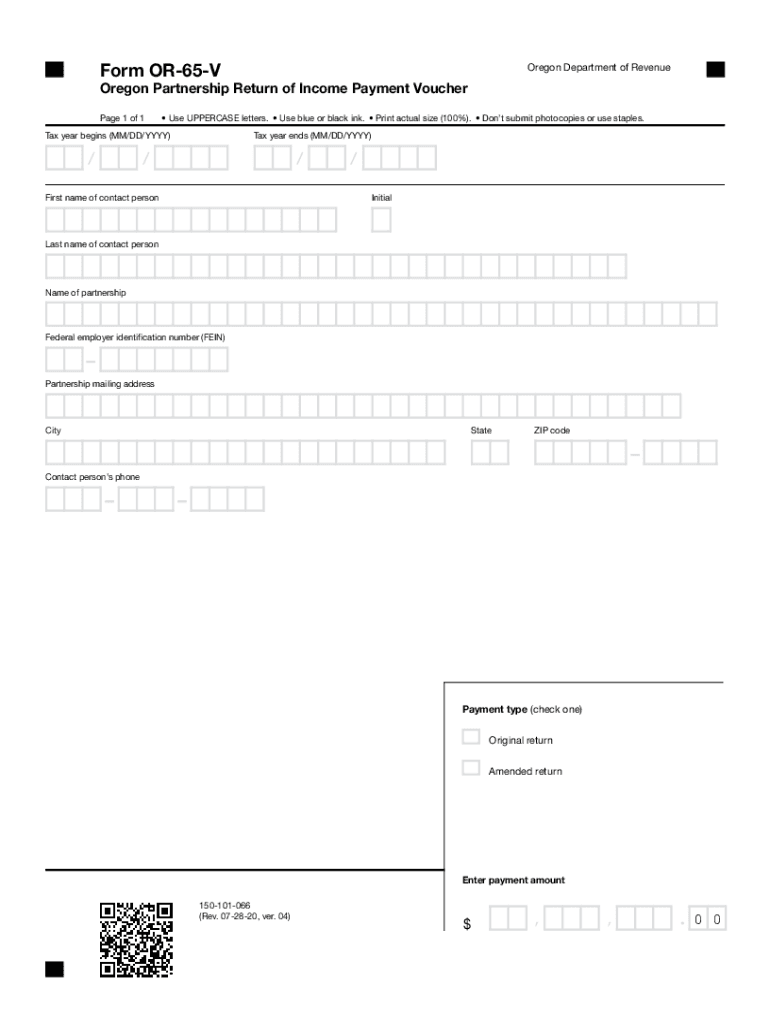

The Form OR 65 V is an essential document used by partnerships in Oregon to submit income payment vouchers. This form is specifically designed for reporting income tax payments owed by partnerships to the state of Oregon. It is identified by the number 150 101 066 and plays a crucial role in ensuring compliance with state tax regulations. The OR 65 V is typically filed alongside the partnership's income tax return, helping to streamline the payment process and maintain accurate records with the Oregon Department of Revenue.

How to use the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher

Using the Form OR 65 V involves several straightforward steps. First, partnerships must calculate their estimated tax liability for the year based on their income. Once the amount is determined, the partnership fills out the OR 65 V with the necessary details, including the total payment amount. After completing the form, it should be submitted along with the payment to the Oregon Department of Revenue. It is important to retain a copy of the form and payment for your records, as this can be useful for future reference or in case of audits.

Steps to complete the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher

Completing the Form OR 65 V requires careful attention to detail. Here are the steps to follow:

- Gather financial documents to determine the partnership's taxable income.

- Calculate the estimated tax liability based on the income earned.

- Download the OR 65 V form from the Oregon Department of Revenue website or obtain a physical copy.

- Fill out the form, ensuring all required fields are completed accurately, including the partnership's name, address, and payment amount.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with the payment to the appropriate address provided on the form.

Key elements of the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher

The Form OR 65 V includes several key elements that are essential for proper completion. These elements typically consist of:

- Partnership Information: Name, address, and federal employer identification number (EIN).

- Payment Amount: The total estimated tax payment owed for the current tax year.

- Signature: A designated partner must sign the form to certify the accuracy of the information provided.

- Filing Period: The specific tax year for which the payment is being made.

Legal use of the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher

The legal use of the Form OR 65 V is governed by Oregon tax laws, which require partnerships to report their income and make estimated tax payments. By using this form, partnerships comply with state regulations, ensuring that their tax obligations are met in a timely manner. The form serves as a formal declaration of the partnership's income tax payment and is essential for maintaining good standing with the Oregon Department of Revenue. Failure to use the form correctly may result in penalties or interest on unpaid taxes.

Filing Deadlines / Important Dates

Partnerships must be aware of specific filing deadlines to ensure compliance with Oregon tax laws. The Form OR 65 V is typically due on the same date as the partnership's income tax return. For most partnerships, this deadline falls on the fifteenth day of the fourth month following the end of the tax year. It is crucial to stay informed about any changes to deadlines or requirements, as these can vary from year to year. Marking these dates on a calendar can help partnerships avoid late fees and ensure timely submissions.

Quick guide on how to complete form or 65 v oregon partnership return of income payment voucher 150 101 066

Effortlessly Prepare Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Alter and Electronically Sign Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Without Stress

- Locate Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method for sending the document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 65 v oregon partnership return of income payment voucher 150 101 066

Create this form in 5 minutes!

How to create an eSignature for the form or 65 v oregon partnership return of income payment voucher 150 101 066

The way to make an e-signature for your PDF file online

The way to make an e-signature for your PDF file in Google Chrome

The way to make an e-signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the pricing structure for airSlate SignNow for users interested in or 65 v.?

The pricing structure for airSlate SignNow offers various plans to fit different business needs, including options for users interested in or 65 v. You can choose from monthly or annual subscriptions, with tiered pricing based on features and the number of users. This flexibility allows businesses to find a cost-effective solution that doesn't compromise on functionality.

-

What key features does airSlate SignNow offer related to or 65 v.?

airSlate SignNow includes essential features such as document templates, customizable workflows, and secure eSigning, all tailored for users interested in or 65 v. These features streamline the document signing process, improve collaboration, and enhance overall efficiency, making it an ideal solution for businesses of all sizes.

-

How can airSlate SignNow benefit my business with or 65 v.?

By using airSlate SignNow, businesses can signNowly improve their document management processes, particularly for or 65 v. The platform's ease of use, combined with its reliability and security, allows teams to accelerate workflows, reduce paperwork, and close deals faster. This translates to time and cost savings for your organization.

-

Is airSlate SignNow compliant with legal regulations for or 65 v.?

Yes, airSlate SignNow complies with major legal regulations relevant to eSignatures, ensuring that users interested in or 65 v. can rely on its legality. The platform adheres to laws such as the ESIGN Act and UETA, providing peace of mind that your signed documents are valid and enforceable. This compliance is crucial for any business looking to maintain legal standards.

-

What integrations does airSlate SignNow offer for or 65 v. users?

airSlate SignNow provides robust integrations with popular applications, which is particularly beneficial for users interested in or 65 v. It seamlessly connects with tools like Google Drive, Salesforce, and various CRM systems, allowing for enhanced productivity. These integrations help streamline workflows and ensure smooth transitions between tasks.

-

How does airSlate SignNow ensure document security for or 65 v. transactions?

Security is a top priority for airSlate SignNow, especially for users engaging in or 65 v. transactions. The platform employs AES-256 encryption, secure data storage, and multi-factor authentication to protect sensitive information. This commitment to security ensures that your documents remain confidential and safe from unauthorized access.

-

Can I try airSlate SignNow for free if I am interested in or 65 v.?

Absolutely! airSlate SignNow offers a free trial for users interested in or 65 v., allowing you to explore its features without any commitment. This trial period is a great opportunity to evaluate how the platform can meet your business's document signing needs and improve your overall efficiency.

Get more for Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066

- Delaware general form

- Revocation of general durable power of attorney delaware form

- Essential legal life documents for newlyweds delaware form

- Essential legal life documents for military personnel delaware form

- Essential legal life documents for new parents delaware form

- General power of attorney for care and custody of child or children delaware form

- Delaware business form

- Company employment policies and procedures package delaware form

Find out other Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement