Form or 65 V, Oregon Partnership Return of Income Payment Voucher, 150 101 066 Oregon 2016

What is the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

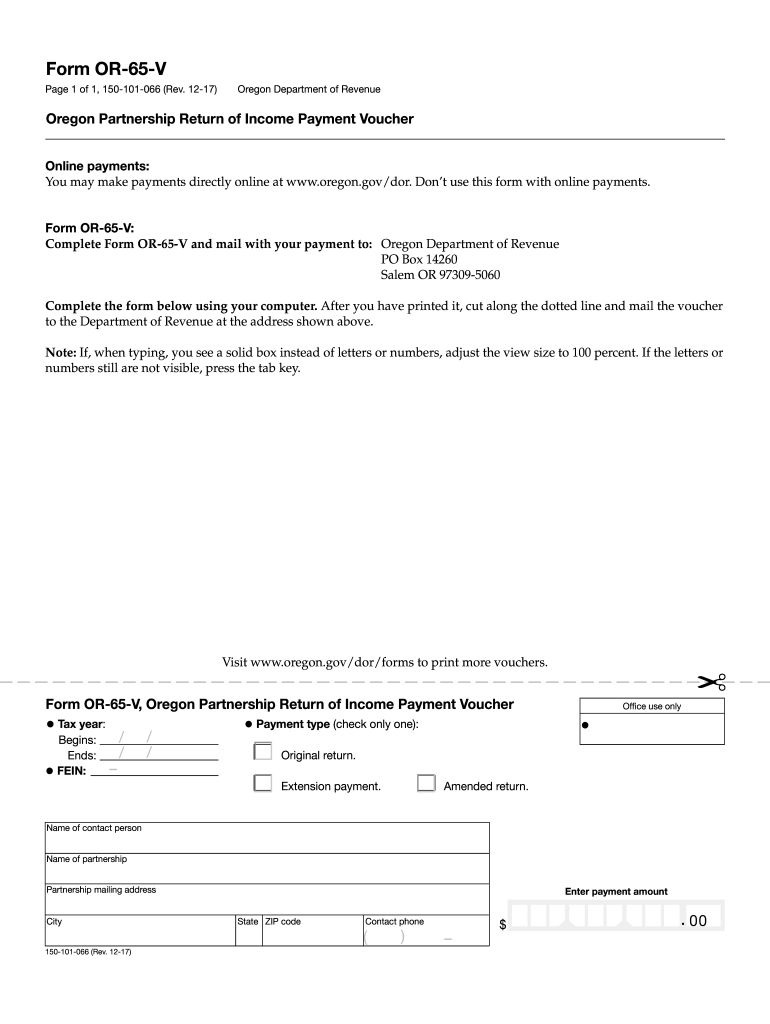

The Form OR 65 V is a payment voucher specifically designed for partnerships operating in Oregon. It facilitates the payment of taxes owed by partnerships when filing their income tax returns. This form is essential for ensuring that the partnership complies with state tax regulations and meets its financial obligations. The designation 150 101 066 refers to the specific form number used by the Oregon Department of Revenue, which helps in identifying and processing the document accurately.

How to use the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

Using the Form OR 65 V involves several straightforward steps. Once the partnership has calculated its tax liability, the form must be filled out with the relevant payment details. This includes the amount owed, the partnership's information, and any necessary identification numbers. After completing the form, it should be submitted along with the payment to the Oregon Department of Revenue. Utilizing electronic submission methods can streamline this process, ensuring timely payments and compliance with state regulations.

Steps to complete the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

Completing the Form OR 65 V requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents to determine the total tax owed.

- Fill in the partnership's name, address, and identification number on the form.

- Indicate the payment amount and ensure it matches the calculated tax liability.

- Review the completed form for accuracy before submission.

- Submit the form along with the payment to the Oregon Department of Revenue, either electronically or by mail.

Key elements of the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

The Form OR 65 V contains several key elements that are crucial for proper submission. These include:

- Partnership identification information, such as name and address.

- Tax identification number specific to the partnership.

- Amount of tax payment due.

- Signature of an authorized representative, if required.

Each of these elements must be accurately filled out to ensure the form is processed without delays.

Legal use of the Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

The Form OR 65 V is legally binding when filled out correctly and submitted in accordance with Oregon tax laws. It serves as a formal declaration of the partnership's tax obligations and must be accompanied by the appropriate payment. Compliance with all legal requirements ensures that the partnership avoids penalties and maintains good standing with the state tax authorities.

Filing Deadlines / Important Dates

It is vital for partnerships to be aware of the filing deadlines associated with the Form OR 65 V. Typically, the payment voucher must be submitted by the due date of the partnership's income tax return. This deadline aligns with the state tax filing calendar and may vary based on the partnership's fiscal year. Missing these deadlines can result in penalties and interest on unpaid taxes.

Quick guide on how to complete form or 65 v oregon partnership return of income payment voucher 150 101 066 oregon

Complete Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon with ease

- Find Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Modify and eSign Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form or 65 v oregon partnership return of income payment voucher 150 101 066 oregon

Create this form in 5 minutes!

How to create an eSignature for the form or 65 v oregon partnership return of income payment voucher 150 101 066 oregon

How to create an electronic signature for the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon in the online mode

How to make an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon in Chrome

How to create an electronic signature for signing the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon in Gmail

How to generate an electronic signature for the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon right from your mobile device

How to make an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon on iOS

How to generate an eSignature for the Form Or 65 V Oregon Partnership Return Of Income Payment Voucher 150 101 066 Oregon on Android OS

People also ask

-

What is Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

Form OR 65 V is the Oregon Partnership Return Of Income Payment Voucher, used by partnerships in Oregon to make payments for their tax liabilities. This form allows businesses to remit their owed income tax in a convenient manner and is tailored specifically for partnerships operating in Oregon.

-

How can airSlate SignNow help in processing Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

airSlate SignNow streamlines the preparation and submission of Form OR 65 V by allowing users to digitally fill and eSign the voucher. This efficient process saves time and minimizes errors, making it easier for businesses to stay compliant with Oregon tax regulations.

-

What are the pricing options for using airSlate SignNow for Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring you have the right tools for managing Form OR 65 V effectively. Users can choose from various subscription models that provide flexibility based on usage and required features.

-

Is there an option to integrate airSlate SignNow with accounting software for handling Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

Yes, airSlate SignNow supports integration with multiple accounting software solutions, making it easier to manage Form OR 65 V. This integration allows for seamless transfer of financial data, ensuring accurate calculations and timely submissions for partnership returns.

-

What features does airSlate SignNow offer to simplify preparing Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

airSlate SignNow provides intuitive features such as customizable templates, automated workflows, and eSignature capabilities that enhance the preparation of Form OR 65 V. By leveraging these tools, businesses can ensure accuracy and efficiency in their tax compliance efforts.

-

Can I track the status of my Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your submitted Form OR 65 V. This feature offers peace of mind by providing real-time updates on the document's progress, ensuring you remain informed about important tax obligations.

-

What are the benefits of using airSlate SignNow over traditional methods for Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon?

Using airSlate SignNow provides signNow benefits such as reduced paperwork, shorter processing times, and enhanced accuracy for Form OR 65 V. Traditional methods can be tedious and error-prone, whereas our solution allows for easy eSigning and document management, optimizing the entire process.

Get more for Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

Find out other Form OR 65 V, Oregon Partnership Return Of Income Payment Voucher, 150 101 066 Oregon

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free